John Engen is a contributing writer for Bank Director. He has more than 30 years of experience as a business journalist, writing for a variety of newspapers and magazines, and was a foreign correspondent for the Associated Press. He graduated with a degree in economics and international relations from the University of Minnesota and did his post-graduate work in Asian studies at the University of Hawai’i.

Specializing in Profits

Christopher Murphy III was in his mid-20s when he became a member of the board of what is now 1st Source Corp. The year was 1972, and he had joined his father-in-law and some other folks to buy the South Bend, Indiana-based banking company from the old Associates First Capital Corp., a big consumer and commercial finance operation the in-laws had helped found decades earlier to help people buy Model Ts from Ford Motor Co. Murphy, then a lawyer for Citibank with family connections, was a perfect fit.

At a time when unit banking laws barred institutions from expanding even into some neighboring communities, 1st Source looked to those specialty finance roots for growth. It hired some old Associates hands and got into financing the trucking business. A few years later, it began working with auto rental companies; a few years after that, aircraft financing was added to the mix, followed by construction equipment.

“We said, ‘If we’re going to be in these businesses, we need to be in a number of different verticals so that we’re not too dependent on any one of them,’” recalls Murphy, 78, 1st Source’s chairman since 1998 and CEO since 1979. “We kept adding things over time to build a broader base of potential clients and markets, drive growth and minimize risks.”

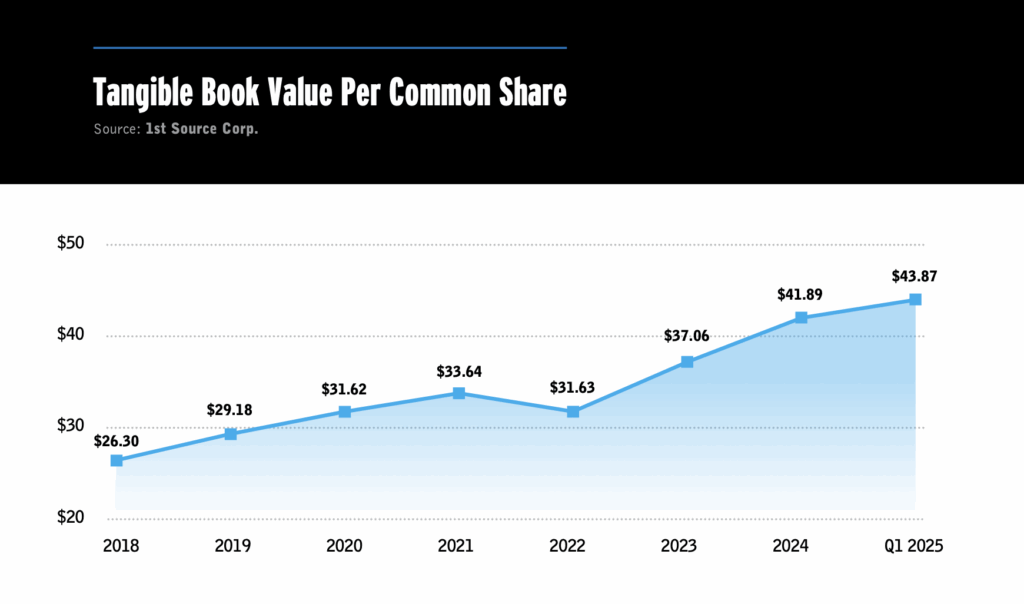

The laws and terms of the competition have changed a lot since then, but 1st Source’s specialty finance group — and the mix of opportunism and conservatism underlying its strategy — continue to drive results. The company’s performance was strong enough to rank No. 19 in Bank Director’s RankingBanking analysis of the 300 largest publicly traded banks. In the ranking, its core return on average asset was 1.55% while its tangible common equity to tangible assets totaled 11.61%. In 2024, the company reported record net income of $132.6 million, up more than 6% from a year earlier.

