Why Banks Are Divesting Insurance Brokerages

Brought to you by MarshBerry

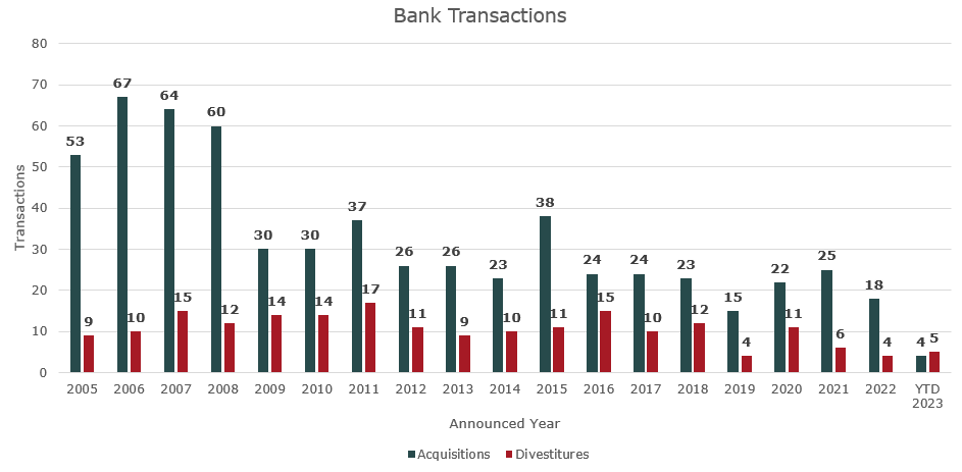

Bank acquisitions of insurance brokerages have been on a steady decline for the better part of 15 years. In 2007, these transactions represented approximately 21.7% of total announced insurance brokerage merger and acquisition (M&A) transactions. By 2012, that percentage dropped to 6.4%, and in 2022 was only 2% of total deals.

Additionally, as banks rebalance toward interest-producing revenue streams, there has been an increase in the number of divestitures of fee-based businesses. For the first time in nearly two decades, announced divestitures of bank-owned insurance brokerages have outpaced announced acquisitions.

Source: S&P Data, Fidelity, and MarshBerry Proprietary Database. Data as of 7/31/23.

Through July 2023 there have been nine announced insurance brokerage transactions involving banks. Of those, five were bank divestitures:

- In February, Charlotte, North Carolina-based Truist Financial Corp. announced a deal to sell a 20% stake of its insurance unit to private equity firm Stone Point Capital.

- In March, Southern Pines, North Carolina-based First Bancorp announced a deal to divest its Arkansas-based BHC Insurance business to employee shareholders.

- In April, Lubbock, Texas-based South Plains Financial, parent company to City Bank, announced the sale of City Bank’s wholly owned subsidiary Windmark Insurance Agency to Alliant Insurance Services.

- In June, Racine, Wisconsin-based Johnson Financial Group divested its Johnson Insurance Services subsidiary to Risk Strategies. MarshBerry served as the financial advisor to Johnson Financial Group.

- In June, Defiance, Ohio-based Premier Financial Corp. sold First Insurance Group to Risk Strategies. MarshBerry served as the financial advisor to Premier Financial.

Why are banks looking to sell their insurance business?

Equity incentive plans are inferior to what other brokerages offer. Banks typically are not able to create competitive equity incentive plans for their brokerage businesses. This puts them at a competitive disadvantage as it relates to attracting and retaining talent, deploying capital for organic and acquisitive growth and aligning interests to drive shareholder value. The cumulative impact of these headwinds translates to inferior enterprise value compared to peer brokerages.

Bank valuations do not fully reflect the value of the insurance subsidiary. Relative to the current third-party valuations that insurance brokerages are commanding, publicly traded bank market valuations are most likely undervalued relative to the sum-of-the-parts of the operating companies. The current price-to-earnings (P/E) ratio of regional banks is 10.3x, while the PE ratio of public insurance brokers is 29.2x. Based on the insurance subsidiary contributing 8% of the holding company’s earnings per share, market capitalizations could increase by 15% if the value was unlocked.

Insurance operations are a drain on the capital ratios of the bank. As banks look to optimize their capital and leverage ratios, divesting insurance operations can potentially have an accretive impact to the holding company that management teams should explore on a case-by-case basis. Beyond the additional capital raised through a divestiture, a sale eliminates the deduction to capital ratios stemming from the non-amortizable goodwill on the balance sheet from past acquisitions.

What are possible solutions for banks?

Invest in the future and implement an equity incentive plan. If a bank is committed to its insurance distribution division, consider ways to incentivize employees that are close to the market through equity shares, deferred compensation or other compensation programs that will retain key producers and leaders.

Look for a financial sponsor to take on a minority stake. Divesting a portion of the insurance business allows banks to optimize their capital and leverage ratios and unlock additional value for reinvestment or to distribute to shareholders.

Look for a majority or outright sale to a financial sponsor. A bank can unlock the maximum value of its insurance business versus the overall valuation of the bank by selling outright to a number of interested buyers.

The acquisition landscape for insurance brokerage continues to be favorable, as consolidation trends in the industry remain strong. Buyers are willing to pay elevated prices for bank insurance subsidiaries and, for the first time in 18 years, there have been more announced bank divestitures than acquisitions.

Disclosure: Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC