David Ruffin is a principal at IntelliCredit, A Division of QwickRate. His extensive experience in the financial industry includes an emphasis on credit risk in a variety of roles that range from bank lender and senior credit officer to co-founder of the successful Credit Risk Management, LLC consultancy and professor at several banking schools. A prolific publisher of credit-focused articles, he is a frequent speaker at trade association forums, where he shares insights gained helping lending institutions evaluate credit risk—in both its transactional form as well as the risk associated with portfolios based on a more emergent macro strategy. Over the course of decades, Mr. Ruffin has led teams providing thousands of loan reviews and performed hundreds of due diligence engagements focused on M&A and capital raising.

Not So Fast! Bank Loan Quality Doesn’t Track With Wall Street Metrics

Despite recent good economic news, the potential for trouble lurks in bank loan portfolios. It’s time for stepped up vigilance.

Brought to you by IntelliCredit, A Division of QwickRate

I recently heard a senior lending officer proclaim, with obvious relief, “Looks like we’ve dodged the recession bullet. We’re refocusing on loan growth opportunities.” The Fed-orchestrated “soft landing” is, of course, what the banking industry desires, but history warns that it can take years before the effects of macro events such as pandemics, rate shocks and rampant inflation show up in lower credit quality. Even as these triggering events subside or abate, the lesson is clear: we shouldn’t let our guard down.

The Good

Despite weaknesses in specific pockets of the economy, overall job growth and unemployment have remained resilient. The inflation rate in December fell to 3.4% vs. 6.5% a year earlier, and the Federal Reserve has hinted at lowering interest rates soon in response. While current rates are moderate compared to standards set in the ‘70s and ’80s, cutting interest rates would certainly be a boon for the mortgage industry and other lenders.

The Bad

Despite those promising economic indicators, other data points to the potential for trouble ahead.

A December 2023 study by the National Bureau of Economic Research indicated that about 44% of banks’ office loans are underwater (equity-to-loan value) and vacancies are soaring. The study reported that a 10% default rate on broader commercial real estate (CRE) loans would result in about $80 billion in bank losses. Some fear that the drag of higher rates on the multifamily housing sector is creating a bubble that could make things worse.

- The research group MSCI Real Capital Analytics reported last summer that the community and regional bank share of the U.S. CRE market had exploded from 17% to 27% since the pandemic. While the smaller banks have increased their CRE loans, investors and larger institutions have shed CRE exposures due to credit quality concerns and heightened regulatory scrutiny.

- Weaknesses in the trucking sector were at the heart of a recent Midwest bank failure — the first credit quality focused closure in quite a while.

- There’s a growing dichotomy between consumers who are living paycheck-to-paycheck and amassing unprecedented credit card debt and those with strong balance sheets and investment resources. This problem might affect credit unions disproportionately but it could impact the performance of banks as well.

