Customer Analytics: Solving the Checking Account Profitability Quandary

What are banks to do when zero percent of customers will gladly pay fees for their basic checking products, yet 100 percent of banks need more fee income, and an average of 43 percent of checking customers aren’t profitable? Simply slap a new fee on an existing product, especially one that’s been free? Sounds easy, but this just ticks off customers, especially the most profitable ones.

What are banks to do when zero percent of customers will gladly pay fees for their basic checking products, yet 100 percent of banks need more fee income, and an average of 43 percent of checking customers aren’t profitable? Simply slap a new fee on an existing product, especially one that’s been free? Sounds easy, but this just ticks off customers, especially the most profitable ones.

It is this Catch 22 situation that led StrategyCorps to create a customizable BaZing consumer checking solution that delivers customer-friendly fee income, fixes unprofitable accounts and protects the profitable ones. As a bonus, it also better connects with the mobile/online financial lifestyles of consumers. Here’s how it works.

Using BaZing’s analytical tool (called CheckingScore), we determine the profitability of each customer’s total householded relationship based on total deposit accounts, loans and fee income. Each customer gets a score based on profitability. With this financial foundation, the bank can then begin tailoring the BaZing-related checking product to the bank’s needs and deciding its place in the checking line-up.

This involves building exactly what the bank’s BaZing product will be, given specific market realities (such as fee income needs, competition, brand identity, marketing resources, current state of mobile and online platforms).

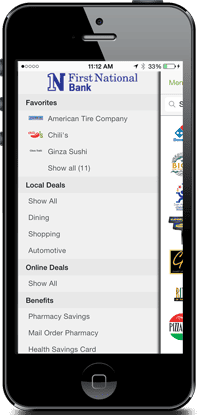

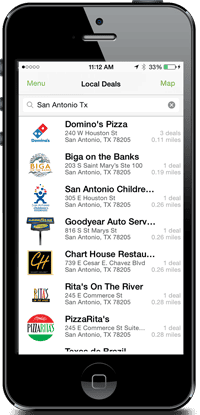

StrategyCorps and the bank determine which traditional banking benefits are necessary to combine with precisely chosen non-traditional benefits, like discounts with local merchants (including the bank’s small business customers) or cell phone insurance, which consumers have already shown a willingness to pay for. These benefits are delivered with a mobile application and online for a reasonable monthly fee of $6. The most profitable customers are provided these non-traditional benefits for free as a reward for being the most loyal and productive customers.

StrategyCorps and the bank determine which traditional banking benefits are necessary to combine with precisely chosen non-traditional benefits, like discounts with local merchants (including the bank’s small business customers) or cell phone insurance, which consumers have already shown a willingness to pay for. These benefits are delivered with a mobile application and online for a reasonable monthly fee of $6. The most profitable customers are provided these non-traditional benefits for free as a reward for being the most loyal and productive customers.

BaZing’s list of available non-traditional benefits revolve around two premises: (1) saving customers money when they spend it, especially with local merchants and (2) protecting customers when something unexpected happens in everyday activities.

Plus, due to StrategyCorps’ purchasing power, the price of a bundle of several of these benefits in the checking account is typically less than the price of just one benefit sold on a stand-alone basis.

There are nearly 200 banks today with the BaZing solution out of thousands of banks facing the fee income and profitability quandary described above.

First Financial Bank in Abilene, Texas employed BaZing to simplify and standardize active and grandfathered accounts. The bank had more than 120 different deposit accounts due to acquisitions and its corporate structure, which were slimmed down to eight accounts across ten banks in its holding company. The bank also used BaZing to upgrade its value-based checking account (Wow! Checking). This allowed customers to save their hard-earned money with local community merchants (including nearly 200 small business customers), while generating substantial new customer-friendly fee income.

First Financial Bank in Abilene, Texas employed BaZing to simplify and standardize active and grandfathered accounts. The bank had more than 120 different deposit accounts due to acquisitions and its corporate structure, which were slimmed down to eight accounts across ten banks in its holding company. The bank also used BaZing to upgrade its value-based checking account (Wow! Checking). This allowed customers to save their hard-earned money with local community merchants (including nearly 200 small business customers), while generating substantial new customer-friendly fee income.

Lakeland Bank in Oak Ridge, New Jersey customized BaZing as Elite Checking to improve consumer checking profitability, with incentives for customers to increase their debit card usage. It also provided the bank with a competitive advantage in the crowded New Jersey/New York City metro market with a checking account that aligned perfectly with their brand identity.

The game-changing innovation of BaZing can be summed up in its typical financial results for a bank:

- Unprofitable checking accounts (about 43 percent of all accounts) can be fixed by generating nearly $75 per year per account in customer-acceptable fee income. This is usually a fee income lift of 250 percent+ over existing levels.

- Super profitable checking accounts (about 15 percent of all accounts) can be protected and retention increased by providing BaZing’s benefits as a reward for their loyal patronage.

- When unconditional free checking is offered (a rarity these days), new checking customers will choose the fee-based BaZing-related account 30 percent of the time, and they will chose it more than 50 percent of the time when totally free checking isn’t offered.

- The consolidation of grandfathered accounts into a simplified active account line-up saves tens of thousands of dollars annually in costs related to maintaining, managing and servicing these grandfathered accounts.

Strategically, BaZing engages customers differently, so they remember the bank when they’re not in the branches (average annual branch visits per customer is three) by going beyond basic banking.