Saturday | January 25

5:00 PM – 5:30 PM

Celebrating Women in Leadership Reception

With so many top executives and board members traveling to this conference on Saturday, this reception allows female executives to meet their contemporaries from across the United States. Please note: a separate registration is not needed to attend this reception as it is included in the conference registration.

5:00 PM – 5:30 PM

First-Time Attendee Reception

Concurrent with our Women in Leadership Reception, we welcome first-time attendees to our Acquire or Be Acquired Conference. Meet members of the Bank Director leadership team and others attending the conference for the first time. Please note: a separate registration is not needed to attend this reception as it is included in the conference registration.

5:30 PM – 6:30 PM

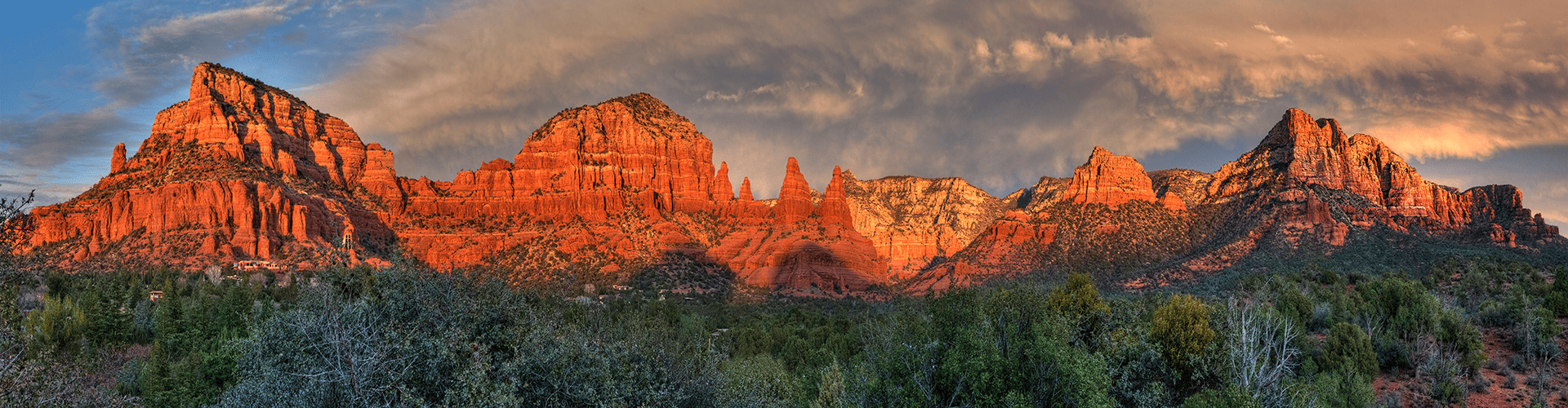

Welcoming Reception & Registration

While winter grips much of the country, we’ve found early evening in Arizona to be a welcome change for many joining us. Kick off the conference by catching up with old friends and making new connections.

Day One | Sunday | January 26

7:00 AM – 8:00 AM

Registration & Breakfast

8:00 AM – 8:05 AM

Day One Opening Remarks: Exploring Your Growth Options

Michelle King, President, Bank Director

Laura Schield, Chief Operating Officer, Bank Director

AOBA remains the meeting ground for the banking industry’s key leaders to engage with each other and learn how to grow and compete in today’s market. To open this year’s event, we highlight how and why the conference agenda explores financial growth opportunities and strategic planning ideas… BEYOND M&A.

8:05 AM – 8:55 AM

The State of Banking

Thomas Michaud, President & CEO, Keefe, Bruyette & Woods, A Stifel Company

The conference opens with an overview of where the industry is today and what that means for you and your bank.

8:55 AM – 9:35 AM

What to Expect From Washington

Changes are on the horizon. What does that mean for your bank and its future? Hear from a panel of experts what to expect from Washington in 2025.

9:35 AM – 10:10 AM

Growth From Your Balance Sheet

A panel of bank CEOs share how they have used their balance sheet to inspire and find growth.

9:00 AM – 9:35 AM

FinXTech Session: Transforming Your Bank for the Future

During this session, we explore how to get greater depth of wallet; how to expand your total “addressable” market; and how to develop new ways to go to market. This session provides a perspective on how different financial institutions have placed their bets on new lines of business.

