Seeking Success Through Innovation

Commercial banking—I’m not talking about the wild ride of investment banking—is conservative for good reason. Banks have long enjoyed special status as the safe house for everybody’s money, not to mention the source of a great deal of the economy’s funding—status that has led to heavy regulation to protect that system. That conservative bone inside the body of nearly every commercial banker leads to a reluctance to spend unnecessarily on technology, or waste shareholder investment, as well as skepticism toward new-fangled products.

But technology has an important role to play in attracting and retaining customers. Boards and management teams should not sit around and watch their customers go elsewhere as the competition installs new technology and steals market share. In an age where customers are increasingly comfortable with mobile banking applications, or shopping online for auto or home loans, your bank will need to pay attention to trends. It is possible to lose customers because you assumed the old way was the best way. Do you really think people under the age of 40 are going to real estate agents to get referrals to mortgage lenders? Or are they going to Yelp, or Angie’s List or Facebook? Some community bankers have expressed a fear to me that their banks might soon become irrelevant.

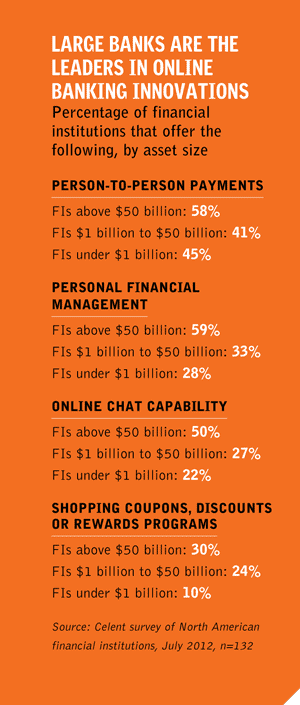

Bank boards clearly have to define their bank’s strategy as it relates to technology. There is no need to be an early adopter if you don’t want to be. The biggest banks use technology to enhance customer service and improve the bottom line, including person-to-person payments and online chat, but smaller banks are definitely finding these technologies useful as well. Banks well below the $50-billion asset mark offer coupons with mobile banking, mobile picture pay and personal financial management tools. “If you are a community bank, it’s unlikely that you are going to have a world leading platform,’’ says The Boston Consulting Group’s Corey Booth. “You don’t have the resources. You might want to keep up with the Jones’ or whatever Fiserv gives you. You have to decide your posture.”

While it may be a few more years before we see anything revolutionize the efficient delivery of services across the board like the ATM did in 1969, we can at least take a look at truly innovative designs and solutions that are changing the experience for some banks, and for their customers. We hoped to find those nuggets of change that are making a real difference.