The Big Debate: Should Bank Boards Approve Loans?

A majority of banks approve individual loans at the board level, but should they?

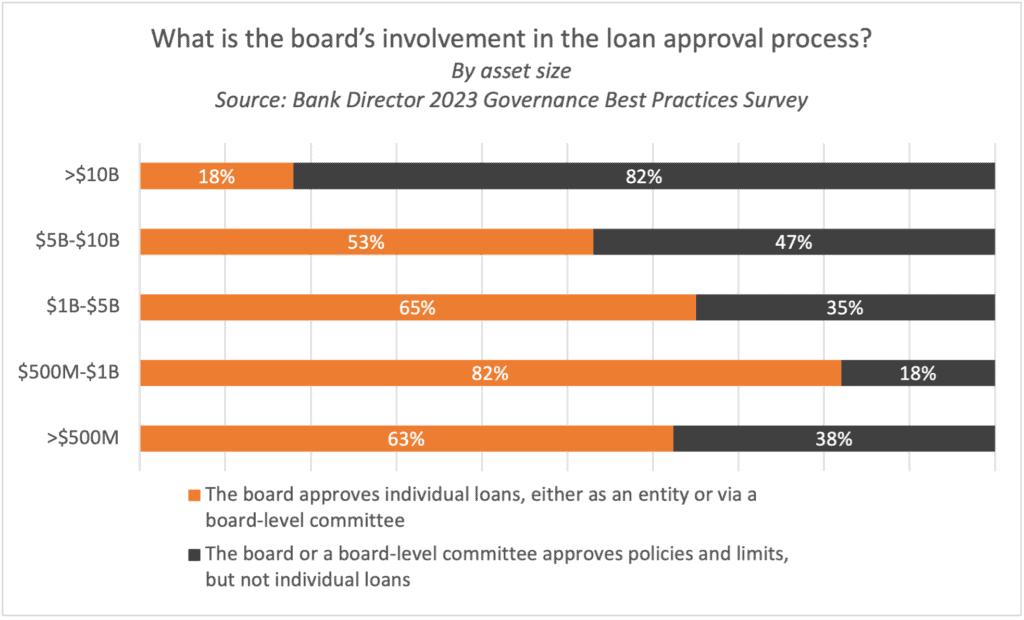

Bank Director’s 2023 Governance Best Practices Survey indicates that while the practice remains common, fewer boards approve individual loans compared to just a few years ago. Sixty-four percent of responding directors and CEOs say their board approves individual loans, either as a whole or via a board-level committee, while 36% say the board approves loan policies or limits. Four years ago, 77% of respondents to Bank Director’s 2019 Risk Survey said their board approved individual loans.

In an environment that’s characterized by economic uncertainty and sluggish loan demand, does this additional layer of review create more risk? Or does it provide a level of assurance that the credit will hold up, should the economy tip into a recession?

“There’s no firm rule that says a board should be or should not be involved in this decision,” says Brandon Koeser, a senior analyst at the consulting firm RSM US LLP.

Boards at banks below $10 billion in assets are more likely to be directly involved in approving individual loans. Those loans may be less complex, and board members may be more likely to know the borrower’s character. While it’s valuable to have former lenders in the boardroom who can review loan packages, it can also help to include perspectives from directors with other types of business experience.

“A lender is going to approach a loan differently than someone who may have been in the actual borrower’s shoes or may still be in a borrower’s shoes,” says Koeser. “They might even give management additional questions to think through when they’re going through that decision.”

Some bankers say the additional board oversight benefits their organization in other ways, by giving directors a clearer window into the risks and opportunities the bank faces. And while it may be more work for lenders, it also allows those bankers to look at the deal several times before it’s finalized.

At Decatur County Bank, the $270 million subsidiary of Decatur Bancshares in Decaturville, Tennessee, the board approves individual loans over a certain size, says CEO Jay England. Many of the bank’s board members have at least a decade of experience in approving loans, and the board recently added a former banking regulator to its membership. Those directors’ collective experience provides valuable oversight for larger deals, he says.

Lending has historically been one of the riskiest activities banks engage in and approving loans as a director carries some degree of risk itself. In the aftermath of the 2008 financial crisis, a number of bank directors and officers at failed banks were sued by the Federal Deposit Insurance Corp. for loans they had approved that later went bad.

If directors could be held liable for bad loans, England says, they “should be getting a look at the decisions we’re making.”

But that doesn’t mean there isn’t room for some improvement. The bank revamped its lending and approval process several years ago, he says. As part of that, it adopted a board portal. Bankers upload loan packages into that portal so board members can review them on their own time in between meetings.

The $1.5 billion Cooperative Bank of Cape Cod moved away from loan approvals by the board as part of an overall shift toward an enterprise risk management structure, says Lisa Oliver, CEO and chair of the Hyannis, Massachusetts-based bank. It created an internal loan committee staffed by bank officers – including the chief credit officer, chief risk officer, chief financial officer and chief strategy officer, along with Oliver as CEO – to approve credits and undertake a deeper analysis of the bank’s credit portfolios, trends, policies and risk tolerances.

At the board level, the bank folded its loan, finance and IT committee functions into one enterprise risk management committee. That committee’s responsibilities around credit include monitoring portfolios for concentration risk, and reviewing each of the bank’s lending areas for trends in delinquencies, nonaccrual rates and net charge-offs.

Loans up to $2.5 million are approved by the bank’s chief credit officer. Loan relationships over $2.5 million are sent to the bank’s internal loan committee for approval, and relationships over 15% of the bank’s total capital move to the board for ratification, says Oliver. In this context, the committee isn’t digging into the merits of a deal to approve a specific credit. Rather, the board sees an executive summary of the loan to evaluate its impact on concentration risk limits, risk rating levels and construction loan limits.

Reading one single loan package can take 45 minutes to an hour for a seasoned credit professional, and Oliver says that moving to this structure has freed up board members’ time and resources to focus on the larger picture of risk management and strategy.

“Everyone’s time is valuable. I don’t want my board to have to spend time reading these deals,” Oliver says. “What I need to do is elevate them out of management, which is really approving loans, and get them into their seat as risk oversight: approving policies, understanding trends, looking at concentrations and developing risk appetites.”

Governance issues like these will be covered during Bank Director’s Bank Board Training Forum in Nashville Sept. 11-12, 2023.

Article updated on Sept. 15, 2023, to clarify approvals at Cooperative Bank of Cape Cod.