Fraud Attempts on the Rise Since Pandemic’s Start

Brought to you by Alloy

As Covid-19 passes its one year anniversary in the United States, businesses are still adjusting to the pandemic’s impacts on their industry.

Banking is no exception. While banks have quickly adjusted to new initiatives like the Small Business Administration’s Paycheck Protection Program, the most notable impact to financial institutions has been the demand for online capabilities. Banks needed to adjust their offerings to ensure they didn’t lose their client base.

“ATM activity is up, drive-through banking is up 10% to 20% and deposits made through our mobile app are up 40%,” said Dale Oberkfell, president and CFO of Midwest Bank Centre last June.

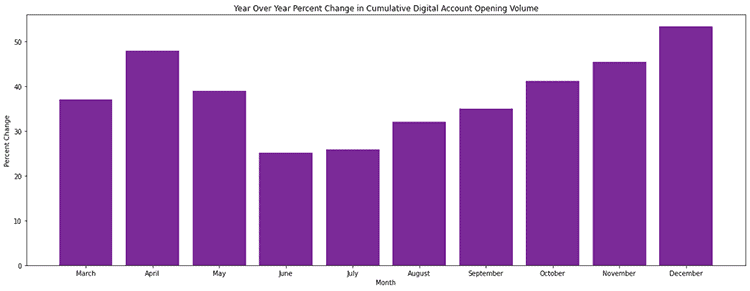

The shift to digital account openings has been drastic. The chart below looks at the percent change in cumulative number of evaluations from 2019 to 2020 for a cohort of Alloy customers, limited to organizations that were clients for both years. Since the onset of the pandemic, digital account opening has increased year-over-year by at least 25%.

Although the shift to digital was necessary to meet consumer demands, online banking opens up the possibility of new types of fraud. To study the pandemic’s impact on fraudulent applications, we took a closer look at changes in consumer risk scores since the onset of the pandemic. Similar to credit scores, risk scores predict the likelihood of identity or synthetic fraud based on discrepancies in information provided, behavioral characteristics and consortium data about past fraud activity.

Comparing the pandemic months of March 2020 to December 2020 to the same period in 2019, Alloy clients saw a dramatic rise in high-risk applications. Total high-risk applications increased by 137%, driven both by overall growth in digital application volume and a comparatively riskier population of applicants.

There are several ways for you to protect your organization against this growing threat. One way is to use multiple data sources to create a more holistic understanding of your applicants and identify risky behaviors. It also ensures that you are not falling victim to compromised data from any one source. It’s a universal best practice; Alloy customers use, on average, at least 4 data sources.

Another way for you to protect your institution is by using an identity decisioning platform to understand and report on trends in your customer’s application data. Many data providers will return the values that triggered higher fraud scores, such as email and device type. An identity decisioning platform can store that data for future reference. So, even if a risky application is approved at onboarding, you can continue to monitor it throughout its lifetime with you.

Digital banking adoption and usage is expected to only increase in the future. Banks need to ensure that their processes for online capabilities are continuously improving. If your organization is spending too much time running manual reviews or using an in-house technology, it may be time for an upgrade. Click here to see how an identity decisioning platform can improve your process and help you on-board more legitimate customers.