Technology: Driver of Profitability or a Big Expense?

How does technology play a role in a bank’s growth and profitability? When asked to rank the importance of certain factors as drivers of their bank’s organic growth plans—culture and people, technology, unique products and services, and brand—technology placed second for 74 attendees who participated in an on-site audience poll at Bank Director’s Acquire or Be Acquired, held in Scottsdale, Arizona, in January, and the Bank Board Training Forum, last week in Nashville, Tennessee. The responses came mostly from bank directors, chairmen and CEOs.

In terms of importance to the organic growth of your bank, rank the following:

| Overall Rank | Score* | |

| Culture/people | 1 | 235 |

| Technology | 2 | 157 |

| Unique products/services | 3 | 136 |

| Brand | 4 | 135 |

*Score is a weighted calculation, with items ranked as first receiving a higher value, or weight, of 4, second weighted as 3, etc… The score is the sum of all weighted values. Source: Bank Director

Technology continues to change the way customers interact with their banks. Respondents were also asked about their biggest fear—an open response about what keeps them up at night—and 10 percent cite non-bank competition. One of the speakers at the Bank Board Training Forum mentioned that Staples plans to begin offering small business loans. The Apples, Googles and retailers of the world are an increasing concern for bank boards, but will a focus on short-term profitability impede a director’s ability to take a long view of the business?

“Technology can move from an expense to a competitive advantage, if you do it right,” says George McGourty, president of the financial services group at Computer Services Inc. Big banks used to have the advantage with a significantly larger branch footprint, but technology can erase this advantage.

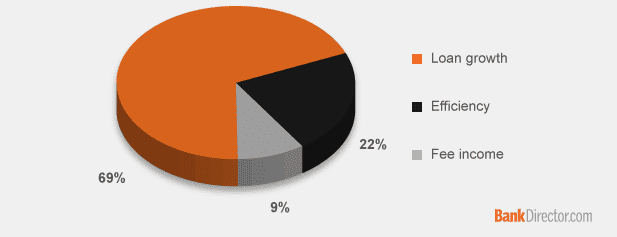

Looking at profitability for your bank in 2015, what do you believe will have the most positive impact?

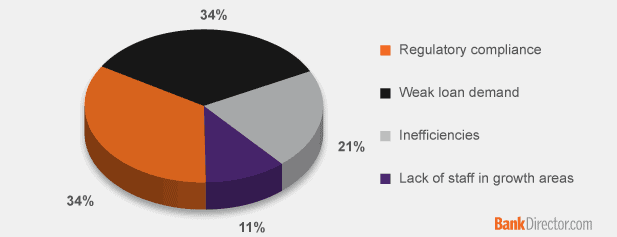

Looking at profitability for your bank in 2015, what do you believe will have the most negative impact?

Sixty-nine percent of survey participants see loan growth as the factor with the most positive impact on the profitability of their financial institution, while no one cites technological innovations. Yet the right use of technology—and the right partnerships—can expand a community bank’s reach and help drive demand. Titan Bank, a $79.4 million asset bank based in Mineral Wells, Texas, partners with San Francisco-based peer-to-peer online lenders Prosper Marketplace and Lending Club to make small business loans, according to a spokesperson at the bank. These relationships help expand the bank’s reach beyond its local markets. (In addition to its Mineral Wells headquarters, the bank has a branch in nearby Graford, Texas, and a loan production office in Dallas, about 90 miles away.)

For Bethesda, Maryland’s Congressional Bank, with $446 million in assets, Lending Club helps the bank diversify its loan portfolio through the purchase of unsecured consumer loans, according to Jeffrey Lipson, the bank’s president and CEO. In February 2015, Lending Club partnered with BancAlliance, giving members of the Chevy Chase, Maryland-based lending platform—roughly 200 community banks—access to Lending Club’s expanded market for consumer loans.

Another technological opportunity is the use of data analytics. Too few banks take advantage of personal financial management tools and even for those that do, few effectively use the valuable customer data it provides, says Bradley Leimer, senior vice president and head of innovation at Santander Bank, N.A., the U.S. subsidiary of Banco Santander, S.A., headquartered in Madrid, Spain. Leimer just joined Santander in September 2014: He previously served as vice president of digital strategy at Richmond, California-based Mechanics Bank, with $3.4 billion in assets, from January 2010 to September 2014. During his tenure, almost 40 percent of Mechanics Bank’s customers used personal financial management tools, with the majority aggregating financial data from external accounts. The bank was able to use that information to target offers to its customers. “There’s money to be had in looking at the data that your customers provide you,” he says.

One-quarter of those polled in Bank Director’s survey view cybersecurity as their biggest fear. Do concerns about cybersecurity turn technology, in the minds of these board members and CEOs, into a potentially disastrous threat? Technology helps fuel growth, but it’s also a big expense. Finding technology’s place in a profitable bank isn’t easy. But bankers that view technology simply as an expense item, and not a way to grow, may find it difficult to get ahead. “If they look at [technology] clearly as an expense, I think they’re going to make some bad strategic decisions,” says McGourty.