From how-to articles, director training videos, key interviews with industry leaders and more, Bank Services provides bank executives and directors with the tools to help grow their financial institutions.rnrnTo sign up for exclusive access to this online bank board resource, please contact Bank Services at 615-777-8461 or [email protected].

Is Your Bank Ready for the CEO Pay Ratio Disclosure?

Here are some questions to ask to see if your bank is ready.

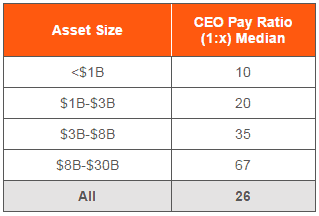

1. Do you know how your CEO pay ratio will compare to the market?

To avoid surprises, know where your CEO pay ratio fits in with similar sized banks. McLagan’s research shows that the estimated CEO pay ratio ranges from 10 to 67, depending on asset size for banks under $30 billion in assets. Business focus also matters. Retail-focused banks tend to have a higher ratio as compared to non-retail focused banks as a result of lower median employee compensation (about 20 percent lower on average). Start planning your communications strategy to proactively consider employee concerns and press coverage. You’ll also need to evaluate the need for supplemental disclosure in the proxy statement if your CEO pay ratio is outside the norm.

Bank CEO Pay Ratio Information

2. Does the CEO pay ratio apply to my bank?

If you are a smaller reporting or an emerging growth company, you do not need to report the CEO pay ratio. However, even if you are not required to disclose the ratio publicly, your board may want to know how your CEO compares to the market.

3. How do I determine who is included in my employee population?

Employees are identified based upon any date within the last three months of the year. It must include all full-time, part-time, seasonal and temporary employees (including subsidiary employees and potentially, independent contractors). While the date flexibility is less of a benefit for banks, this may simplify the process for some companies, such as those in the retail industry who have significant seasonal employees.

4. Is there flexibility in the methodology used to calculate the median employee?

Yes, W2 data, cash compensation, or some other consistently applied compensation measure can be used. In addition, the time period for measuring compensation does not have to include the date on which the employee population is determined. Keep in mind that decisions regarding specific methodologies may affect the resulting median and may require additional disclosure.

5. Can I use estimates?

Yes, reasonable estimates and sampling can be used; however, the methodology and assumptions must be disclosed. Regardless of the method used, ensure that your process is reliable, repeatable and able to be explained in the proxy. This is not likely a benefit for wholly owned U.S.-based banks with centralized human resource information or payroll systems.

6. How often is the disclosure required?

Annually; however, the median employee may be updated every three years, provided the employee population has not changed significantly. Banks on an acquisition path may need to update the median employee each year.

7. Can all my data providers supply the information I will need and on time?

Do your due diligence now to determine your data requests from payroll vendors, stock reporting systems, benefits providers, actuaries for retirement plan accruals, etc. The time and resources to comply could be substantial and working through the various decisions and establishing a methodology ahead of time will make for a smoother process in 2018.

In summary, don’t assume your CEO pay ratio calculation will be quick and easy. Getting started now will allow time to provide education and manage expectations. Be proactive to ensure your methodology is well tested to be ready for implementation in your 2018 proxy statement.

You have accessed a resource that is only available to our Bank Services members.

Read The Article

Please enter your username and password bellow. If you have established a password please click ‘forgot your password’