5 Principles to Improve Financial Benchmarking

Brought to you by OTC Markets Group

In financial analysis, the question of “How are we doing?” should almost always be answered with “Compared to what?”

As directors prepare for year-end meetings, there are a number of key ways executives and directors can improve the bank’s approach to benchmarking. A focused program can decrease workload, reduce information overload and yield strategic insight. Here are five ways banks can start.

1. Reconsider Your Peers

Most bank directors are familiar with the national asset-based peer groups featured in Federal Deposit Insurance Corp.’s Uniform Bank Performance Report, or UBPRs. These peer groups can serve an important purpose when it comes to macro-prudential purposes (such as regulatory monitoring for safety and soundness within the entire banking system). But for bankers trying to extract value from this data, we recommend looking beyond asset sizes toward more relevant factors such as geography, funding strategy and lending portfolio.

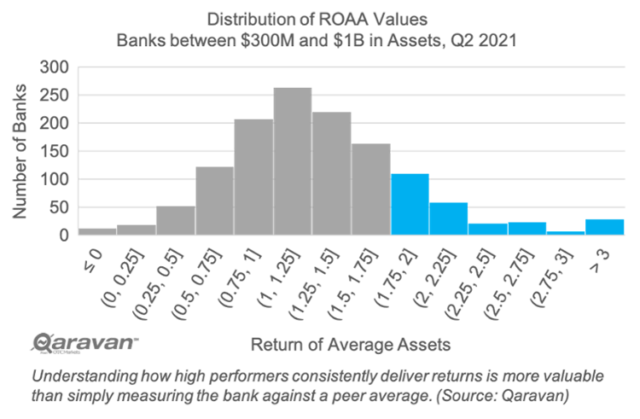

2. Look Toward Leaders, Not Averages

Being above average is not the same thing as being a leader. Rather than compare themselves against the mean or median, banks should be more focused on how they stack up to the best of their peers. If they want to set realistic goals for high performance, boards should first understand what excellence looks like across a relevant set of bank peers.

3. Use Multiple Peer Groups

It’s rare that a bank can be purely labeled as an agricultural or commercial or industrial lender, or something similar. By design, most community banks have a balanced and diversified portfolio of loans and services. The same can be said for funding sources, risk tolerances, investments and fiduciary activities, among others. Despite these complexities, many banks tend to benchmark themselves against a single, universal peer group. Executives may find it more productive and insightful to use multiple, targeted peer groups, depending on the context of the analysis.

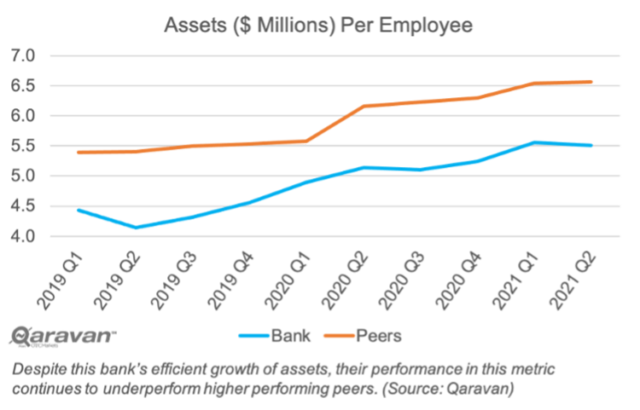

4. Add Context to Trends

Trend charts are a powerful way to monitor for constant improvement – but they only tell half of the story. Many bankers will close out 2021 celebrating a much deserved “record year;” a smaller group of insightful executives will pause to consider their stellar results in the context of the entire sector’s stellar results. Nearly every bank has been excelling at growing the portfolio, capturing fee income and improving efficiency ratios. Prudent directors should ask for additional context.

5. Limit the Scope

Since Qaravan’s inception in 2014, we have helped hundreds of banks pull together board packs, dashboards, decks, report cards and all sorts of other financial reports. The biggest challenge our clients encounter in this process is the information overload they inflict on the report recipients. In a sincere attempt to arm directors with as much information as possible, bank management ends up sending the board an overwhelming amount of data. Pulling these “kitchen sink” reports together is not easy, and it takes bank staff away from more important things. Directors can help minimize the inefficiencies associated with these data calls by encouraging a more focused review of key performance benchmarks.

To learn more, visit https://www.qaravan.com/.