Andy Heusel is an experienced banker having held leadership positions at a regional bank in the Southeast. Over his 20+ year career in the financial services industry he has led efforts related to regional banking leadership, M&A, market expansion, strategic planning, budgeting and was responsible transformative initiatives such as LOS and CRM implementation, prospecting efforts and enhancing the pricing and profitability efforts using PrecisionLender.

How Some Banks Are Prevailing in the Battle for Deposits

A look at the practices and approaches used at banks that have expanded deposits in this rate environment.

Brought to you by Q2

We recently asked bankers in our “State of Commercial Banking Midyear Update” presentation what was top of mind for the remainder of 2023. The answer was clear: 80% of the respondents selected deposit growth and retention.

As interest rates have surged to their highest levels in decades, financial institutions have found themselves navigating uncharted waters. Some have experienced success in defending — and growing their deposits. In response, we dug into the Q2 PrecisionLender database to determine the strategies and tactics that separate the “deposit expanders” from the “deposit contractors.” Within those institutions, we homed in on groups of top-performing relationship managers at the expander institutions and groups of bottom performers at the contractors.

What Makes a Deposit Expander?

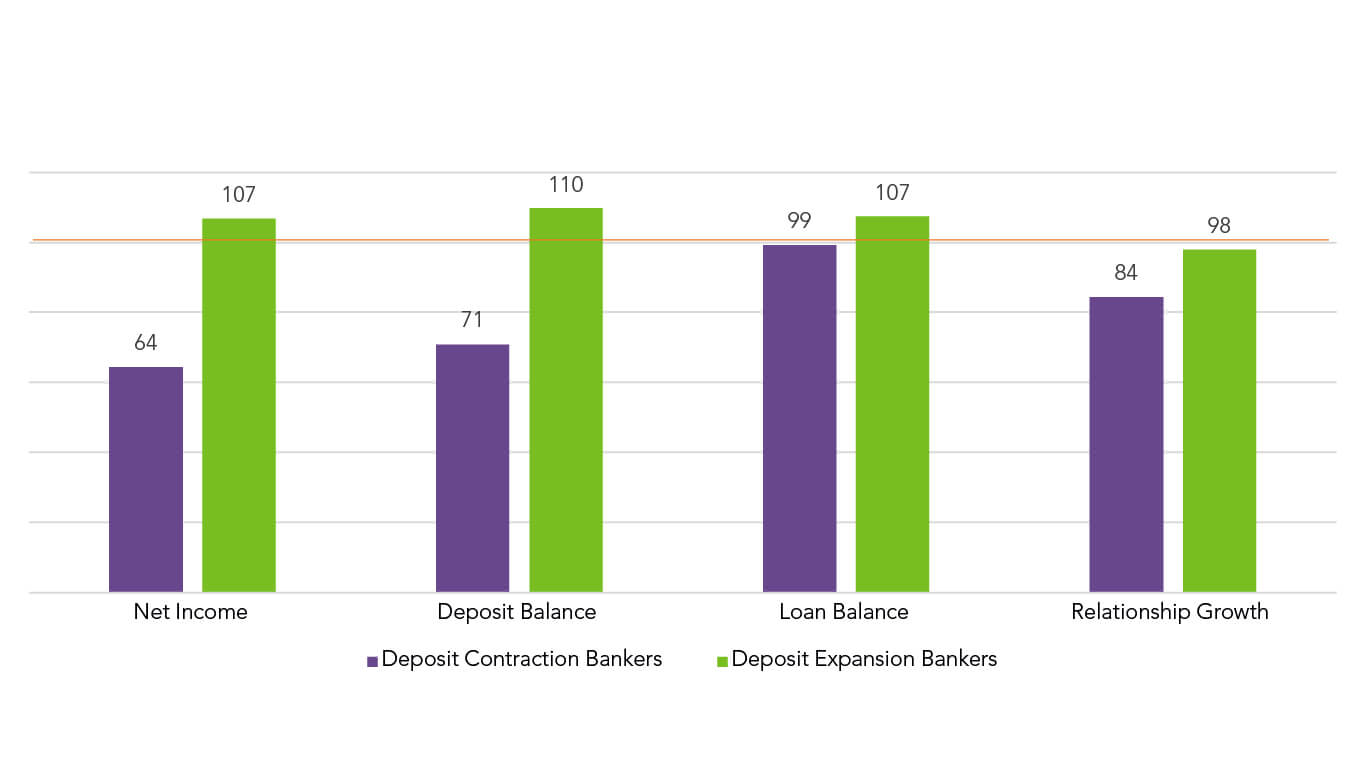

As we studied the deposit expanders, we found that their success is rooted in a broader pricing culture that encompasses leadership commitment, relationship manager (RM) empowerment, desired behaviors and effective measurement of outcomes. Our research into the best relationship managers at those institutions also revealed two important truths:

- Top deposit gathering RMs are also top performers in other measurements, growing loan balances, improving net income and growing the size of the overall relationship.

