The Smart Acquisition in a Low-Rate Environment

Brought to you by Raymond James

Ask a local banker about the robustness of the post-crisis

economic recovery and you may just face a blank stare.

The last decade has been a difficult operating environment for the traditional bank model: compressed net interest margins, anemic loan growth and heightened regulatory pressures on fees, capital requirements and compliance costs. It’s no wonder that banks seek new sources of fee-based revenues and other noninterest income to diversify and reinvigorate profitability.

Among other paths, this search has led many bank CEOs to the

land of wealth management. Banks have acquired 166 registered investment

advisors (RIAs) post-crisis. That figure that is even higher if we include

trust companies, whose business models complement those of RIAs.

It’s easy to understand why. Even as a standalone business,

wealth management is a compelling model. The typical firm enjoys recurring

revenue streams, high customer retention, attractive margins and substantial

operating leverage.

Most wealth management firms can stabilize their margins and

cash flows during prolonged market downturns by resetting headcount and compensation

– two expenses that frequently comprise the majority of a firm’s cost

structure. Wealth management firms can also generate strong financial returns, given

that day-to-day capital requirements are relatively modest.

While growing a wealth management subsidiary organically is

often the most profitable strategy, some banks acquire an RIA because they

either do not have an existing platform or have grown their core businesses so

much that wealth management revenue has not kept pace.

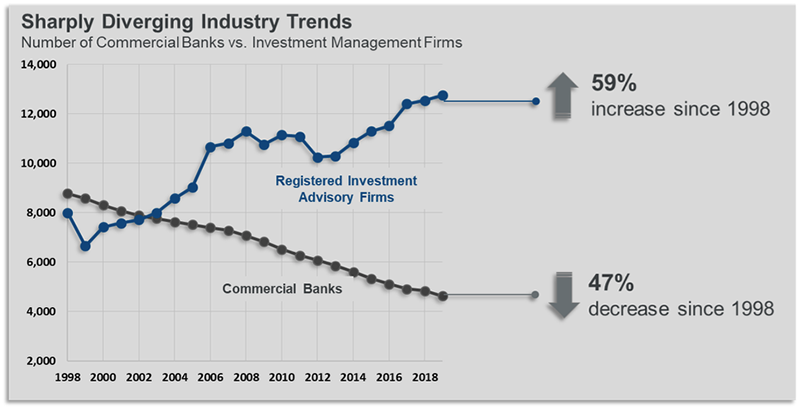

Fortunately, RIAs present a target-rich environment that offers ample opportunity for growth and further consolidation. Since 1998, the number of RIAs has grown 59%, while the number of banks has declined 47%. There are approximately 12,750 RIAs in the United States that manage more than $83 trillion of client money, according to the Securities and Exchange Commission. That figure includes both asset and wealth management firms. Approximately 4,450 firms thrive in a robust middle market, which we define as RIAs with $500 million to $10 billion of client assets, with $9.7 trillion (or 12%) of assets under management.

The ample availability and opportunities

means that banks can enter new markets with smaller, measured RIA acquisitions

– rather than overpaying for the last remaining bank in a market through a

competitive auction. For instance, Chicago-based First Midwest Bancorp entered

Milwaukee via an RIA acquisition; Westerly, Rhode Island-based Washington Trust

Bancorp established a physical presence in Connecticut in a similar manner.

Banks are also uniquely positioned to capitalize on this market opportunity. There are multiple reasons why it can make tremendous sense strategically to combine banking and wealth management:

- Whether a deposit is in the bank or in

the stock market, many clients are looking for holistic advice in a

one-stop-shop experience. - Local banks already have trusted

relationships with countless retail and small business customers – excellent

wealth management prospects. - A bank offers brand strength, an

established branch distribution network and trust capabilities. - Owners of RIAs wear multiple hats

(business development, investment manager and small business operator, among

others); the infrastructure of a bank can allow RIA principals to optimize

their efforts. - Banks that successfully cross-sell with

their RIA subsidiaries capture more wallet share, increasing customer switching

costs.

In a market crowded with offerings that, at times, can seem

commoditized (particularly at the mass affluent level), these benefits can

serve as a powerful differentiator against even the most formidable competitors.

The public markets also share this appreciation for wealth management. RIA-driven income streams generally command higher valuation multiples than those that are interest margin based. For instance, small and mid-cap banks might trade at roughly 10x to 11x forward earnings, whereas valuation multiples for wealth management firms are frequently 20% higher. We attribute this premium largely to wealth management’s sticky revenues that are fee-based, capital efficient and highly predictable.

Wealth management is a natural strategic fit for banks in

particular because it is insensitive to interest rates, leverages the bank’s

physical infrastructure and regional brand and captures more wallet share.

Accordingly,

wealth management can generate attractive returns despite a lower-risk profile

than traditional lines. These benefits are so compelling that many bank CEOs

cite wealth management acquisitions as a key strategic priority for their driving

long-term growth and leveraging their growing capital bases.