The Intersection of Paying and Playing in Online Video Gaming

Brought to you by Visa

Video gaming is a vast, fast-growing global industry touching various sectors, including payments.

The global revenue for 2021 was estimated at $175.8 billion, which, represents a compound annual growth rate of 8.7% between 2020 and 2024, according to a Boston Consulting Group analysis. This is a clear opportunity for banks to take advantage of growing card usage and enhance consumer engagement in online video gaming.

The global community of online gamers is set to exceed 3 billion people in 2022, nearly a third of the world’s population, according to the 2021 Global Games Market Report. That’s a lot of goals scored, hazards avoided and quests completed. This community now includes consumers from nearly all demographic segments; with that comes a closer correlation between paying and playing in the online universe.

Visa Consulting & Analytics has outlined the key characteristics of the online video gaming market, including its customer base, revenue models, integration of payments, pain points and opportunities for today’s payments businesses.

Understanding the Value Chain, Revenue Models

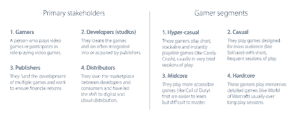

In online gaming, there are generally four primary stakeholders and four broad gamer segments, shown below.

There are multiple revenue models in online gaming – all of which can be lucrative for stakeholders. One such revenue model is in-game micro-transactions, which has become a core driver of transaction volume across platforms. Although there is overlap among them, gaming revenue models can generally be codified as follows:

- Buy-to-play: The gamer buys the game and can play indefinitely. However, the game continues to be supported by the developer or publisher (such as providing downloadable content), which the gamer may need to pay to access.

- Free-to-play: The gamer does not need to purchase the title to play, but access to some features and content may require a subscription or micro-transactions.

- Freemium games: These are free to start but are limited in terms of how far the gamer can progress before they must purchase the game.

- Subscription: The game is typically free to play to entice new gamers, but they must pay a regular subscription to maintain access to all parts of a game.

- Ad-supported games: These are typically free to play, with the developer or publisher earning revenue from advertisements that the gamer needs to watch periodically to continue playing.

- Play-to-earn games: These typically incorporate blockchain elements such as non-fungible tokens, or NFTs. Gamers are incentivized to use NFTs to improve their value or to create new NFTs. Gamers may need to pay an upfront fee to participate, but are paid for their contribution to new and/or upgraded NFTs.

How Payments Fit Into Gaming

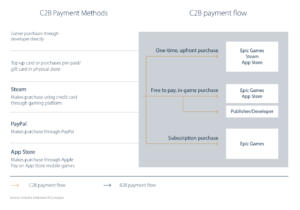

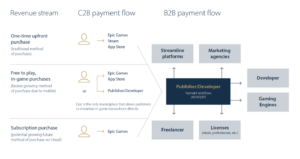

With the appearance of new revenue models, the gaming ecosystem has become increasingly more complex, with many parties and a myriad of payment flows. There’s business-to-business (B2B) and consumer-to-business (C2B); with the emergence of play-to-earn gaming, there’s also the potential for business-to-consumer (B2C) and consumer-to-consumer (C2C).

The predominance of digital delivery and the rapid growth of freemium models and in-game purchases means there is considerable potential for publishers and marketplaces to influence “top-of-wallet” payment behaviors. This is due to the closed-loop nature of the marketing channels on the platforms, which limits a financial institution’s ability to influence payment behaviors.