Kiah Lau Haslett is the Banking & Fintech Editor for Bank Director. Kiah is responsible for editing web content and works with other members of the editorial team to produce articles featured online and published in the magazine. Her areas of focus include bank accounting policy, operations, strategy, and trends in mergers and acquisitions.

What Will Rates Do in 2024?

Not even the group setting the interest rate knows.

The following piece appeared in the fourth quarter 2023 issue of Bank Director magazine.

What will the interest rate environment look like in 2024? If the summary of economic projections is any indicator, not even the group setting the rate knows.

The Federal Reserve’s Board of Governors and the Reserve Bank presidents submit their economic projections every quarter, in conjunction with the Federal Open Market Committee’s March, June, September and December meetings. These include their estimates about the direction of inflation, growth in gross domestic product, the unemployment rate and, of course, the target federal funds rate. The Fed releases an aggregated, anonymized version of these projections after those meetings conclude.

Those economic projections are the closest the public gets to being able to read the FOMC’s mind, especially when it comes to the future. A look at the projected target midpoint ranges for the federal funds rate in 2024 underlines that the FOMC’s mind isn’t made up at all. The June projections indicated the 2024 target midpoint range spans almost 250 basis points, from 3.63% at the lowest end to 6.12% at the highest end. A 2024 midpoint of 4.38% to 4.62% received the most consensus.

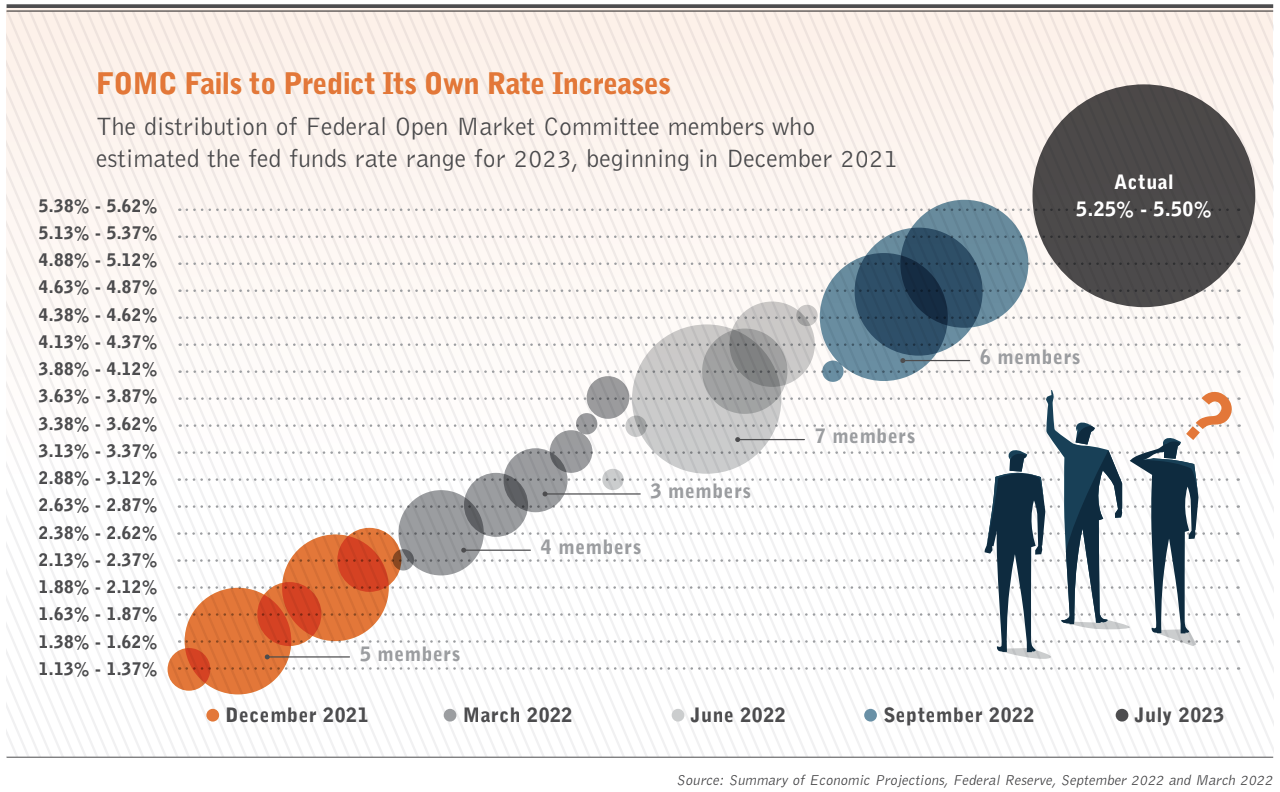

Looking even further back, the FOMC’s interest rate predictions in 2022 for 2023 demonstrate the extent the committee underestimated its own changes and revised its projections over the course of a year. In September 2022, a little more than a year ago, the median 2023 fed funds rate that FOMC members projected was 4.6%; their summary of projections ranged from 3.9% to 4.9%. What actually happened in July 2023 was another increase in the fed funds rate, to a target range of 5.25% to 5.5% — about a percentage point higher than they had projected. Throughout 2022, participants’ projections for 2023 stayed within range of each other, but the rates they targeted grew.

Now, as 2023 draws to a close, the target range for 2024 rates is widening. Disagreement among voting members is increasing, according to August research from the Federal Reserve Bank of San Francisco. Researchers created an index that charts divergence in rate projections using the quarterly changes in the FOMC’s “dot plot” and found that disagreement among members has increased from “nearly nonexistent” levels at the start of the coronavirus pandemic. “Since the dots typically do not align, the degree of disparity between them gives an indication of the level of disagreement at any point in time,” they wrote.

When it comes to interest rates, the Fed’s outlook is less certain the further it goes into the future — and that includes the next year.

“[T]here tends to be relatively less disagreement about policy in the year the forecast is made, but more disagreement about the next year, and even more about the following year,” the researchers write.

Bankers may feel the need to pin down a prediction of interest rates for 2024, and the direction and pace of change. The Fed feels no such pressure.