Tom Brown, CEO of Second Curve Capital, says the blend of a strong core banking franchise with a handful of specialty niches helps 1st Source differentiate itself and maintain its independence, even as it continues to grow. “They do a really good job of balancing focus with diversification, and they’ve been able to maintain a community feel that fuels deposit growth,” says Brown, who has met with both management and the board this year. “They pick their spots, and they win in those spots. That’s what banks this size need to do to be successful.”

A 50/50 Split

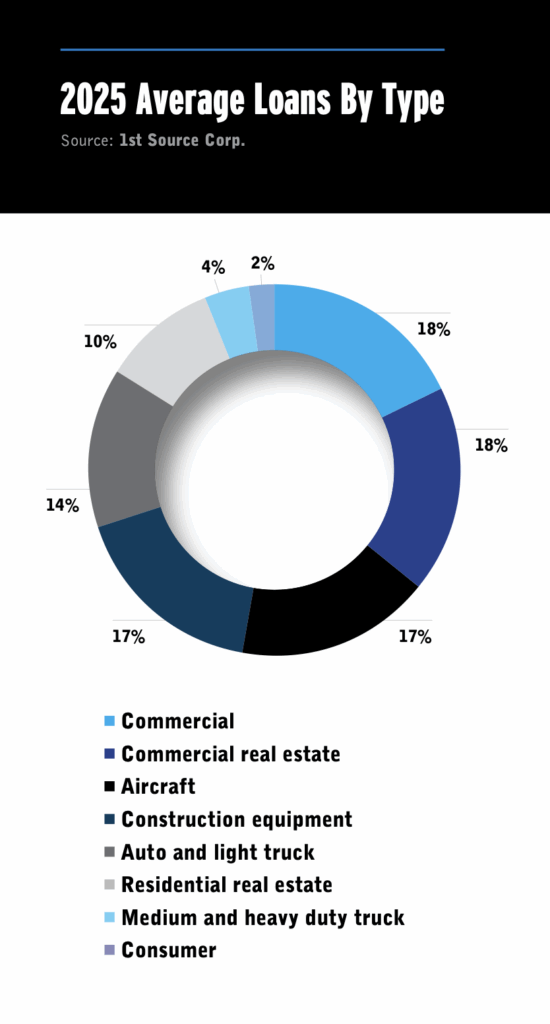

1st Source is a commercial banking company with a balance sheet that’s split roughly 50/50 between community banking operations and its four established specialty finance verticals. It also boasts a relatively new niche that provides construction loans and other financing for solar and other renewable energy projects.

“It’s a really solid story and one that I’ve recommended for years,” says Nathan Race, a managing director and senior research analyst for Piper Sandler & Co. “The diversity of loans means the headwinds aren’t as acute as they are for the prototypical Midwestern bank of similar size that’s more focused on in-market [commercial and industrial] and commercial real estate.”

The company’s 78-branch community banking franchise, a powerhouse deposit gatherer, is the foundation of the formula. It’s primarily a business bank — consumers, many of them small business owners, account for 48% of its deposit base and only 2% of loans. The institution boasts No. 1 deposit market shares in 16 contiguous counties in its northeastern Indiana and southwestern Michigan footprint. In a fiercely competitive environment, it regularly beats out the likes of JPMorgan Chase & Co., Fifth Third Bancorp and a bevy of local banks and credit unions, growing core deposits at an average annual compounded rate of 4.6% since 2021.

It also has a wealth management business with $5.9 billion in assets under management — much of it from its loan customers — that generated $26.7 million in noninterest income in 2024, and an insurance business that contributed another $6.7 million in commissions. In total, 1st Source gets 23% of its revenue from noninterest sources.

The banking team’s quest to gain more of existing customers’ business is constant. The company was an early adopter of Salesforce’s customer relationship management (CRM)

platform and uses it aggressively. “If they don’t have a piece of a customer’s business, they’ll make sure it’s recorded in the Salesforce CRM, and their bankers will go after that business,” Race says. “It’s a solid organic growth story. They’re focused on full-client relationship banking and maximizing wallet share.”

