Market Intelligence

The Road Ahead

It took nearly eight years, but the banking industry finally gained some relief from the Dodd-Frank Act with the recent passage of the ambitiously named Economic Growth, Regulatory Relief and Consumer Protection Act. Although the new law is not a complete repudiation of Dodd-Frank, it could negatively impact the safety and soundness of some of the largest U.S. banks. Recently, Allen Tischler, senior vice president at Moody’s Investors Service, outlined his concerns with Bank Director magazine Editor in Chief Jack Milligan.

When you look at the new law, what concerns you the most?

We rate somewhere in the neighborhood of 60 U.S. banks. Regulatory oversight for some of those banks will be relaxed as a result of the law. We see that as credit negative, because it could ultimately lead to an easing of some of their risk governance and potentially encourage more aggressive capital management. And the way we think that may come about is by the law’s increase in the Systemically Important Financial Institution (SIFI) designation, which was raised from $50 billion to $250 billion. Banks in that size range will no longer have to participate, for example, in the annual stress test mandated under the Comprehensive Capital Analysis and Review (CCAR) program, which is administered by the Federal Reserve.

Should banks still stress test?

The short answer is yes. We think that stress testing, coming out of the financial crisis, was one of the really great, strong and creditor-friendly enhancements in Dodd-Frank. We do think that a lot of the banks that participated in it have built up a stress-testing infrastructure and see the value in it. So, we’re not expecting all that infrastructure will just get thrown out the window. A lot of the banks in our coverage universe will continue to do stress testing in the context of their own risk management process. But the fact that they won’t have that third-party, publicly-disclosed oversight from the Fed is, we think, a credit negative. I should say, there’s a little bit of a nuance to the new law. However, only the banks between $50-$100 billion get out from the enhanced standards immediately. For banks from $100-$250 billion, the Fed has 18 months to tailor some kind of enhanced oversight if they choose, so some of those banks will no doubt still be subject to some enhanced oversight.

Could a more relaxed approach to supervision result in more buybacks and higher dividend payments-and less capital?

Yes. These banks will now have more leeway in managing their capital.

The Road Behind

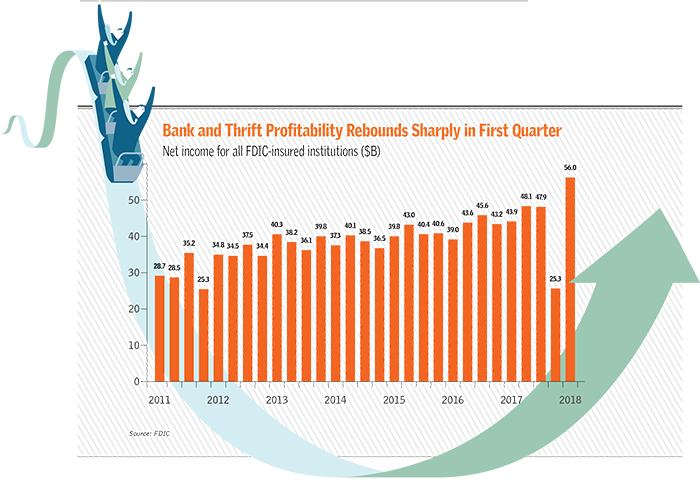

When Bank Director last spoke with hedge fund investor Tom Brown, he expected banks to report strong earnings in 2018.

What was your impression of first quarter earnings?

Clearly, the lower tax rates that all banks experienced drove earnings. The performance was slightly less unexpected. And if a bank had lower than anticipated earnings, it was because of weak commercial loan demand.

What are you expecting for the rest of the year in terms of earnings?

The economy has gotten stronger as the year has gone on. Loan demand has gotten better. So I think the second half of 2018 is shaping up to be a good one. The majority of banks will see more margin improvement, and they should see loan demand improvement. That’s good, because 75 percent of their revenues come from lending money and earning a spread on it.

The charts regularly included in Market Intelligence can be found in the print edition of Bank Director magazine.

Join OUr Community

Bank Director’s annual Bank Services Membership Program combines Bank Director’s extensive online library of director training materials, conferences, our quarterly publication, and access to FinXTech Connect.

Become a Member

Our commitment to those leaders who believe a strong board makes a strong bank never wavers.