The Risks of Banking on Mortgage-Backed Securities

Mitigating the Risks of Mortgage-Backed Securities

Mitigating the Risks of Mortgage-Backed Securities

In an environment where many investors are searching for yield, mortgage-backed securities (MBS) have generated significant interest. With higher yields, lower duration, and either implicit or explicit guarantees from the U.S. government against loss of principal and interest, MBS appear to be an attractive option relative to the broader Barclays U.S. Aggregate Bond Index.

Of course, MBS carry the additional risk of negative convexity, which can drive duration higher as interest rates rise (i.e. extension risk) and lower as interest rates fall (i.e. prepayment risk). While investors are compensated for this risk in the form of higher yields, the impact of duration extension in a rising rate environment should not be underestimated. Extension risk, however, can be mitigated through diversification into non-negatively convex bonds such as non-callable (i.e., bullet maturity) corporate securities.

A Word on Negative Convexity

The negative convexity in MBS is driven by the option that borrowers hold to repay their loan at any time. While similar to embedded call options in many corporate bonds, the negative convexity associated with the homeowner prepayment option is a more prevalent feature of MBS than corporate bonds. And while investors are compensated for the risk associated with negative convexity in MBS, the compensation earned for holding convexity risk is not significantly different than the compensation investors receive for holding investment grade credit risk.

Modeling the Potential Impact of Extension Risk

In a recent paper, we modeled the expected impact of extension risk for an MBS investor, and examined how rate changes effected the duration and total return of the Barclays MBS index. Our analysis demonstrated that:

- The duration of a diversified set of mortgage pools can be expected to significantly extend in a rising rate environment.

- Conversely, we found that the durations of investment grade corporate bonds and treasuries did not materially change when rates moved. When they did, the direction of the duration changes were inverse to rate moves (the indices are positively convex).

- Because of this positive convexity, the modeled losses for treasury and corporate indices were much lower relative to the MBS index even though they carry lower yields and their (initial) durations were approximately equal.

