Brandon Koeser is the audit services director at RSM US LLP. He is in the company’s cutting-edge Industry Eminence Program, positioning him to understand, forecast and communicate economic, business and technology trends shaping the industries RSM serves. Mr. Koeser advises clients on conditions influencing middle market leaders, with a focus on the financial services industry. In client service, Mr. Koeser has over 14 years of experience serving clients across the country. He provides industry-specific insights and thought leadership that allows clients to stay at the forefront of the changes within their industry, while also providing audit and risk advisory services, including financial statement audits, attestation engagement services, operational risk assessments and specialized compliance audits.

Navigating a Higher Interest Rate Reality

Strong capital can minimize impact across the balance sheet

Brought to you by RSM US LLP

In March 2022, the Federal Reserve embarked on a historic rate hiking campaign to bring rapidly rising inflation under control while attempting to preserve the economic cycle.

Now, as the odds of recession fall and the odds of continued growth in this business cycle increase, the reality of higher rates is coming into focus. The impact of this new rate environment on borrowers, depositors and investment portfolios will increasingly drive banks’ decision-making on how they use their balance sheet to grow. Many banks will likely exercise more discretion with investing, lending and capital-intensive activities in the near future.

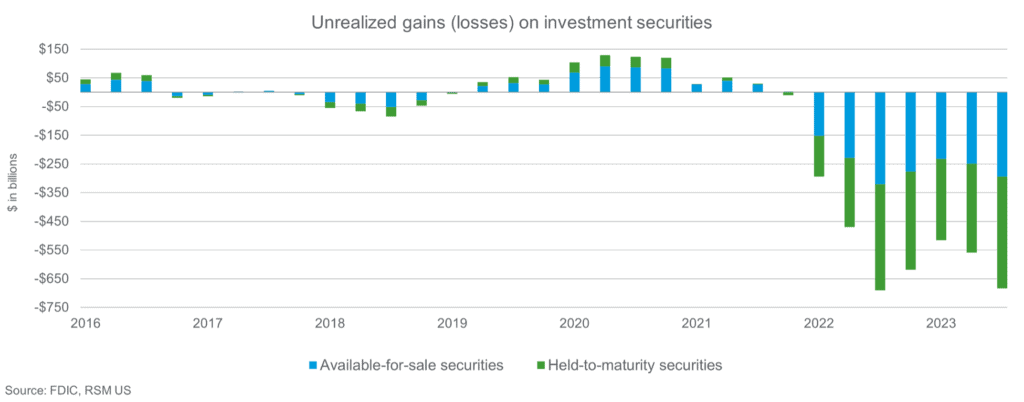

Sticky Unrealized Losses Persist

As we enter this new rate environment, unrealized losses that set records on bank balance sheets will likely become semi-entrenched and remain until the bonds mature or are sold. The longer these paper losses hang around, the more likely they are to impact long-term bank strategy, including 2024 growth activities, M&A opportunities, the lending pipeline and capital planning.

For banks with capital strength — those with ratios well exceeding regulatory requirements — an opportunity presents itself. As higher-for-longer rates continue and the prospect of a return to low-to-no rates fades, banks are exploring the possibility of crystalizing these losses and redeploying the funds. Examples began to abound late in the third quarter of 2023 as more banks decided to reposition their securities portfolio.

Risk of Losses Loom in Loan Portfolios

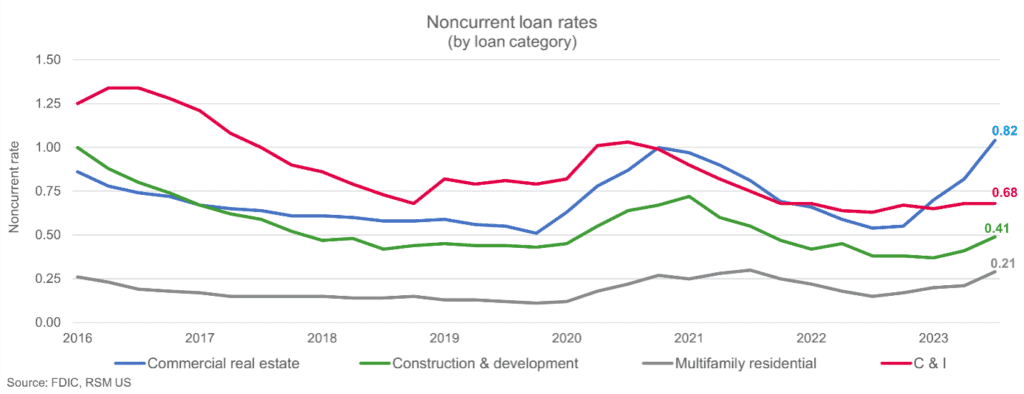

While rates have likely peaked and are forecasted to fall in 2024, the impact of these still-higher rates on borrowers has yet to be realized.

