2018 RankingBanking: The Best of the Biggest

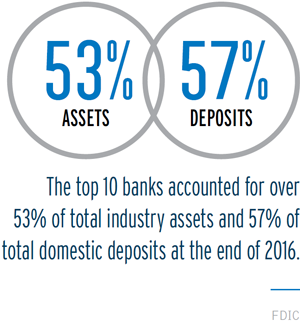

The 10 largest U.S. retail banks play an enormously important role in the nation’s economy and the lives of everyday Americans. For example, at the end of 2016, the top 10 banks accounted for over 53 percent of total industry assets, and 57 percent of total domestic deposits, according to the Federal Deposit Insurance Corp. The top four credit card issuers in 2016—JPMorgan Chase & Co., Bank of America Corp., Citigroup and Capital One Financial Corp.—put more than 303 million pieces of plastic in the hands of eager U.S. consumers, according to The Nilson Report.

The big banks have long been an engine for economic growth and change. Some of the industry’s most important advancements, including the credit card and the ATM, were pioneered by large U.S. banks. And much of the innovation that is occurring in banking today around financial technology is being deployed to scores of customers at the 10 biggest banks. Large banks have reshaped the industry through their acquisitions over the last two decades, leaving banking more concentrated than at any other time in U.S. history. In 1997, the country had 10,923 insured depository institutions. Today, it has just 5,787, or about 47 percent fewer.

These banks’ impact is undeniable. But which one is the best?

We believe that is a highly relevant question, because it provides valuable insight into the strengths and weaknesses

of a group of companies that play such a central role in the U.S. economy. Bank Director’s 2018 Ranking Banking study takes a business rather than a consumer perspective, so we chose 10 categories that we believe contribute significantly to a big bank’s success. There are undoubtedly additional categories that we could have selected, and what one chooses to measure usually influences the outcome, but we believe these are the 10 categories that are most important to the success of a very large bank today:

Both the overall ranking and the 10 category scores were determined using a proprietary algorithm that included over 50 data points, mostly reflecting year-end 2016 activity. The primary data sources were the FDIC and Securities Exchange Commission. Additional sources were also used in some categories, and we consulted with a variety of industry experts. Bank Director examined the 10 largest retail banks with significant operations in the U.S., which excludes institutions such as The Goldman Sachs Group and The Bank of New York Mellon Corp. that are more focused on non-retail businesses.

The individual category score for each bank, as determined by our algorithm, helped determine the final ranking of the

10 banks. While no single category determined the final ranking on its own, extra weight was given to the category scores for best board and best brand. Banking has become a very complex business, particularly for the 10 largest institutions in the country. The post-crisis business environment, with its low interest rates and intense competition to book quality earning assets, has created tremendous challenges for boards of directors and their senior management teams, as has the heightened compliance environment that is also a post-crisis phenomenon, due largely to the passage of the Dodd-Frank Act of 2010. For the last 27 years, Bank Director has been a leading source of information about banks and banking. Through Bank Director magazine, industry leading conferences and website, we keep bank CEOs, senior executives and directors well informed of what is happening in their industry. It is a foundational principle of our company that strong boards build strong banks, and so we chose to give extra weighting to this category.

Although we did not break them out as a separate category, profitability metrics like return on equity and return on assets, and credit agency ratings as a proxy for safety and soundness, were also included in the algorithm that determined the final overall ranking.

JPMorgan is the largest bank in the U.S., and it dominates the 2017 Ranking Banking analysis, winning five of the 10 categories outright—Best Brand, Best Mobile, Most Innovative, Best Credit Card Program and Best Bank for Big Business— and scoring in the top five in three other categories, Best Branch Network, Best Small Business Program and Best Wealth Management Program.

JPMorgan emerged from the financial crisis not only with its reputation intact, but actually stronger. Federal regulators asked the bank to acquire the failed thrift Washington Mutual after it had been taken over by the FDIC, and also asked it to take over Bear Stearns Cos., an investment bank that also ran into trouble in 2008. Both acquisitions ultimately benefited the bank.

U.S. Bancorp finished second on the 2017 Ranking Banking study. The bank had top five finishes in the board, brand, mobile, credit card, small business and wealth management categories. While it did not win any single category outright, its consistency across the board served it well. The bank was also highly profitable in 2016, and this boosted its scores with the credit rating agencies and had a positive impact on its profitability ratios.

The third place finisher was actually a bit of a surprise. Wells Fargo has been dogged by an embarrassing account opening scandal that led to the retirement of former Chairman and CEO John Stumpf. Not surprisingly, Wells came in last in the brand and board categories. But there is much strength in the Wells Fargo franchise, and its high finish reflects that. The bank came in first in the branch and small business categories, second in core deposits and innovation, and in the top five for mobile, big business and wealth management. It was also highly profitable last year, which helped its profitability metric and credit rating.

Bank of America placed fourth in the ranking, finishing first in the wealth management category, second for big business and mobile banking, and in the top five for branch, brand, innovation and credit card. It was also very profitable last year, which helped its profitability metric and credit ratings. There is no question that its Merrill Lynch subsidiary is a crucial piece of the Bank of America franchise, because it helped it excel in the wealth management category and gives the bank the distinction of being just one of three banks in the top 10 (the other two are JPMorgan and Citigroup) that can deliver an integrated commercial, investment banking and capital markets product set to large multinational corporations, which is a significant competitive advantage.

Capital One Financial Corp., at number five, scored second for its brand, mobile strategy and credit card program, and placed in the top five for branch network, innovation and its small business program.

PNC Financial Corp., at sixth, scored in the top five for its board, brand, core deposit strategy, wealth management program and ability to bank big businesses. It also boasted strong credit ratings.

Citigroup, at seventh, topped the board category, and scoredin the top five for innovation, big business and credit card.

TD Bank, at number eight, scored second for its branch network and board, and in the top five for its core deposit growth strategy. It also earned the lowest score based on profitability.

BB&T Corp., at ninth, topped the core deposit growth category and placed in the top five for its board and small business program.

This project was a collaborative effort involving many members of the Bank Director team. The algorithm was developed by Bank Director’s research team, headed up by Director of Research Emily McCormick and Chief Operating Officer Mika Moser. Moser was also the project manager and ably kept everyone on task. Claire Kennedy provided much-appreciated research services to the team. McCormick, Editor Naomi Snyder and Editor in Chief Jack Milligan wrote and edited the stories featured here. And our founder, Bill King, provided the inspiration and motivation for the Ranking Banking endeavor, along with crucial guidance on the construction of the ranking.