What Bank Boards and Management Need to Know about M&A in 2013

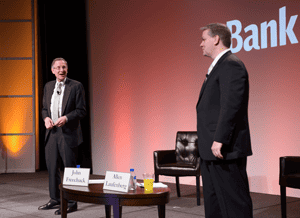

John Freechack, chairman of the financial institutions group at Barack Ferrazzano Kischbaum & Nagelberg, and Allen Laufenberg, managing director of investment banking at Stifel Nicolaus Weisel, answered some timely questions about mergers and acquisitions at a recent Bank Director conference.

John Freechack, chairman of the financial institutions group at Barack Ferrazzano Kischbaum & Nagelberg, and Allen Laufenberg, managing director of investment banking at Stifel Nicolaus Weisel, answered some timely questions about mergers and acquisitions at a recent Bank Director conference.

Where are we compared to a year ago?

Bank valuations have improved slightly but they’re still not great, said Laufenberg. Healthy institutions above $1 billion in assets are now trading above book value, improving their ability to become acquirers. The economic outlook is still positive but sluggish. The number of “problem” institutions on the Federal Deposit Insurance Corp.’s list is no longer north of 800, but it is still above 600. Still, there are more buyers in many markets than a year ago. Some markets had only two or three potential acquirers a year ago but now have five or six.

What is an important quality for an acquirer these days?

Patience. Your favorite targets and their boards may need time to digest the fact they need to sell. Many banks will need to raise capital or make tough decisions in the coming years. Dividends will increase on stock sold originally through the Troubled Asset Relief Program or Small Business Lending Fund. Sellers do not want to feel forced to sell. They want to feel they are selling on their own terms. You may need more retained earnings to persuade your regulators that you can be an acquirer.

What steps should you take if you’re interested in being an acquirer?

This is a fabulous time to do planning, and many banks are focused on strategic planning and organic growth, even if they think they will sell in the next two to three years, said Freechack. Regulators are more willing to discuss getting banks off of regulatory orders and resolving those problems for good, he said. Have those discussions with your regulator now.

Will you need to or be able to raise capital in the foreseeable future?

Will you need to or be able to raise capital in the foreseeable future?

One aspect of strategic planning is figuring out if you will need capital in the future, either to grow or become an acquirer, for example. What sources of capital might you need? Regulators love common equity but it has been difficult to raise and can dilute existing shareholders. Preferred stock has been popular lately, Laufenberg said. There is a perception that management and directors have been “tapped out” and are no longer willing to put more money into the bank. That was two or three years ago and might not be the case today.

How should you approach other banks about an M&A discussion?

Get a preferred target list of banks together and involve your independent board members in the discussion of strategy and acquisitions. Be careful about how you treat these potential sellers. Don’t hire away their second in command (and possible successor to the current CEO)and expect them to be nice to you later on. Don’t approach boards and management with a pitch that sounds like you know they have a troubled bank or will have a retiring CEO in the next year or two. That can turn people off. Regulators need to know what you are planning but they might not be of help too early in the planning process.