Using Big Data to Assess Credit Quality for CECL

New Calculation Methods Require New Data

The new FASB standard replaces the incurred loss model for estimating credit losses with the new current expected credit loss (CECL) model. Although the new model will apply to many types of financial assets that are measured at amortized cost, the largest impact for many lenders will be on the allowance for loan and lease losses (ALLL).

Under the CECL model, reporting organizations will make adjustments to their historical loss picture to highlight differences between the risk characteristics of their current portfolio and the risk characteristics of the assets on which their historical losses are based. The information considered includes prior portfolio composition, past events that affected the historic loss, management’s assessment of current conditions and current portfolio composition, and forecast information that the FASB describes as reasonable and supportable.

To develop and support the expected credit losses and any adjustments to historical loss data, banks will need to access a wider array of data that is more forward-looking than the simpler incurred loss model.

Internal Data Inventory: The Clock is Running

Although most of the data needed to perform these various pooling, disclosure and expected credit loss calculations can be found somewhere, in some form, within most bank’s systems, these disparate systems generally are not well integrated. In addition, many data points such as customer financial ratios and other credit loss characteristics are regularly updated and replaced, which can make it impossible to track the historical data needed for determining trends and calculating adjustments. Other customer-specific credit loss characteristics that may be used in loan origination today might not be updated to enable use in expected credit loss models in the future.

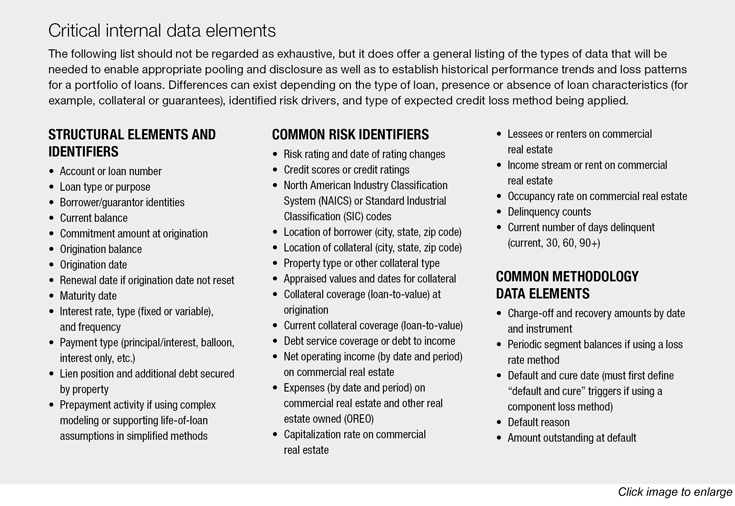

Regardless of the specific deadlines that apply to each type of entity, all organizations should start capturing and retaining certain types of financial asset and credit data. These data fields must be captured and maintained permanently over the life of each asset in order to enable appropriate pooling and disclosure and to establish the historical performance trends and loss patterns that will be needed to perform the new expected loss calculations. Internal data elements should focus on risks identified in the portfolio and modeling techniques the organization finds best suited for measuring the risks.

External Economic Data

In addition to locating, capturing, and retaining internal loan portfolio data, banks also must make adjustments to reflect how current conditions and reasonable and supportable forecasts differ from the conditions that existed when the historical loss information was evaluated.

A variety of external macroeconomic conditions can affect expected portfolio performance. Although a few of the largest national banking organizations engage in sophisticated economic forecasting, the vast majority of banks will need to access reliable information from external sources that meet the definition of “reasonable and supportable.”

A good place to start is by reviewing the baseline domestic macroeconomic variables provided by the Office of the Comptroller of the Currency (OCC) for Comprehensive Capital Analysis and Review (CCAR) and Dodd-Frank stress testing (DFAST) purposes. Because regulators use these variables to develop economic scenarios, these variables would seem to provide a reasonable starting point for obtaining potentially relevant historic economic variables and considerations from the regulatory perspective of baseline future economic conditions.

Broad national metrics—such as disposable income growth, unemployment, and housing prices—need to be augmented by comparable local and regional indexes. Data from sources such as the Federal Deposit Insurance Corporation’s quarterly Consolidated Report of Condition and Income (otherwise known as the call report) and Federal Reserve Economic Data (FRED), maintained by the Federal Reserve Bank of St. Louis, also can be useful.

Data List for CECL Compliance

Looking Beyond Compliance

The new FASB reporting standard for credit losses will require banks to present expected losses in a timelier manner, which in turn will provide investors with better information about expected losses. While this new standard presents organizations of all sizes with some significant initial compliance challenges, it also can be viewed as an opportunity to improve performance and upgrade management capabilities.

By understanding the current availability and limitations of portfolio data and by improving the reliability and accuracy of various data elements, banks can be prepared to manage their portfolios in a way that improves income and maximizes capital efficiency.