9:45 AM – 10:20 AM

FinXTech Session: Meeting Your Small Business Clients Where They Are

The small business market continues to be a huge opportunity for banks. What can your bank do to take advantage of this space, and help clients expand their relationship with your institution?

10:10 AM – 10:30 AM

Refreshment Break

10:30 AM – 11:10 AM

Breakout Sessions

Participants have the opportunity to select one of seven breakout sessions to attend. These sessions are strategic and build on this morning’s general session presentations. Based on feedback from past attendees, there will be designated session(s) for banks under $1Bn in assets and for those above $1Bn in assets. Sessions to be announced.

10:30 AM – 11:10 AM

FinXTech Session: Are You in the Payments Game?

Technology continues to transform the industry, and the payments landscape is no exception. Whether it is the increased demand for contactless and embedded options or a diminishing reliance on analog processes, payments are changing. This session covers the information you need to know to stay up-to-date and competitive amidst the changing payments landscape.

11:25 AM – 12:00 PM

FinXTech Session: The Risk of Not Doing Something

As your financial institution focuses on the future, decisions need to be made on where to invest time and money. But with the many options you could choose, what is best for your organization? Hear from leaders in the space on where you might want to invest and why.

11:25 AM – 12:05 PM

Creating a Strategic Plan Focused on Growth

What has worked in the past may not support one’s future plans. New competitors are continually changing the business of financial services. Since bank executives and board members need to prioritize the issues and initiatives that will make a difference to their banks, this session lays out the new strategic imperatives for CEOs and boards to consider.

12:05 PM – 1:15 PM

Networking Peer & Guest Lunch

12:20 PM – 1:00 PM

Lunch & Learn Sessions

Lunch & Learn sessions offer participants the chance to learn about a shared topic of interest over lunch. Six sessions run concurrently, so attendees may select one to attend. Sessions to be announced.

1:15 PM – 1:55 PM

Creating Your Highest Value

How can you create the highest value for your bank – and its shareholders? During this session, we look at how current market conditions, recent transaction trends and future pricing expectations might impact the value of your bank.

1:15 PM – 1:50 PM

FinXTech Session: Embracing AI

Artificial intelligence in the financial world is not new, but it is changing. With its ability to expedite operational tasks, assist in client credit decisions and improve the efficiency of financial crimes monitoring, AI may be a viable investment for your financial institution. This session explores the many options for embracing this technology.

2:10 PM – 2:50 PM

FinXTech Session: The New Frontier of Data Sourcing & Integration

Banks have a wealth of client data, but how is it best utilized to not only help the bank expand its existing relationships but also provide a better customer experience? During this discussion, we dive into the opportunities to best integrate your bank’s data in your digital strategy.

2:10 PM – 2:50 PM

Breakout Sessions

Participants can select one of seven concurrent breakout sessions to attend – focused on exploring all of your bank’s many growth options. Based on feedback from past attendees, there will be designated session(s) for banks under $1Bn in assets and for those above $1Bn in assets. Sessions to be announced.

2:30 PM – 4:30 PM

M&A Simulation

The process of striking a deal for a prized target has never been more competitive than it is today. For buyers, careful discipline is required to ensure that bids are designed to accomplish acquisition growth without damaging the company’s value. For sellers, a competitive bid process must be skillfully navigated to earn the best deal for shareholders. In this session, participants work through the final rounds of a competitive auction involving a prized seller to see which bank emerges as the successful acquirer. Of course, as in real deals, some wrinkles will emerge. The simulation is exclusive to 45 bank attendees only, allows for one banker per institution, no capital markets titles (this session is NOT for investment bankers of any kind) and runs concurrently with the below breakout sessions.

2:50 PM – 3:10 PM

Refreshment Break

3:10 PM – 3:50 PM

FinXTech Session: Why the Cloud?

In this session, we discuss the benefits of moving core banking systems to the cloud and ways the cloud is giving institutions a leg up in today’s competitive landscape.

3:10 PM – 3:50 PM

Breakout Sessions

Conversations continue with a second round of afternoon breakout sessions — participants select one of seven concurrent opportunities. Based on feedback from past attendees, there will be designated session(s) for banks under $1Bn in assets and for those above $1Bn in assets. Sessions to be announced.

4:05 PM – 4:40 PM

FinXTech Session: Wealth Management Made Easy

Addressing the needs of your most affluent clients is typically a very consultative process that aligns your bank services with your clients personalized strategy. Given this highly specialized area of the bank, banks should consider what technology is available to assist in offering wealth management services (or enhance your existing services), and is it something you should consider adding to your bank’s product offerings?