Relationship Composition Change

Indexed to September 2022 = 100, as of April 2023

2. The best RMs do not necessarily price up to attract deposits. In fact, an institution’s deposit pricing strategy that focuses solely on the rate paid may limit the potential of RMs.

2. The best RMs do not necessarily price up to attract deposits. In fact, an institution’s deposit pricing strategy that focuses solely on the rate paid may limit the potential of RMs.

Deposit expanders also maintained a delicate balance between interest-bearing and noninterest-bearing deposits, producing a strategic mix that supports the institution’s liquidity needs. This balance is crucial in maintaining stability, especially during periods of banking sector uncertainty.

Challenges Faced by Deposit Contractors

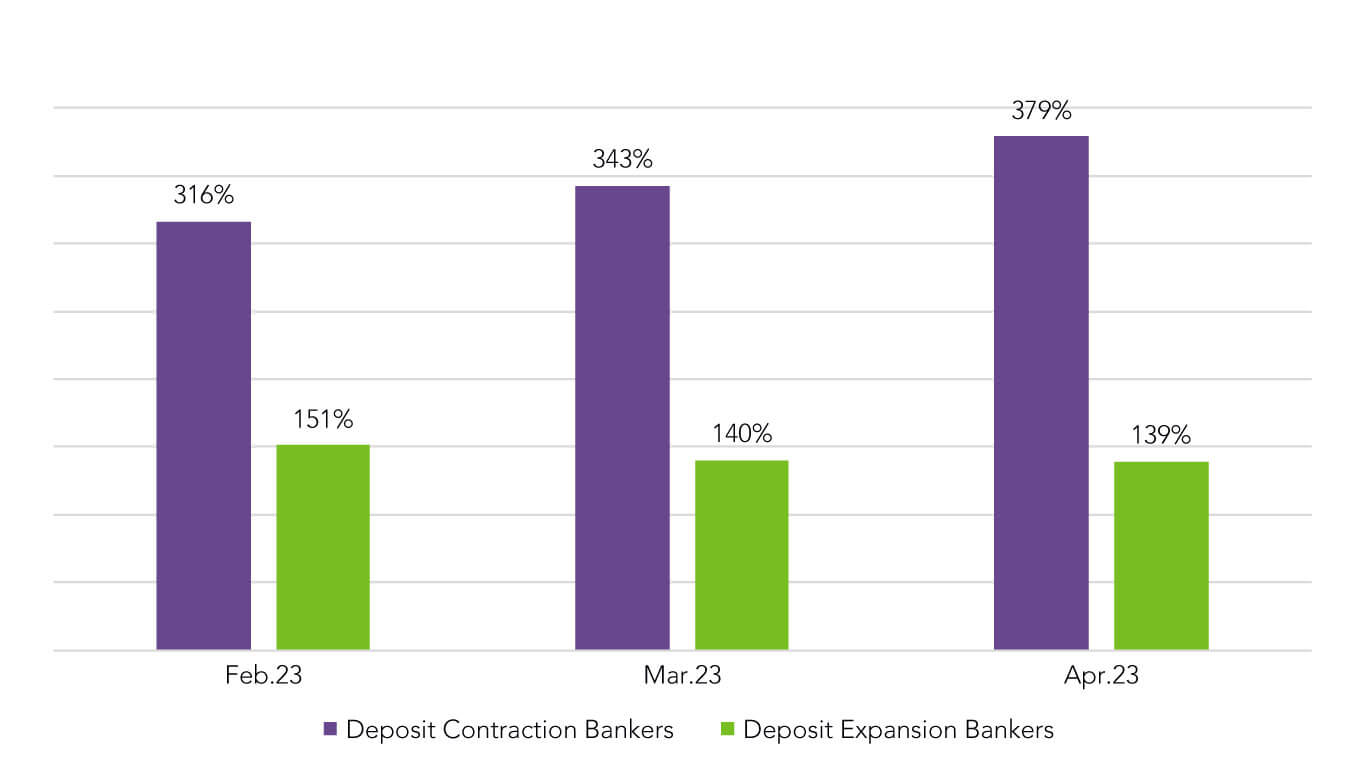

On the flip side, deposit contractors faced several challenges that hindered their efforts to add deposits. Poorly communicated approval processes and workflows disempowered RMs; easy-to-reach loan targets and incentives discouraged them from having deposit-focused conversations. The transient nature of deposits in 2023 has really exacerbated the loans-to-deposits ratio for these institutions, with interest-earning assets consuming liquidity at an alarming rate. By comparison, deposit expanders have largely maintained their loan-to-deposit ratios.

