How to Give Cardholders Digital Self-Service, Fraud-Fighting Capabilities

Brought to you by Fiserv

Despite the dramatic changes in consumer spending habits over the last 18 months, an unnerving constant remains: Fraudsters are ever-present, and financial institutions and consumers must stay on guard.

To address fraud issues and enhance safety, credit and debit card payments are being reimagined and increasingly conducted via digital channels. By deploying digital self-service card capabilities, banks can better protect their consumers and allow them to keep transacting securely.

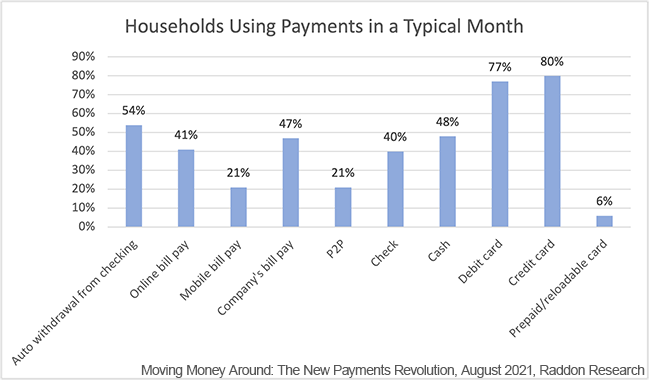

Recent research by Raddon, a Fiserv company, shows the ongoing primacy of credit and debit card payments. In a typical month, 77% of U.S. households use a debit card for purchases and 80% of household use a credit card for purchases, according to the research.

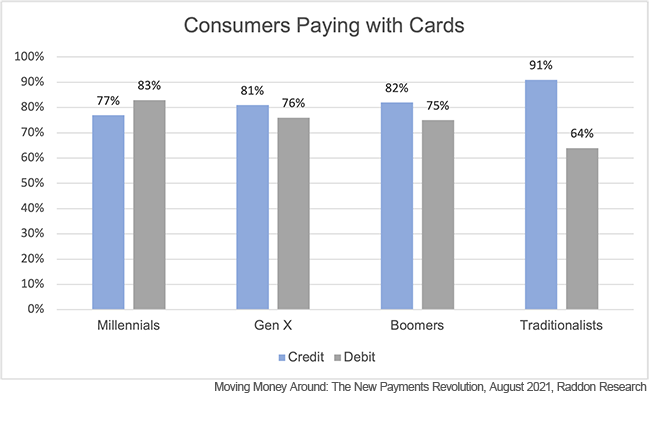

Card usage among varying demographic consumer segments remains robust, with millennials, Generation X and baby boomers all reporting significant reliance on card-based payments.

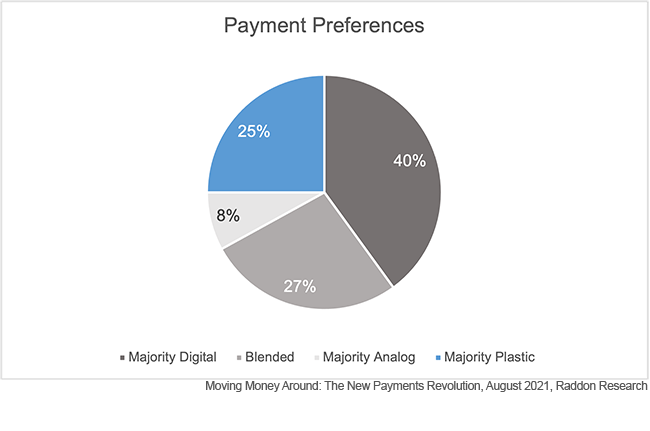

However, the definition of a “card payment” is changing. Consumers are increasingly using their cards digitally, with 40% saying at least half of their monthly transactions are done digitally on their mobile phones or computers, according to Raddon.

Mobile card applications are the answer to these changing trends. Today’s digitally minded consumer needs card apps that help them manage their accounts when and how it suits them. Banks can keep customers satisfied and safe by implementing a comprehensive mobile card management solution.

Digital wallet participation enables banks to give cardholders the ability to add a card to their smartphone or wearable. If cards can be digitally issued at the time of account opening, all the better. This process enables immediate card access via the digital wallet and provide an easy, secure and contact-free way to pay. Card apps can also provide control features designed to keep cardholders safe and their financial institution top-of-mind. Consumers can use these apps to protect their accounts, manage their money and take charge of card usage. Their increased peace of mind will drive transaction volume and cardholder engagement, empowering users to fight fraud through alerts for card transactions and personalizing usage controls.

Consumers are concerned about their spending patterns. Providing cardholders with detailed spend insights and enriched transaction information makes it easier for them to understand their spending and make informed spending decisions. An enriched transaction can make the difference between a panicked consumer who is worried about fraud and someone secure in knowing that each purchase is one they’ve made. The transactions should include real merchant names, retail locations for physical purchases, transaction amount and purchase date. It should also include contact information for the merchant, so consumers can make any inquiries about the purchase directly with the merchant.

Every interaction with consumers is a chance to make a great impression, especially on mobile. Consumers appreciate fresh app designs and features that focus on simplicity, including one-touch access to functions. For example, consumers should be able to quickly and easily lock a misplaced card to prevent fraud and unlock it when located. These digital-first, self-service capabilities create an efficient and safe cardholder experience. Banks can leverage existing marketing resources and creative assets to keep their consumers informed about and remind them of secure self-service aspects of the payments program.

Consumer expectations continue to rapidly evolve and drive change. Banks must respond by staying focused on consumer needs and regularly delivering new app features and interconnected payment experiences. The institutions that do will succeed by continuing to provide consumers with convenient and safe digital management capabilities for their credit and debit cards, whenever and wherever consumers transact.