Bank Failures Reveal Stress Testing Gaps

Within days of Silicon Valley Bank’s failure on March 10, Democratic lawmakers quickly pointed out that the bank’s holding company, $212 billion SVB Financial Group, and $110 billion Signature Bank, which failed days later, weren’t subject to regular stress tests mandated for the largest banks under the Dodd-Frank Act. The requirement for mid-sized banks, between $50 billion and $250 billion in assets, had been rolled back in 2018.

But the stress test scenarios developed by the Federal Reserve largely focused on adverse impacts on credit and declining interest rates. In contrast, SVB’s failure had its roots in a rising rate environment that led to an unprecedented deposit run; the Fed’s Vice Chair for Supervision, Michael Barr, testified on March 28 that customers were set to withdraw $142 billion in deposits over two days – roughly 82% of the bank’s total deposits.

“When we think of stress testing, the key word is stress,” says Brandon Koeser, senior manager and financial services industry senior analyst at RSM US. “When you think of true stress and how that impacts the organization as a whole, it can be credit – but it should also hit liquidity, it should hit capital, and then look at earnings and profitability.”

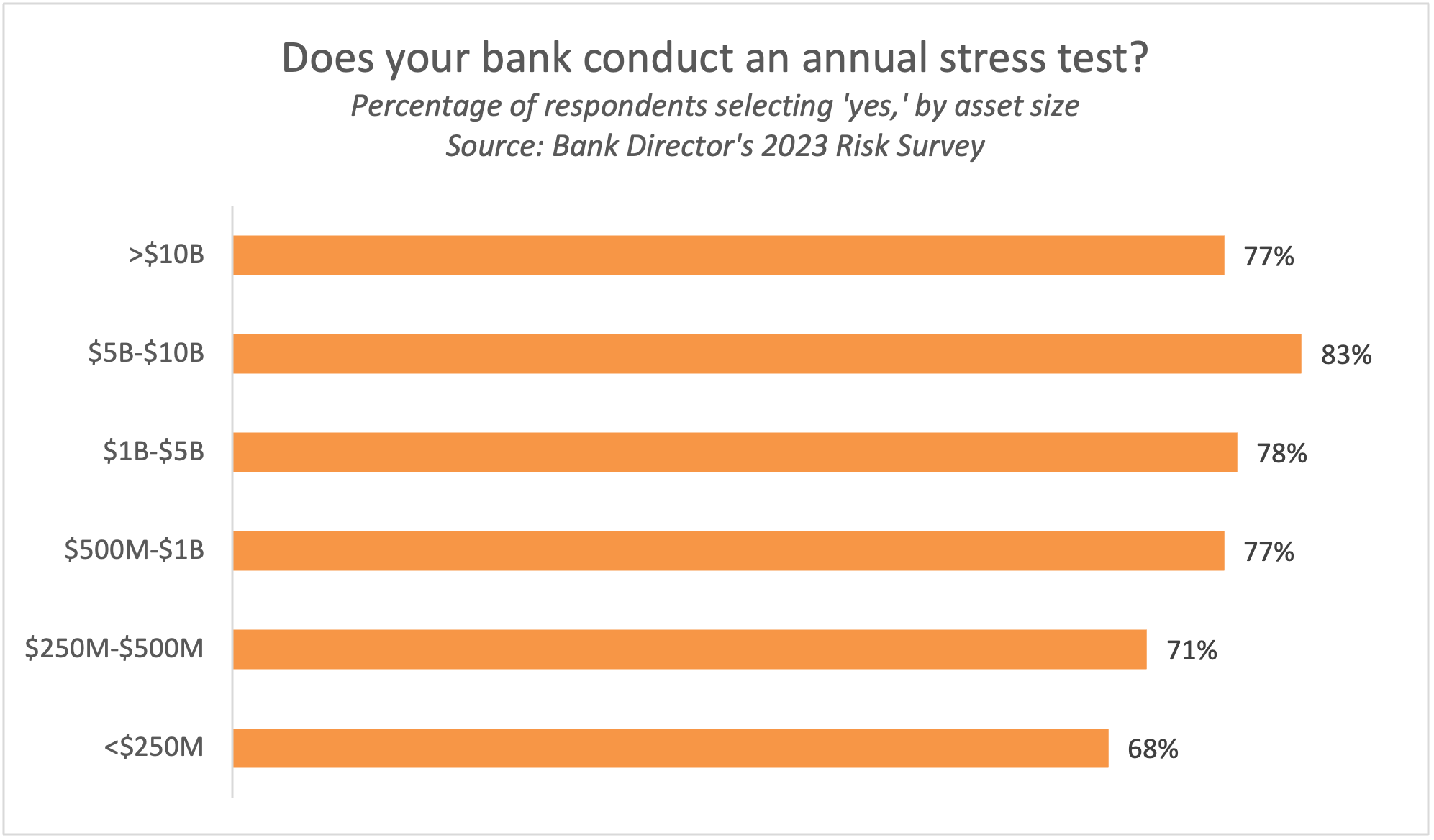

Internal stress testing is a regular practice for community banks, according to Bank Director’s 2023 Risk Survey. More than three-quarters of executives and directors say their institution conducts an annual stress test. This can be a valuable exercise that helps boards and leadership teams understand the impact of adverse events on their organization.

Members of the Bank Services Program can access the complete results to all Bank Director surveys, by asset size and other attributes.

“Banks have enough resources, even small banks, to do some simple stress testing and put pen to paper,” says Patrick Hanchey, a Dallas-based partner at Alston & Bird. The results should be shared with the board, with the discussion reflected in the meeting minutes. “You can take small steps to show that you’ve been thoughtful,” he says. “That’s all the stress test is – thinking about, ‘What if x happens? What do we do, and how does it affect us?’”

Banks should build scenarios that consider account types and depositor behavior, says Sean Statz, a senior manager at Baker Tilly. “We’ve been doing data analytics on the loan portfolio forever,” he says. “Data analytics around the deposit portfolio is going to be a big focus to better understand what [the] portfolio is made up of [and] what could happen [so banks can] start applying some assumptions.” It’s easier to forecast behavior around assets, due to set terms around investments, borrowings and loans. Industry-level assumptions around deposit activity can help fill in some gaps.