Loans-to-Deposits Ratios

Despite offering higher deposit rates, deposit contractors experienced eroding deposit balances, net income and relationships. This decline in total book performance underscores the importance of a holistic approach to balance sheet growth.

Despite offering higher deposit rates, deposit contractors experienced eroding deposit balances, net income and relationships. This decline in total book performance underscores the importance of a holistic approach to balance sheet growth.

Deposit contractors also had a disadvantage when it came to product mix, with a significant underrepresentation of noninterest-bearing deposit balances (2%) compared to deposit expanders (55%).

Winning Strategies for Deposit Growth

During our analysis, we identified several winning strategies for financial institutions aiming to successfully navigate current liquidity challenges.

1. Cultivate a broader pricing culture. Deposit strategy should be an integral part of a broader pricing culture that has leadership commitment, empowers relationship managers, fosters desired behaviors and provides appropriate measurement of outcomes.

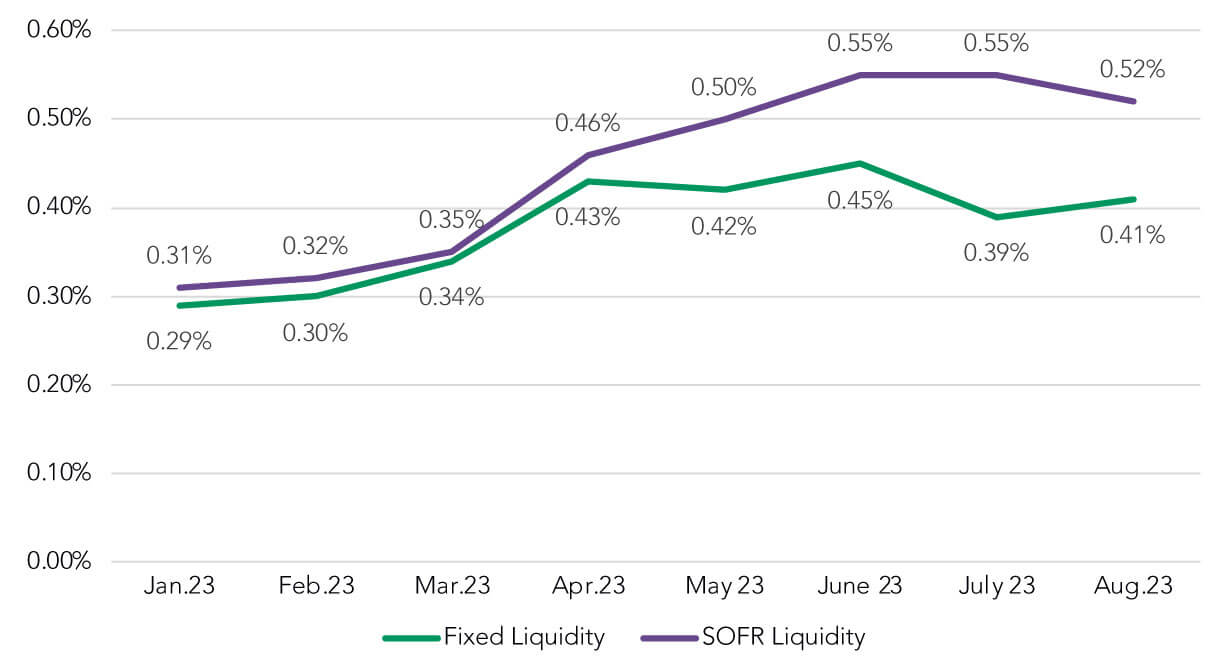

2. Consider funds transfer pricing valuation and liquidity premiums. Recognize that premiums have increased significantly in 2003 — up 67% for floating liquidity and 42% for fixed from January through August — and should be actively considered within the deposit valuation. Banks that expanded deposits gave a clear message to their bankers on the relative value of the deposit relationship by increasing the funds transfer value of those accounts.

Liquidity Cost, Rolling Trend

3. Optimize timing and change management. Managing deposit valuation in real time, with a focus on rapidly adapting to the current macroeconomic environment, is essential for success. In today’s environment, where institutions are not as focused on loan growth, it is essential to create a balance in banker compensation plans and provide tools that allow them to understand the value of clients — and when it is OK to exit a relationship.

4. Focus on the right industry verticals: Prioritize strategies to secure and expand core deposit operating accounts, understanding the significance of earnings credit rates (ECR) in this dynamic environment. This may also include a shift away from certain industry verticals that do not provide a balanced relationship.

In today’s rapidly changing environment, it is essential to give bankers the right messaging and tools to understand the value of the entire banking relationship. For many banks, this may necessitate a complete shift in culture, one that empowers the banker to be the CEO and CFO of their own book of business. This requires careful consideration of many factors — such as what drives the profitability calculus and how it is balanced with the needs of the balance sheet — along with the correct tool set that makes the strategy real, actionable and in the moment for your banking team.