The Magic Margin Number Needed to Satisfy Investors

The low rate environment has

brought community banks’ net interest margins into sharp focus. It turns out,

there might be a number they should aim for.

“We think you need about a 350 basis point

margin to run a bank,” says ServisFirst Bancshares Chairman and CEO Tom

Broughton III, calling that figure “the bare minimum.”

The net interest margin indicates how much a bank earns from its portfolio of earning assets – mainly, loans and securities. While it matters to all banks, it matters most to institutions that make most of their revenue from lending, rather than fees.

ServisFirst, which has $9 billion

in assets, recorded a NIM of 3.36% in the third

quarter, down slightly from the second quarter’s 3.44%. Broughton says the

Birmingham, Alabama-based bank is stabilizing its margin by focusing on deposit

costs, but aims for a NIM of 400 basis points.

Margins have been under

pressure for years. ServisFirst’s NIM was in line with the industry average

of 3.35% for the third quarter, according to the Federal Deposit Insurance

Corp. The regulator cited a “challenging interest-rate environment,” the flat yield

curve and funding costs that are increasing faster than earning asset

yields as driving industry NIM compression.

Executives at many banks today

probably wish those factors were reversed, and that their NIMs were higher. But

is there a baseline, minimum NIM that banks should aim for? And if there is, is

it the same for all banks?

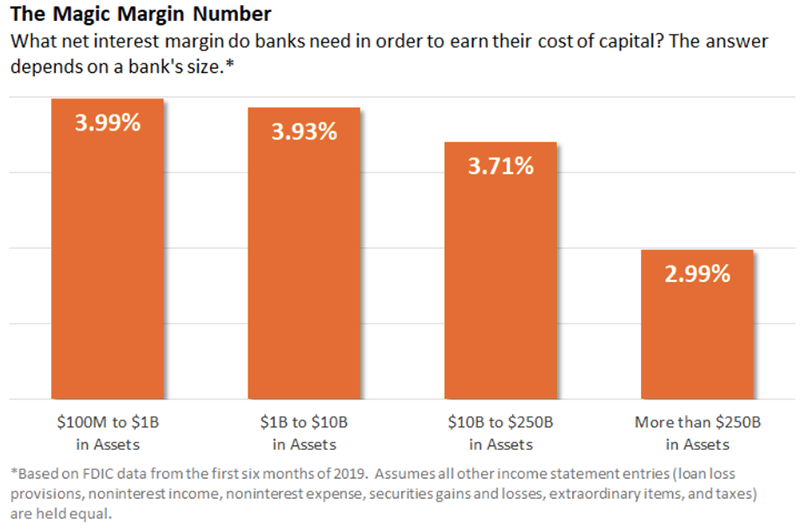

A Bank Director analysis found that banks with between $100 million and $1 billion in assets that want to earn a 12% return on equity, a measure often cited as the cost of capital for a typical bank, should aim for a net interest margin of 3.99% in the current environment. At banks with between $1 billion and $10 billion, that figure is 3.93%. That figure decreases as banks increase in size and generate a greater proportion of their revenue from noninterest income. Banks with more than $250 billion in assets should aim for a NIM of 2.99%.

These numbers are helpful benchmarks, as experts point

out that the magic minimum NIM number is based on a number of assumptions and

variables. “There is no magic NIM for every institution,” says Matthew

Pieniazek, president of Darling Consulting Group. “If somebody argues it,

they’re talking about [their bank]. NIM is relative and is relative to a

battery of things.”

Pieniazek says executives should

figure out “what is the minimum level of acceptable sustainable performance” of

their bank, given variables like loan and deposit mix and cost structure, and

peg their minimum NIMs to those levels. They need to consider what key metrics

to focus on and what sort of risks or moves they are willing to take.

An acceptable NIM may also vary on the orientation of the institution, says Terry Wise, analyst and consultant at Banking Strategist. Commercial banks may have a lower yield on loans that is offset with lower expenses from a branch-light footprint, while retail banks may have higher branch costs but cheaper deposits. Overall, he says community banks have done an “excellent job” of managing their margins.

“It’s hard to look at a specific

number, that 350 basis points is the absolute minimum a bank needs to be

viable,” he says. “There are banks out there that are extraordinarily good at

managing their expense base, so they could live with that slightly lower net

interest margin.”

One challenge to ServisFirst

defending and increasing its NIM is a refrain that will be familiar to many

banks: stiff competition in the lending markets.

“If you start [a loan] with a number in the 3s, you’re certainly going to have a margin less than 400 basis points,” Broughton says. “We can’t control what other people do. If we miss on a deal, we just move onto the next one.”

More banks may be making similar

choices, or unwilling to make dramatic moves that would increase the margin. Pieniazek

says he could increase the NIMs of any bank in the country by shrinking its balance

sheet, getting rid of high-cost funds and shedding low-yielding assets. But the

downside to doing so is that would hurt return on equity and earnings per

share.

“You’ve got to be careful when you look at NIM,”

he says. “I can’t pay bills with NIM, I pay bills with real cash flow.”