4:05 PM – 4:40 PM

Banking Is Risky Business

Banking is a risk-mitigation business. Learn about the new risks facing banks and their boards today and how financial institutions can best manage them.

4:45 PM – 6:30 PM

Networking Peer & Guest Reception

Day Two | Monday | January 27

7:00 AM – 8:00 AM

Breakfast

8:00 AM – 8:10 AM

Day Two Opening Remarks: New Horizons

Michelle King, President, Bank Director

Laura Schield, Chief Operating Officer, Bank Director

As leadership teams consider entrepreneurial opportunities to grow deposits, relationships and reputations, we shine a light on five high-performing businesses operating outside of the financial sector. Some have jumped on retail trends; others focus on consumer spending habits. The common thread is that all have grown their business in ways that should inspire participants at this year’s AOBA to assess how they are positioned to grow, compete and enhance their institution’s franchise value.

8:10 AM – 8:50 AM

The Best of RankingBanking

Based on the latest iteration of Bank Director’s RankingBanking study, hear from three banks that topped our list.

8:50 AM – 9:10 AM

Results from Bank Director’s 2024 Technology Survey

Hear the findings from Bank Director’s latest Technology Survey – and what they mean to you and your bank.

9:10 AM – 9:30 AM

State of Technology

Hear from a mover and shaker in the banking industry on what banks should do right now.

9:30 AM – 10:10 AM

Lessons From the Latest Acquisitions

Hear what worked and what didn’t from experts featured in this panel session.

9:40 AM – 10:15 AM

FinXTech Session: Growing Deposits for Long-Term Sustainability

According to BankDirector’s 2024 Risk Survey, released March 25, 2024, more than half (59%) of respondents say they have experienced some deposit loss, with minimal to moderate effects on the bank’s funding base, as a result of rising interest rates. Another 9% have experienced significant impacts on their funding base. During this discussion we explore best practices for growing and maintaining deposits for the long-term.

10:10 AM – 10:30 AM

Refreshment Break

10:30 AM – 11:10 AM

FinXTech Session: Let’s Be Real About Integration

Finding the right technology partner is hard, but integrating the technology can be even harder. What questions should be asked prior to integration? Who from your team should be brought to the table? And how do you ensure there is a cultural alignment between your team and your new vendor’s team? Setting the right expectations in advance could make all the difference in the world for both sides.

10:30 AM – 11:10 AM

Breakout Sessions (select one)

Participants have the opportunity to select one of seven breakout sessions to attend. Based on feedback from past attendees, there will be designated session(s) for banks under $1Bn in assets and for those above $1Bn in assets. Sessions to be announced.

10:30 AM – 12:00 PM

FinXTech Session: Fintech Workshop

Join this workshop to learn how banks work best with fintechs. This session includes the how-to’s around decision-making, integration, market analysis and more. This workshop is exclusive to 36 bank attendees only, and allows for one bank representative per institution. This session is NOT for investment bank/capital markets leaders of any kind.

11:25 AM – 12:05 PM

FinXTech Session: Cybersecurity & Fraud Prevention

Ninety percent of bank leaders would be open to using artificial intelligence technologies for fraud prevention and alerts, and 81% would use AI for cyberattack prevention and detection, according to BankDirector’s 2024 Risk Survey. During this session we dive into what bank’s can do today to guard against a cyber or fraud intrusion.

11:25 AM – 12:05 PM

Breakout Sessions (select one)

Conversations continue with a second round of morning breakout sessions — participants select one of seven concurrent opportunities to engage with industry leaders. Based on feedback from past attendees, there will be designated session(s) for banks under $1Bn in assets and for those above $1Bn in assets. Sessions to be announced.

12:05 PM – 1:05 PM

Networking Lunch

12:05 PM – 1:05 PM

Women in Leadership Luncheon

Expanding on the Women in Leadership Reception held on Saturday, this is an opportunity for women to come together over lunch. Both men and women are invited to attend this luncheon.

1:05 PM – 1:10 PM

Strong Board. Strong Bank.

Jackie Wall, Vice President of Bank Services, Bank Director

Creating a strong board and strong bank is no easy task – and you can’t have one without the other. Bank Director’s Vice President of Bank Services shares key indicators and lessons learned from banks of all sizes, types and locations.