MBS Extension in the Spring of 2013

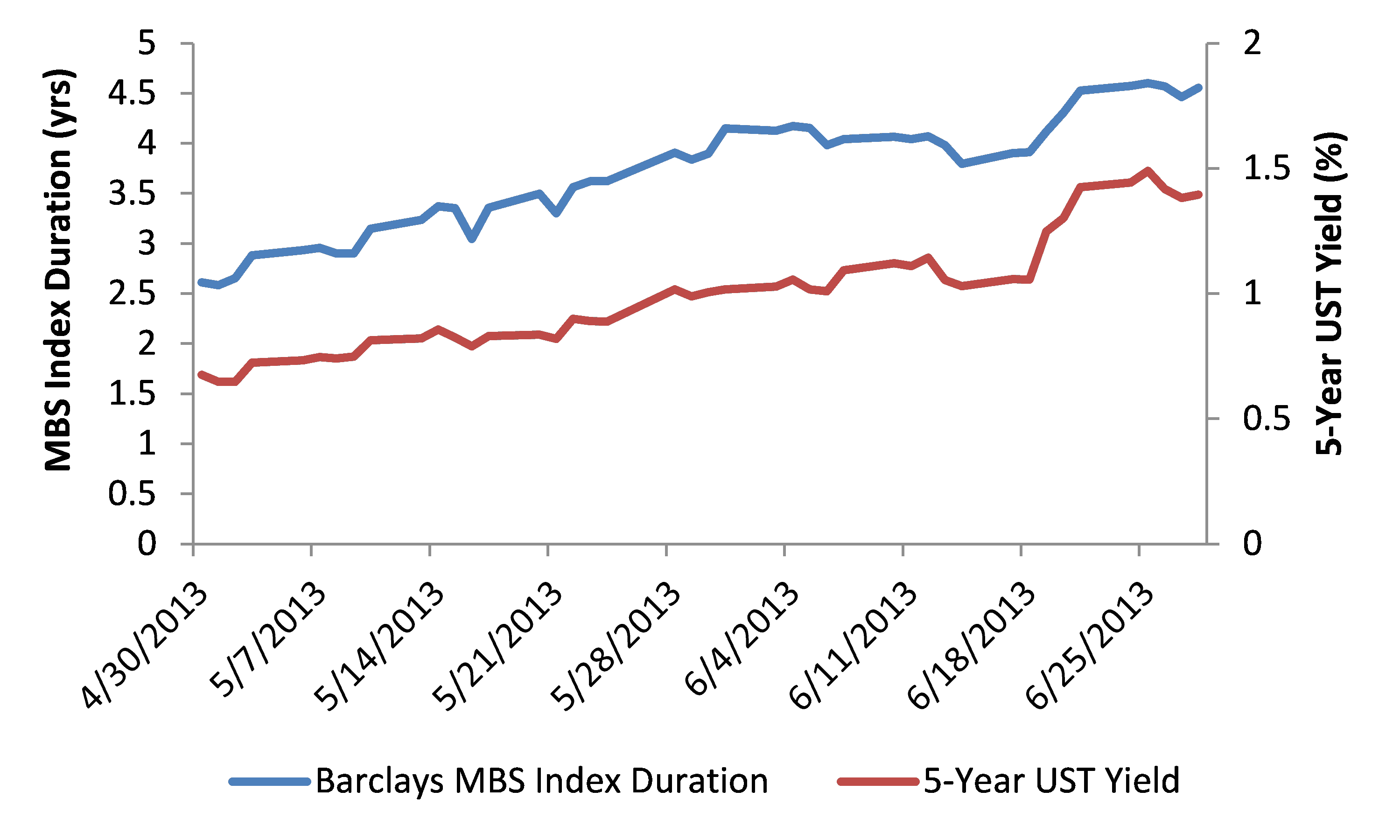

While scenario analyses are helpful for understanding how securities may react to changes in rates, they rely on assumptions that may not be observed in practice. However, empirical data illustrating the impact of MBS duration extension can be observed in the sharp rise in rates between May and June of 2013 when the 5-year U.S. Treasury (UST) yield rose from 68 basis points (bps) to 139 bps.

Beginning in May with a duration of approximately 2.6 years, the Barclay’s MBS index declined 2.48 percent over the next two months as rates rose. Meanwhile, the Barclays 1-5 Year UST index and the Barclays 1-5 Year Corporate index, which had similar durations at the beginning of May, only declined by 0.87 percent and 1.54 percent respectively.

MBS duration extension was the most striking result of the surge in rates, with the duration of the MBS index climbing two years from 2.61 to 4.54 years. An investor holding the index at the beginning of May who was comfortable with a duration of 2.6 years, might have felt much different two months later when the duration extended to more than 4.5 years.

Change in MBS duration vs. changes in 5-year UST rates

Source: BlackRock, using Bloomberg data as of June 30, 2013. Past performance does not guarantee future results.

Conclusion: Managing Negative Convexity Through Diversification

In stable rate environment, MBS should provide an attractive return relative to comparable bullet bonds (bonds that are non-callable by the issuer). However, the higher yield of MBS does not come without added risk. In volatile rate environments, MBS can be expected to underperform bullet bonds, which are positively convex. Combining the two types of securities into a portfolio helps to diversify interest rate exposure through varying rate environments, lowering the overall risk of the portfolio.

U.S. Treasuries and corporate bonds can diversify a portfolio with excessive convexity risk. Corporate bonds also provide further diversification of the sources of yield. This extra layer of diversification historically helped during rising rate environments as increases in interest rates often occur because economic conditions are improving, lowering credit risk and tightening spreads. And while corporate bonds expose investors to the idiosyncratic risk of the issuers within a credit portfolio, this can easily be mitigated through the use of a broadly diversified vehicle such as an exchange-traded fund.

Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. The information included in this publication has been taken from trade and other sources considered to be reliable. We do not represent that this information is accurate and complete, and it should not be relied upon as such. Any opinions expressed in this publication reflect our analysis at this date and are subject to change.