The recent bank failures spotlight a key area of risk: deposit concentrations within particular sectors or industries. While much has been made of uninsured deposits, Hanchey cautions that these aren’t necessarily bad if they’re managed safely and soundly. Deposits from municipalities, for example, can be quite stable. Decision-makers should understand how those deposits are concentrated.

Hanchey adds that regulators within the Texas Department of Banking acted quickly to compare levels of uninsured deposits to the availability of other funding sources in a crunch, such as lines of credit from the Federal Home Loan Banks or correspondent banks. “Stress testing your FHLB advance capabilities, lines of credit from your correspondent banking relationships, access to the Fed [discount] window, all those traditional sources of liquidity that have always been important,” says Hanchey. “It’s a new focus on the interplay between those sources of liquidity and [a bank’s] ability to cover uninsured deposits.”

Scenarios should take multiple factors – credit, interest rates, liquidity – into account, helping decision-makers build a narrative that they can use to discuss and assess the impact on the organization, says Joe Sergienko, a client relationship executive at Treliant. They can then come up with a playbook for each scenario – essentially a decision tree that examines how leadership could react in different situations. “No scenario is going to play out exactly the way you forecast,” he says, “but it gives you [a] road map to say, ‘Here’s how we should manage our bank or our process through this.’”

And executives and boards should prepare for the absolute worst: the seemingly low-probability event that could break the bank, like massive outflows in deposits such as those that caused SVB and Signature Bank to fail. This reverse stress testing process provides clues to help leaders avert a disaster. At what point does the bank lose so much liquidity that it can no longer operate? How quickly could that occur?

Stress testing should help foster a larger conversation around risk, and strengthen risk management governance and policies, says Koeser. Scenarios and models should consider the bank’s size, geography and other factors relevant to the business, like concentrations on either side of the balance sheet.

Examiner scrutiny on risk management promises to get more onerous in the year ahead. “We should all expect the pendulum to swing toward heavy, heavy oversight and strict regulation of very discrete issues,” says Hanchey. “Banks should be prepared and have their answers ready when the regulators come in and ask them about things like deposit concentration, interest rate risk, stress tests, rising rate environments. The more proactive banks can be on the front end, the more pleasant their examination experiences will be.”