1:10 PM – 1:30 PM

Findings From Bank Director’s 2025 Bank M&A Survey

What will 2025 hold for M&A activity? Bank leaders’ enthusiasm for M&A appears muted going into 2024, but an appetite for sticky, low-cost deposits could motivate some financial institutions to make a deal in the year ahead. Bank Director’s 2024 Bank M&A Survey, sponsored by Crowe LLP, finds that 35% of bank executives and directors believe they are likely to acquire another institution by the end of 2024, down from 39% in 2023 and 48% in 2022. Eighty-five percent point to an attractive deposit base as a top attribute of an acquisition target in today’s environment, compared with 58% who said as much a year ago. That was followed by a complementary culture (58%), efficiency gains (55%) and locations in growing markets (48%).

1:30 PM – 2:10 PM

Keynote Presentation

2:25 PM – 3:05 PM

Breakout Sessions

Participants may select from one of six breakout sessions to attend. Based on feedback from past attendees, there will be designated session(s) for banks under $1Bn in assets and for those above $1Bn in assets. Sessions to be announced.

3:05 PM – 3:25 PM

Refreshment Break

3:25 PM – 4:05 PM

Breakout Sessions

Participants may select from one of six breakout sessions to attend. Based on feedback from past attendees, there will be designated session(s) for banks under $1Bn in assets and for those above $1Bn in assets. Sessions to be announced.

4:20 PM – 5:00 PM

Lessons Learned in Growing Shareholder Value

Hear a panel of bankers share their long-term growth strategies. Find out how banks have made money over a long time horizon and how they created the best value for their banks – regardless of size.

5:00 PM – 5:40 PM

Point/Counterpoint Debate

Back by popular demand, this session pits investment bankers and lawyers against each other to debate the most controversial issues in banking. You don’t want to miss this heated – and informative – session!

5:00 PM – 5:40 PM

Networking Peer & Guest Reception

Sponsored by: Keefe, Bruyette & Woods, A Stifel Company

Day Three | Tuesday | January 28

7:00 AM – 8:00 AM

Breakfast

8:00 AM – 8:10 AM

Day Three Opening Remarks: Taking New Chances

Michelle King, President, Bank Director

Laura Schield, Chief Operating Officer, Bank Director

Today, we focus on perspectives that have not already been shared on the first two days of the conference – and look into forces outside of our industry that may have deep implications.

8:10 AM – 8:40 AM

What Does Your Brand Say About You?

How do you build a brand that works for your bank? Unlock the power of your brand by hearing strategies and tactics that work.

8:40 AM – 9:10 AM

Recruiting & Retaining the Best Talent

Finding talent continues to challenge all businesses – but especially financial institutions. During this session, we dive into best practices, new ideas and lessons learned for creating the best teams and hiring the best talent.

9:10 AM – 9:40 AM

What’s on the Horizon

While M&A is one method for growth, there are many other opportunities your bank could capitalize on to grow. During this session, a panel of industry experts dives into strategies you should consider.

9:40 AM – 10:00 AM

Refreshment Break

10:00 AM – 10:40 AM

Breakout Sessions (select one)

Conversations conclude with a final round of breakout sessions — participants select one of six concurrent opportunities to learn. Based on feedback from past attendees, there will be designated session(s) for banks under $1Bn in assets and for those above $1Bn in assets. Sessions to be announced.

10:55 AM – 11:25 AM

Lessons From the Past & Advice for the Future

As we conclude the 31st annual AOBA Conference, hear from experts in the industry as they share the lessons they have learned and their advice for moving forward.

11:25 AM – 11:30 AM

Parting Thoughts

Michelle King, President, Bank Director

Laura Schield, Chief Operating Officer, Bank Director

1:00 PM – 4:30 PM

Let’s Play Pickleball

Enjoy the afternoon playing pickleball with your peers. Registration is required and space is limited to 136 players. Please visit our FAQ page to find the pickleball registration rate.

1:00 PM – 6:00 PM

L. William Seidman Annual Acquire or Be Acquired Golf Tournament

Enjoy the afternoon playing golf with your peers. Registration is required and space is limited to 144 players. Please visit our FAQ page to find the golf registration rates.

5:45 PM – 7:00 PM

Closing Peer & Guest Reception

Attendees and their guests join in the fun to see who are the winners of the L. William Seidman Golf Tournament and the Pickleball Tournament!

The opinions expressed at the conference are those of the individual speakers only and do not necessarily reflect the opinions of Bank Director, the other speakers or the entities with which the speakers are associated.