Market Intelligence

The Road Ahead

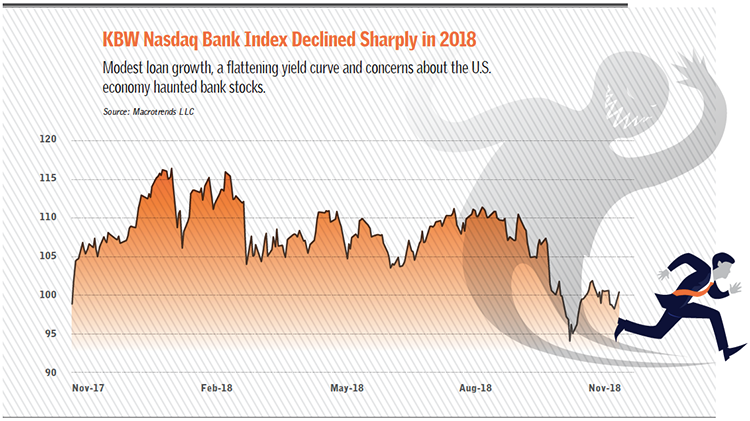

Bank stocks declined in 2018 after starting out strong at the beginning of the year, thanks to investor enthusiasm over the reduction in the corporate tax rate included in the Tax Cut and Jobs Act of 2017. Fred Cannon at Keefe Bruyette & Woods, explains what some of the factors were and offers a forecast for bank stocks in 2019. He spoke in early December with Jack Milligan, editor in chief of Bank Director magazine.

The KBW Nasdaq Bank Index declined over the course of 2018. What were the driving factors?

The January drop was a little bit of an overhang from the big rally that we saw around the tax cuts in late 2017. I don’t think there was any overall concern about the banks. In March, we began to see some volatility in bank stocks, which accelerated as we moved toward the end of the year. Loan growth numbers continued to come in relatively modest in terms of overall economic growth after there was a certain amount of enthusiasm that the tax cuts would lead to more rapid growth. In second quarter and certainly third quarter results, we also saw higher deposit costs and a greater focus on a flat yield curve, which proved to be negative. And finally, some of the larger M&A transactions that often have been a positive catalyst for banks stock [valuations] turned negative, because investors didn’t like the prices paid for some of those deals.

Are there banks that you thought outperformed the bank stock market in 2018?

Last year was really a focus on quality. CullenFrost has long been viewed as a high-quality bank and is up 7 percent year-to-date. Another one that didn’t disappoint was First Republic Bank, the only bank that had a double-digit share price increase among the large-cap banks.

What is your outlook for bank stocks this year?

Our outlook is fairly positive. There are a number of factors that are slowing economic growth-higher interest rates, the waning impact of the tax cuts and international trade frictions-but overall you don’t see a lot of excesses built up in the economy, so we think there’ll be a soft landing and, given that, the valuations are compelling. What’s really key in the first half of the year is that banks achieve the expectations the market has for them. Banks that don’t meet expectations will be harshly punished by the market. We think it could be a pretty good year, but it’s best to stay with the higher quality institutions you believe can make their earnings estimates.

The Road Behind

When Bank Director magazine last talked to Rick Childs about the impact of the 2017 tax cut on bank M&A, he said it was already having an effect. We caught up with him in November and asked if that was still the case.

Did the tax cut, which boosted bank profitability in 2018, have a material impact on M&A valuations?

Yes and no. As the concept of a tax cut became a possibility, prices for bank stocks began to increase in anticipation, and that allowed acquirers to be able to pay higher prices. This did increase M&A activity, though not in every market. Then a counter result began to occur. Higher profits and a lower regulatory burden gave bankers optimism, and we now see many of them opting to remain independent and focus on organic growth because of the strength of the economy. If the economy slows down and organic growth opportunities diminish as a result, bankers could once again return to the M&A market.

Join OUr Community

Bank Director’s annual Bank Services Membership Program combines Bank Director’s extensive online library of director training materials, conferences, our quarterly publication, and access to FinXTech Connect.

Become a Member

Our commitment to those leaders who believe a strong board makes a strong bank never wavers.