A Look at 2020’s Remarkably Resilient Leveraged Loan Market

Brought to you by BancAlliance

What happened with the leveraged lending market last year?

Not surprisingly, leveraged loan markets tracked very closely to the broader economy and enjoyed their own K-shaped recovery in the latter half of 2020. Face-to-face businesses and the energy industry faced headwinds brought about by the pandemic, while IT, health care and pockets within manufacturing managed to thrive and even grow.

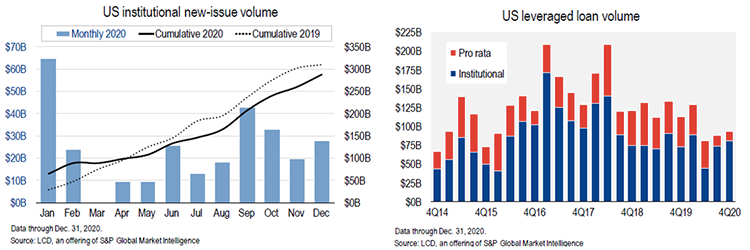

Loan volume finished the year on a strong note after cratering to a four-year low during the second quarter, due to the initial shock of the spreading pandemic. Institutional loan issuance gathered steam through the summer; by the third and fourth quarters, issuance totals were in the range of 2019’s quarterly average of $77.5 billion, according to S&P Global Market Intelligence’s Leverage Commentary and Data. Much of the demand was driven by the re-emergence and recovery of the collateralized loan obligation, or CLO, market, buoyed by investors searching for yield in the low interest rate environment.

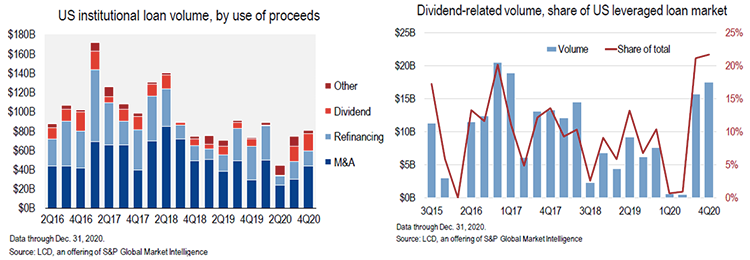

Loans supporting buyouts and acquisitions drove the fourth-quarter tally, surging 49% from the third quarter. New buyout deals had nearly dried up amid the economic uncertainty that gripped markets in the second quarter and into the third quarter, but private equity firms clearly have regained their confidence since then. There were 33 separate leveraged buyouts priced in the loan market during the fourth quarter, a pace not seen since the third quarter of 2018. Even as merger and acquisition issuances gained pace, sponsored issuers continued to take advantage of demand with opportunistic deals.

Secondary prices fell dramatically during the initial phases of the pandemic but have also recovered to pre-pandemic levels. The average bid of the S&P/LSTA Leveraged Loan Index reached 97.17 as of Jan. 12 – its highest level since the index was at 97.29 nearly a year ago, on Jan. 26, 2020.

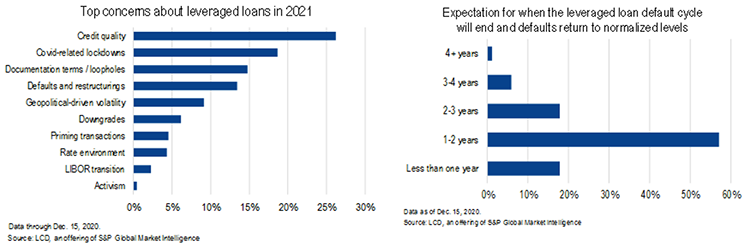

While default rates have increased compared to recent record lows, they ended 2020 at a modest 4.22% as measured by number of issuers. This compares over 10% during the depths of the Great Recession. Leading the charge was face-to face industries, such as retail and leisure, in addition to borrowers in the oil and gas industry.

Looking forward to 2021, analysts at Bank of America Corp., Barclays and Wells Fargo & Co. have a relatively sanguine view and are anticipating a healthy market, with a rise in overall leveraged loan issuance. Analysts at JPMorgan Chase & Co. were slightly less optimistic with a prediction of a 10% decline in gross issuance, according to S&P Global.

Based on a survey of portfolio managers, technology and health care continue to lead the sectors that are expected to outperform in 2021. Given the magnitude of the shock to the system during the first half of the year, the default cycle is expected to be relatively short.

BancAlliance believes that the loan market should be able to sustain the robustness seen in the second half of 2020 performance through 2021, as businesses have successfully adapted to the new normal, in addition to the anticipation of the vaccine rollout. To start the year, we have already seeing a flurry of activity from the lower middle market, middle market and broadly syndicated loan space across a multitude of industries and transaction types, such as buyouts, dividends and repricings. We expect this energetic output to continue.