“Clumping Risk”

1st Source can put those deposits to work in ways that most smaller banks cannot. Fully 52% of its loans and leases lie in the specialty finance portfolio — national businesses that generate higher yields and growth potential than standard commercial banking. The company won’t release exact yields on its specialty lending verticals, but Chief Financial Officer Brett Bauer says they’re higher than the community bank business. In 2024, yields on 1st Source’s overall loan book stood at 6.84% while its net interest margin was 3.64%. Both are higher than the typical bank.

There’s a reason for that: The risks of lending for things like an $8 million construction crane or an asphalt plant are higher and different than a typical commercial loan. Andrea Short, a two-year board member who is president of the holding company and CEO of 1st Source Bank, says the vertical lending niches all rely on fossil fuels, leaving the loan book susceptible to a spike in oil prices — something the 1st Source team calls “clumping risk.”

“The specialty finance group is what differentiates them. It’s a higher-yielding business than the banking business,” says Damon DelMonte, managing director at Keefe, Bruyette & Woods. But the loan book, which has been known to suffer short-term losses in the past, “can make investors a little nervous because a lot of it isn’t in their market and is in sectors that might be more exposed to changes in the economy.”

As travel plummeted during the pandemic, for example, some loans for tourist buses in New York City soured. Another time, a client got into trouble with a helicopter purchase, creating a workout situation for the bank.

Right now, Murphy says, some of 1st Source’s auto rental clients are seeing declining revenues in the face of growing competition from rideshare companies like Uber Technologies and changing customer behaviors. “The good news is that car values have held up,” he says. “If you can convince your customer to [sell some of its fleet] you can manage the risks.” If not, 1st Source might eventually look to repossessions.

Another potential concern is the impact of abrupt changes in federal renewables policy under President Donald Trump on the solar business. At first glance, the $500 million solar loan book looks similar to the other specialty finance lines — almost like a hedge on its fossil fuel-based specialties. But the characteristics are different enough — the loans are usually backed by power repurchase agreements, not hard collateral — that it’s considered separate from those businesses in-house. “If and when [federal] renewable energy credits go away, the business will probably slow,” Short says. “But there will still be demand for this type of financing for years to come.”

Getting Burned

The company compensates for the risks with a combination of experience, connections and conservative capital management. 1st Source’s top six executives boast an average of 36 years in banking, while its 25 specialty finance officers average 24 years of lending experience.

The company spends years researching before it enters a new vertical and emphasizes continued learning as things evolve. Specialized businesses require specialized knowledge, such as understanding how to maintain a complex piece of machinery or where exactly to sell that repossessed helicopter. The company has a strong network of dealers and understands the nuances of its lending niches and the resale markets should it need to seize collateral.

“You have to know your collateral,” says Short, 62, an accountant by training who has steadily climbed the executive ranks and is expected to become CEO when Murphy steps aside. “When you’re financing a private or corporate aircraft, you want to make sure it’s being flown, because it’s not good for the aircraft not to be flown. So, we monitor the [Federal Aviation Administration] register to make sure our planes are flying and the engines are being maintained.”

The knowledge requirements form a barrier to entry that keeps competitors largely at bay and provides pricing power. “Financing equipment is in our DNA. Our strength is that we know how to work through the downsides in these businesses,” Murphy says. “How? You develop experience. You get hurt, you get burned. And then you learn from those experiences and codify that learning.”

Capital Defense

That learning is supplemented by one of the higher capital levels in the industry. In 2024, 1st Source boasted total risk-based capital of 17.1% and a common equity tier 1 ratio of 14.2%. The company’s loan loss reserves were 2.27% of the loan book, even though net charge-offs were just 0.09% of loans and leases.

“Could we bring the reserve down a little bit and move earnings up a little bit for the quarter?” asks Bauer, the CFO. “We could but managing for the long term is so embedded in our culture, we aren’t apt to do that. The reason we have the reserve is so we can be there for customers in bad times. It’s all about the long term.”

