Treasury Management Steps Into the Spotlight

Brought to you by Q2

At Q2 we typically perform our “State of Commercial Banking” analysis and report on an annual basis. But 2023 has been no typical year for the banking industry. The tumultuous events that began in March prompted us to take stock earlier, with a mid-year analysis. You can download the full report here, but this article will focus on a particularly intriguing finding involving Treasury Management.

Before we dive into the numbers, a quick reminder: the data in this article is pulled primarily from Q2’s proprietary databases and reflects actual commercial relationships with more than 150 banks and credit unions in the United States – ranging from small community banks to top 10 U.S. institutions. We also gleaned insights from relationship manager pricing activity on the Q2 PrecisionLender platform.

The Shift from NIM to NII

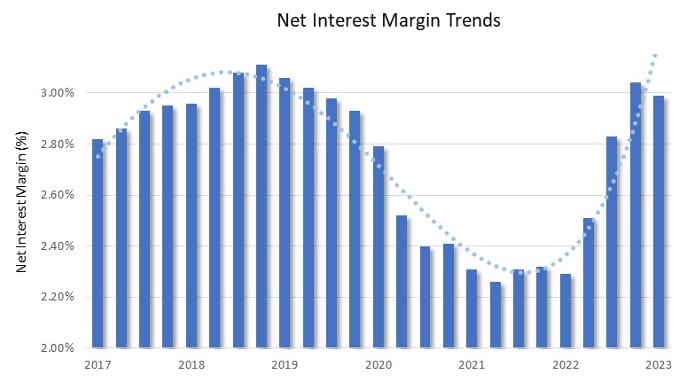

Until the first quarter of 2023, each progressive rate increase had a direct, positive impact on net interest margin. With deposit betas relatively low, the spread between lending rates and funding costs had widened with each Fed increase. But that positive correlation between the Federal Reserve’s fed funds rate and NIM came to an abrupt halt earlier this year, as industry wide NIM compressed despite rising rates.

Source: FDIC

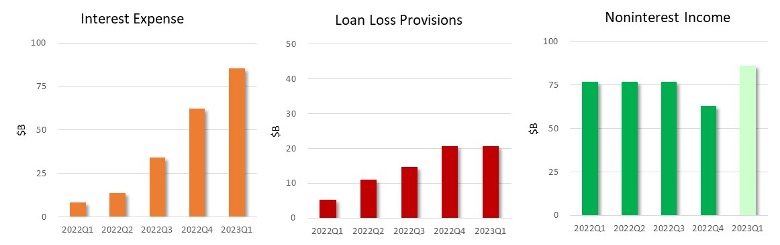

Meanwhile, the rising costs associated with commercial lending – interest expense, liquidity premiums and loan loss provisions – have shone a light on cross-sell as banks seek to preserve or even strengthen profitability. After non-interest income had trended lower in the latter stages of 2022, the first quarter of 2023 saw a renewed focus on NII and some impressive gains.

Source: FDIC

Treasury Management Powers Relationship ROE

The data in those FDIC charts highlighted a trend we’d already suspected, confirming what we’d heard anecdotally during our daily conversations with bankers throughout the United States.

It’s hardly a surprise that banks are putting increased emphasis on cross-selling. Irrespective of the rate environment, relationships with ancillary business produce measurably stronger yields than those without. Cross-sell helps preserve long-term operating accounts, granting customers the benefits of earnings credit to offset the cost of the additional services, while also securing low-cost deposits for the bank. Additionally, the non-credit business itself is fee-rich and highly lucrative.

Still, when we delved into the Q2 PrecisionLender Commercial Pricing Database to get a measure of how big that cross-sell impact is, and what’s driving it, we were struck by what we found.

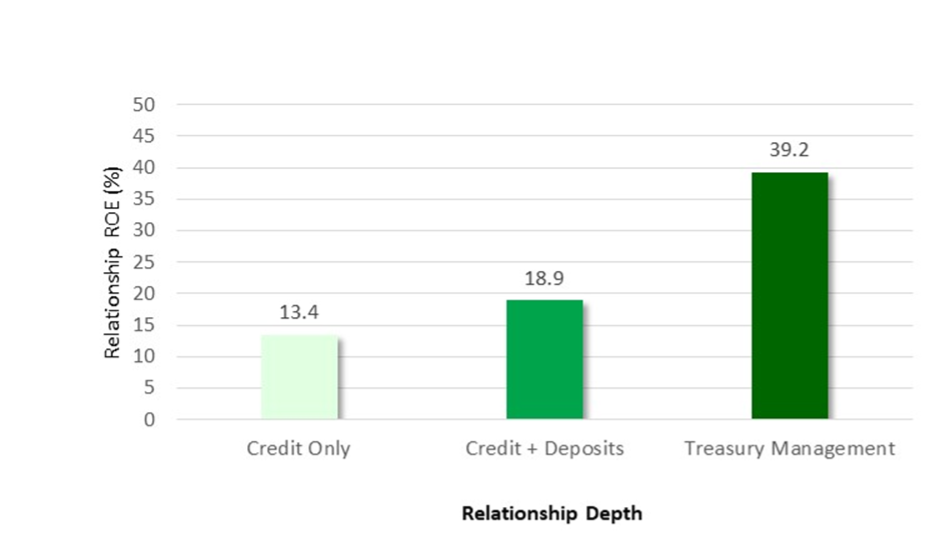

In the first half of 2023, with NIM still relatively high, credit-only relationships gave a solid 13.4% ROE. The ROE rose by nearly 40% (to 18.9%) when relationships also included deposits.

But take a look at what happens when the relationship includes treasury management (TM).

Source: Q2

The ROE on those relationships (both those that include a credit element and those that are only deposits and treasury management) averaged 39.2%!

Moving Forward

The data from the first half of 2023 shows that banks can no longer ride the wave of rate increases to maintain risk-adjusted returns. As lending costs rise, banks are putting increased emphasis on cross-sell. When that cross sell adds treasury management products and services to the relationship, the ROE impact can be powerful.