How is Your Bank Perceived by the D&O Underwriter?

Whether you are an executive preparing for the upcoming directors & officers (D&O) liability insurance renewal or a board member preparing for the D&O discussion at the next meeting, there is one person you should be trying to impress. That’s the underwriter who is analyzing your bank and determining the D&O renewal terms and conditions.

Whether you are an executive preparing for the upcoming directors & officers (D&O) liability insurance renewal or a board member preparing for the D&O discussion at the next meeting, there is one person you should be trying to impress. That’s the underwriter who is analyzing your bank and determining the D&O renewal terms and conditions.

The perceptions of this individual are going to determine whether the insurance policy that protects the personal assets of the directors and officers and the corporate balance sheet is comprehensive enough to include the most up-to-date coverage enhancements, or is so restrictive as to include a regulatory exclusion. Now before getting into what steps you can take to improve that perception, it is important to understand the claims and litigation trends that these underwriters are talking about before they start to take a look at your bank.

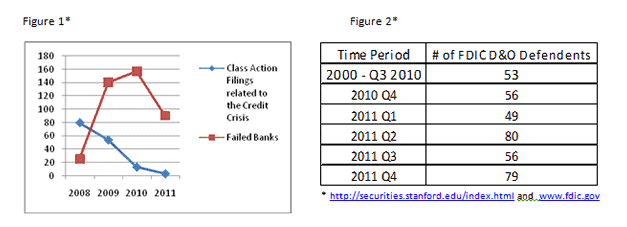

The top two claims leaders in the banking D&O marketplace continue to be regulatory exposures and M&A. With regards to regulatory concerns, the data provides an interesting dichotomy. While we see a decrease in 2011 for both class action claims relating to the credit crisis and to the number of failed banks (figure 1), we continue to see a very large spike in the number of FDIC D&O defendants (figure 2).

This is consistent with the fact that the FDIC reports that “most investigations are completed within 18 months from the time the institution is closed” (www.fdic.gov). And it is not just failed banks that concerns underwriters. Most underwriters would categorize a bank as a regulatory risk if any of the following exist:

- Any open regulatory agreement

- Consent order

- Cease and desist order

- MOU (memorandum of understanding relating to asset quality, earnings, or capital, but not so much for safety and soundness or the Bank Secrecy Act)

- Severe degradation of asset quality following a regulatory exam or audit where the expectation would be a regulatory restriction on the following exam (Texas ratio close to 100 percent or Tier 1 capital/total loan ratio of <2 percent)

And once a bank is perceived as a regulatory risk, there is a good chance that the D&O liability terms would include the very restrictive regulatory exclusion.

As mentioned, the second significant risk exposure is M&A (mergers and acquisitions), which also demonstrates compelling data points. In 2010, M&A filings represented the largest broken out category with 40 such filings representing out of 167 filings or 24 percent. That percentage jumps to 30 percent in the first half of 2011. So if your institution has any regulatory exposures or is anticipating some type of M&A, you can expect a lot of questions during the upcoming renewal process.

And while there are many ways to address those questions, we believe that coordinating some type of underwriter meeting or call is the best way to improve underwriter perceptions and generate the most comprehensive D&O renewal with regards to terms, conditions and pricing. The process usually entails coordinating a meeting with the management team, the incumbent underwriter and all competing underwriters either at the bank’s office or a centrally located site. In order to make the meeting as productive as possible, your broker should obtain any questions the underwriters would have and present that to the management team prior to the meeting. The benefits of such a meeting are four-fold:

1. Unlike insurance lines such as property/casualty or workers’ compensation, where actuaries are able to somewhat predict the likelihood of a claim based on past trends, there has been no reliable model to mathematically predict when the next securities class action or next suit against a director/officer will be. So when an underwriter has an opportunity to meet or listen to the management team, this provides a gut feeling as to the quality of the management.

2. Having all of the underwriters in a room or on a call at the same time goes a very long way in fostering the competitive influences in the marketplace. One comment I hear is that it is unfair to include the incumbent underwriter in the same meeting as all of his/her competitors What we recommend instead is to then have a one-on-one lunch or dinner meeting with the incumbent underwriter(s) to further develop that existing relationship.

3. By meeting with the underwriter, you have now developed more of a personal relationship with the underwriter, which can be helpful in the future is in the event of there is a claim or a service request.

4. One of the frustrations I hear a lot from bankers is that the process to finally bind up the renewal often incorporates a lot of last minute questions or requests. At this meeting with the underwriters, you are basically saying, “speak now or forever hold your peace.” We find that once the meeting is completed, the remainder of the renewal process becomes very streamlined.

So as you prepare for that D&O renewal or discussion, don’t forget to think about that underwriter and what you can do to improve the perception of the bank.