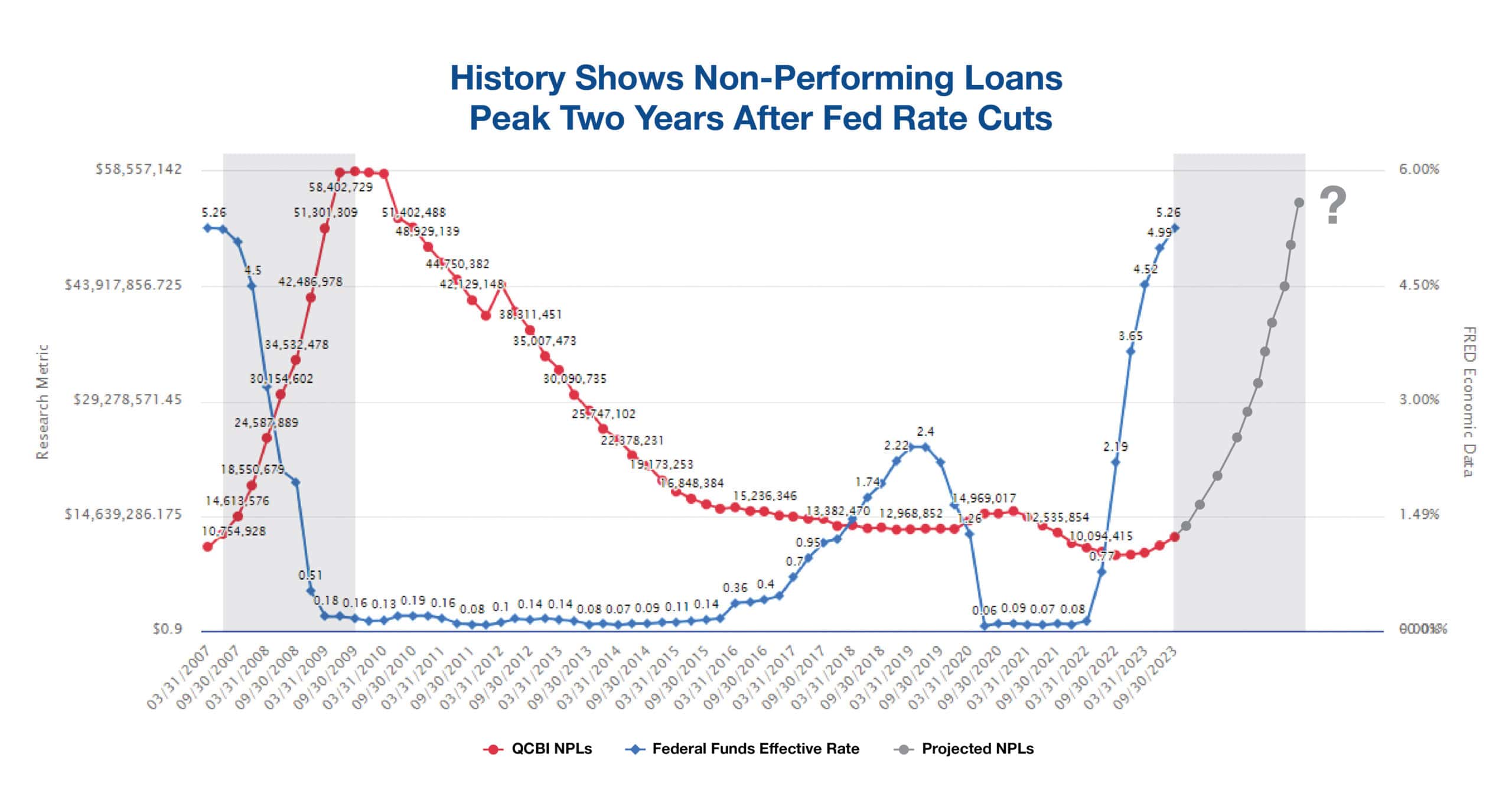

The below chart of historical data from the QwickAnalytics® National Performance Trends Report (based on the proprietary QwickAnalytics Community Bank Index (QCBI) of true community banks) shows a roughly two-year lag between the end of rate hikes and the peak of non-performing loans (NPLs). This may be the most telling data supporting the continuing need for credit risk management vigilance!

The Now

The above data mandates that those directly responsible for a bank’s credit portfolio performance be constantly vigilant. Here are some areas to focus on:

- Accept that regulatory scrutiny is increasing significantly, particularly in the CRE arena. Be sure to reinforce your adherence to both the December 2006 Interagency Guidance on CRE Concentrations (Fed SR7-1) and the June 2023 guidance, Prudent CRE Loan Accommodations and Workouts (Fed SR23-5). Anticipate CRE repricing and performance, monitor concentrations unique to the bank and ensure that management and the board are fully informed.

- Enhance all aspects of loan review — whether performed internally or by an external provider — and ensure the quality and experience levels of those performing the reviews are up to the task. Remember, loan review is one of the most reliable tools for early detection of credit risk, which can play a key role in minimizing loan losses.

- Perform stress tests, preferably in concert with loan reviews, that go beyond providing theoretical losses. Think about focusing on suspect borrowers who could potentially move the needle on losses higher.

- Embrace practical and affordable portfolio analysis tools that provide early detection of weakening trends and emerging hotspots, particularly within the bank’s lending concentrations. A bank’s loan portfolio is its DNA, and bankers need to understand what it is telling them before regulators arrive. Smaller banks remain laggards in this area. Waiting for call report data to depict loan quality is a fool’s errand, because as they say, “Those horses are already out of the barn.”

Despite the desire to put recession fears in the past, history and current conditions mandate that the industry keep its guard up and manage what appears poised to be the greatest level of credit stress since 2008’s Great Recession.