In a recent special report on corporate funding from the RSM US Middle Market Business Index survey, 82% of respondents said that rising rates would have anything from a minor to a critical impact on their operations. The survey, conducted by The Harris Poll for RSM from July 5 to July 25, 2023, aggregated the responses of 416 senior executives across a range of middle-market companies.

Of the survey respondents, 59% indicated that they expected their borrowing rates to increase somewhat in the coming year, while 14% of respondents said they expected their borrowing rates to increase substantially.

While much has been written about the impact of higher rates on commercial real estate borrowers, moderate to significant rate increases will create myriad challenges for any unprepared borrower. Although still relatively low, rates of noncurrent loans are beginning to rise despite the long and variable lag of rate hikes being fully realized by bank borrowers.

During the third quarter 2023 earnings season, banks were quick to point out that credit losses were largely idiosyncratic or tied to previously identified credit weaknesses. And yet a common theme began to emerge: vigilance will be key to ensure institutions can appropriately mitigate future losses as the rate hit to borrowers takes effect.

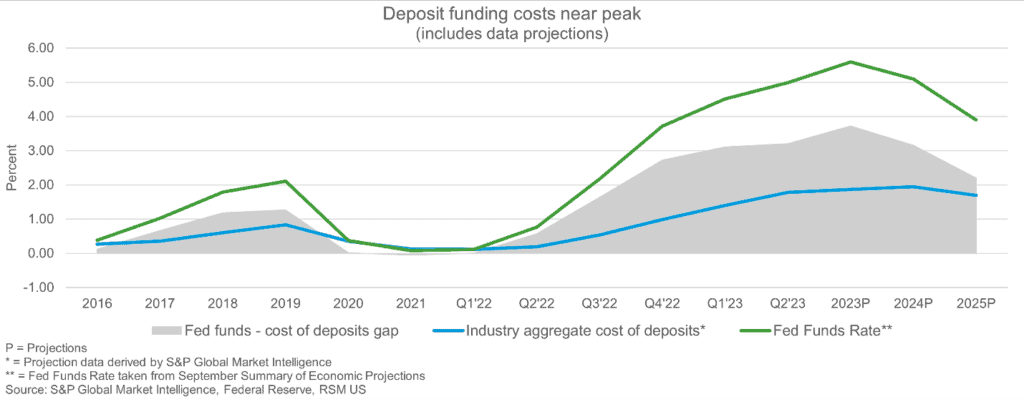

New Normal Ahead as Funding Costs Near Peak

While the rate hikes beginning in March 2022 had an early net benefit to bank net interest margins as loan rates climbed from at or near historic lows, the increase in deposit rates soon followed. And with that ensued the challenge of operating funding costs in a new rate world.

Peak deposit funding costs are still on the horizon for the industry. And for many banks, these funding costs are likely to be sticky, with a heavy focus by banks on deposit growth or retention. A return to funding cost levels that largely dominated the years between the Great Recession and the Covid-19 pandemic will prove nothing more than wishful thinking.

Capital: The Cure for What Ails

Despite the challenges brought about by this higher interest rate environment, the horizon is not cloudy for every bank. Those institutions that have peer-leading capital strength and capital ratios well exceeding regulatory requirements will find themselves at a tremendous advantage.

Institutions with plentiful capital can explore the following routes to use that capital and strengthen their positions:

- Leaning into M&A activity to support strategic growth plans, whether in market, adding new markets or expanding organizational capabilities and offerings.

- Repositioning securities portfolios to gain a pickup in earnings through redeploying proceeds in higher yielding instruments.

For banks without peer-leading capital strength, focusing efforts on capital preservation and growth through cost management and proactive credit monitoring will provide meaningful balance sheet support when credit losses pick up or the need to sell underwater investments arises.