Why Community Banks Should Use Derivatives to Manage Rate Risk

Brought to you by Chatham Financial

As bank management teams turn the page to 2022, a few themes stand out: Their institutions are still flush with excess liquidity, loan demand is returning and the rush of large M&A is at a fever pitch.

But the keen observer will note another common theme: hedging. Three superregional banks highlighted their hedging activity in recent earnings calls.

- Birmingham, Alabama-based Regions Financial Corp. repositioned its hedging book by unwinding $5 billion of receive-fixed swaps and replacing them with shorter-term receive fixed swaps. Doing so allowed the $156 billion bank to lock in gains from their long-term swaps.

- Columbus, Ohio-based Huntington Bancshares increased its noninterest income in a scenario where rates increase 100 basis point from 2.9% to 4%. The $174 billion bank terminated certain hedges and added $6 billion of forward starting pay fixed swaps.

- Providence, Rhode Island-based Citizens Financial Group executed $12 billion of receive fixed swaps in 2021, including $1.25 billion since June 30, 2021. The $187 billion bank’s goal is to moderate their asset sensitivity and bring forward income.

These banks use derivatives as a competitive asset and liability management tool to optimize client requests, investment decisions and funding choices, rather than be driven by their associated interest rate risk profile.

Why do banks use derivatives to hedge their balance sheet?

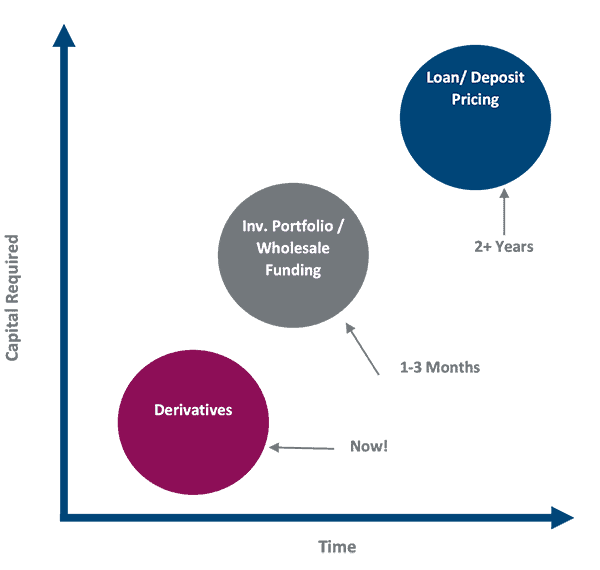

- Efficiency. Derivatives are efficient from both a timing and capital perspective. In a late 2021 earnings call outlining their hedging strategy, Citizens Financial’s CFO John Woods said, “We think it’s a bit more efficient to do that (manage interest rate risk) off-balance sheet with swaps.”

- Flexibility. It’s more flexible than changing loan and deposit availability and pricing.

- Cost. It’s often less expensive when compared to cash products.

Why are some banks hesitant to use swaps?

- Perception of riskiness. It’s easy for a bank that hasn’t used derivatives to fall into the fallacy that swaps are a bet on rates. In a sense, though, all the bank’s balance sheet is a bet on rates. When layered into the bank’s asset-liability committee conversations and tool kit, swaps are simply another tool to manage rate risk, not add to it.

- Accounting concerns. Community banks frequently cite accounting concerns about derivatives. But recent changes from the Financial Accounting Standards Board have flipped this script: Hedge accounting is no longer a foe, but a friend, to community banks.

- Fear of the unknown. Derivatives can bring an added layer of complexity, but this is often overdone. It’s important to partner with an external service provider for education, as well as the upfront and ongoing heavy lifting. The bank can continue to focus on what it does best: thrilling customers and returning value to shareholders.

- Competing priorities. Competing priorities are a reality, and if something is working, why bother with it? But growth comes from driving change, especially into areas where the bank can make small incremental adjustments before driving significant overhauls. Banks can transact swaps that are as small as $1 million or less.

For banks that have steered clear of swaps – believing they are too risky or not worth the effort – an education session that identifies the actual risks while providing solutions to manage and minimize those risks can help separate facts from fears and make the best decision for their institution. The reality is community banks can leverage the same strategies that these superregional banks use to enhance yield, increase lending capacity and manage excess liquidity.