Stick to the Basics as Bank M&A Heats Up

Brought to you by KPMG LLP

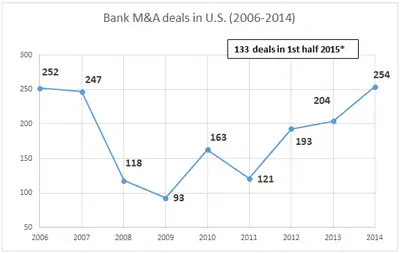

Anyone paying close attention is seeing that the number of bank deals in the United States is increasing.

There was a 25 percent increase in bank deals in the U.S. in 2014, compared to 2013, and there is a good possibility that the number of deals in 2015 will exceed that of 2014.

While good news for the deal makers, investors and regulators are ratcheting up the pressure on buyers and sellers to get things right. But, if history has taught us anything in mergers and acquisitions (M&A), it is that they often are fickle undertakings, where many of them simply don’t work out as planned.

Costly and sometimes fatal mistakes are made in the planning, due diligence, and execution stages, just to name a few steps along the way. Those and other critical factors make it vital to issue a common reminder: Stick to the basics.

Fundamental Questions Can Help Form the Foundation

The top question management should ask themselves before the start of a M&A transaction is, “does this deal fit our current business model, both culturally and strategically?”

There must be a recognition that people sometimes get so wrapped up in trying to get the best deal possible that they lose sight of whether the deal makes sense on its merits.

A message we often deliver is that there will be times that participants might not get the best deal from a price perspective, but when deep considerations are made about the other matters that are involved—long-term strategic objectives, the people you will acquire, the level of technological sophistication, the seller’s culture of connecting with customers—the deal could be a very good one.

In short, it sometimes comes down to having to pay a bit of a premium on the price in order to get the best deal, given the circumstances and strategic plan.

We often counsel board members and top management—whether the buyer or the seller—to ask this question: Does the deal put me in a better place tomorrow than I am today? Beyond that baseline question, there always are considerations about fundamentals: Does this make sense as it relates to the strategy that is already laid out?

Four other key questions include:

- What are the quality of earnings? Just a few years ago, many prospective buyers looking at the balance sheet of the target actually didn’t believe the financials. Now, in more than a few cases, we are seeing the main issue being some skepticism about earnings. Although we see fewer concerns about the balance sheet, it remains a prime area for deep review. When the issue of quality of earnings is raised, it is prudent to investigate whether there has been a flurry of reserve releases. Have costs been squeezed down so much that, from an operational perspective, there are some key processes that are untenable for a long-term period? Has the bank gone too far out the rate curve in seeking yield on the bond portfolio so that when rates finally start going up, the bank is going to get whipsawed and take a bunch of mark-to-market hits on those bonds?

- What is the current asset / liability management profile of the bank? It would be useful to discover whether the target bank has been focused too much on short-term products. Another question: After rates rise, will the customers who are happy to be in a transaction product today (because they are not making much on CDs or money markets) walk out the door if another bank has a better product?

- Is the target bank up to date on their regulatory compliance efforts? Beyond the numbers, there should be ample evidence that the target’s regulatory profile is rock solid. Is there clear evidence that the bank has had professional assistance in determining any liability relating to anti-money-laundering or Bank Secrecy Act issues? If it has not engaged professional assistance, ask the bank board and senior management how it gained comfort that it has done the proper level of diligence regarding these critical challenges?

- What are the data practices of the target bank? Where and how is data stored? What security protocols have been instituted and followed? How often are those protocols reviewed and updated? Does the board and top management believe the data it receives after it orders a report?

In a rapidly evolving M&A landscape, our message is simple: When the time comes to do a deal, rely on the basics.