1st Source manages its balance sheet “from a liquidity perspective first and foremost,” Bauer adds, always targeting about 15% or 16% of the investment portfolio to total assets. That’s higher than other banks, “but since we have the risk of [the specialty finance businesses], we keep the investment portfolio a little shorter than most other banks and monitor that market risk.”

Beyond bolstering risk management, Murphy also believes maintaining high capital levels is the best defense against regulators forcing him to do something he doesn’t want to do. “You don’t want regulators telling you how to run the business. They will have you do things that are just the opposite of what you need to do to help companies having problems,” he says. “The key is to have enough capital that regulators will leave you alone.”

“The Monument”

It’s all part of a culture that is at once innovative, conservative and confident in its own way of doing things. Murphy “is probably one of the most conservative CEOs out there in terms of how he thinks about the world from a worst-case scenario perspective,” Race says. “Chris has pretty much seen it all in running the bank over the decades, and he wants to make sure they have more than ample reserves to weather any particular downturn.”

Murphy’s down-to-earth style and willingness to occasionally defy industry conventions lie at the heart of 1st Source’s success and play well in South Bend, home to his alma mater, the University of Notre Dame. The CEO is well-connected in the community and was a lead donor for the construction of the Raclin Murphy Museum of Art, which opened on the Notre Dame campus in 2023.

Inside the company, Murphy is humble and leads by example. Second Curve Capital’s Brown, who has known Murphy for more than 15 years, tells the story of when the CEO fell for a phishing scam set up by the bank’s security team and wound up attending a special training session with other employees. “As successful as Chris has been, and as long as he’s been CEO, he didn’t say, ‘I’m not going to a class with everyone else,’” Brown explains. “He wasn’t too proud to say, ‘I should have known better.’”

The culture is reflected in a five-pillared visual that looks like the façade of a Greek temple and is known in-house as “the monument.” It includes names of past employees as the base. Steps labeled with values like teamwork, integrity and providing superior customer service climb to a platform that supports the pillars. The pillars represent a set of broad initiatives — “create exceptional experiences” or “produce superior financials” — that can help deliver on goals outlined in three- and five-year plans.

A thin strip at the base of the roof features the billboard mission statement: “to help clients achieve security, build wealth and realize their dreams.” The incline of the roof reinforces what all bankers say they want long term: to offer high-quality service, win more business and be a good place to work.

Nobody quite recalls when the monument was born — sometime around 2000 seems a popular answer — but it’s become a cultural guidepost, highlighted in employee orientation meetings, referenced in company town hall meetings and discussed in officers’ meetings. “It helps drive a lot of our thoughts and decision-making,” Bauer says. “The monument represents the core of what we’re trying to do and how we do it.”

Independent Thinkers

The monument’s uniqueness reflects 1st Source’s willingness to do things its own way. Murphy and his lieutenants are regulars at industry events and keep active tabs on the latest trends. For example, the bank was an early mover on instant payments and has sent or received $270 million in 250,000 transactions via FedNow and The Clearing House’s RTP platform since 2023.

But leaders also are more than willing to ignore current trends or conventional wisdom if they don’t reinforce the mission. While much of the industry focuses on return on tangible common equity, for example, Murphy, who owns 17.2% of the outstanding shares, views return on assets as a truer measure of the institution’s health. The company doesn’t do much commercial real estate lending, a bread-and-butter business for many community banks, limiting most such loans to existing clients.

Its executive incentive plans are based on the stock’s book value, not its market value — something Brown says is unusual. “We can’t control what the market thinks about banks,” Murphy explains. “What we can control is what we earn, what stays in the bank as book value and what gets paid out in dividends.” Dividends have grown by an average rate of nearly 9% since 2015.

Nor does the company have much appetite for mergers and acquisitions — its last deal was in 2007, for a small bank in Valparaiso, Indiana — focusing instead on organic growth. Despite its position in a geography coveted by many bigger banks, Murphy says the board has little interest in selling, either.

“Bankers tend to be like lemmings that jump on the beach and die together,” Murphy says. “You’ve got to watch the fads and not do what everyone else is doing.” It’s an approach that has served 1st Source and its investors well.