The Huge Lending Opportunity You’re Overlooking

The number of clients and revenue have tripled, she says. HIIT Box has relocated three times in four years to pursue more space. And there’s still a waitlist to join.

But despite this success, Zadeh has struggled to obtain the capital she needs to keep up with the rapid growth of her business. She initially invested her own money—a $13,000 inheritance—and later obtained $35,000 from American Express (her payment processor, through its working capital program) and two smaller loans totaling $27,000 from the online lending platform Biz2Credit.

But it wasn’t enough, and other lenders turned her down when she sought additional capital to move into a bigger space. So, she turned to customers to fill the funding gap, offering her 40 largest clients a discount if they paid a lump sum up front. Twenty-three clients took advantage of her offer. “That’s what gave us that big chunk of money [for] construction, because no lender would give it to us,” says Zadeh.

Growing pains like these are common among female entrepreneurs.

Women own more than 11 million businesses in the U.S., or 39 percent of businesses, according to a 2017 study commissioned by American Express—a number that has risen over the past 2 decades. A Bank of America survey published last year found that 56 percent of female entrepreneurs plan to grow their business over the next five years. To do so, however, many of them will need to raise capital.

“Women-owned firms face persistent funding gaps and funding source mismatches,” according to a study published in 2016 by the Federal Reserve Banks of New York and Kansas City. Twenty-eight percent of women-owned firms applying for a loan over the previous year were not approved for any funds, and 64 percent obtained less money than they needed.

Some banks have developed educational programs to better engage this potentially lucrative demographic.

Renasant Bank, based in Tupelo, Mississippi, launched its “Nest” program in March, which provides financial education to female entrepreneurs. It’s part of a larger bank-wide program focused on developing female leaders, both in the community and within the bank.

Tracey Morant Adams, the chief community development and corporate social responsibility officer at the $13 billion asset bank, saw that female entrepreneurs often weren’t as comfortable discussing the financial position of their business. They also didn’t understand the financing options available to them and were more likely to rely on personal wealth—dipping into their retirement savings, for example—to fund their small business.

Renasant will use a lunch-and-learn format to explain financial basics—how to read pro forma financial statements, for example—so women can gain the confidence and knowledge they need to understand their financial position. Renasant will also explain the funding solutions available, and how to understand which one is the best fit for their business—when a line of credit is more appropriate than a credit card, for instance.

Ultimately, at least in theory, some of these women will seek a loan or deepen their relationship with the bank. “You have to be intentional and deliberate in your efforts to reach out and find that business,” says Adams. “The Nest is going to allow us to be more intentional, particularly in that female space.”

Bank of America’s study asked female entrepreneurs to identify solutions to address the funding gap women face. Twenty-four percent pointed to education—echoing the importance of programs like Renasant’s.

But even more women—42 percent—pointed to the need for gender-blind financing to reduce the role that unconscious bias—and outright sexism—play in the loan application process.

When she’s applied for capital, Zadeh—the CEO and sole founder of her company—has been asked where her (male) partner is. Some have assumed she was running a yoga studio, not a gym. She’s even been asked if she can do push-ups. (She can.)

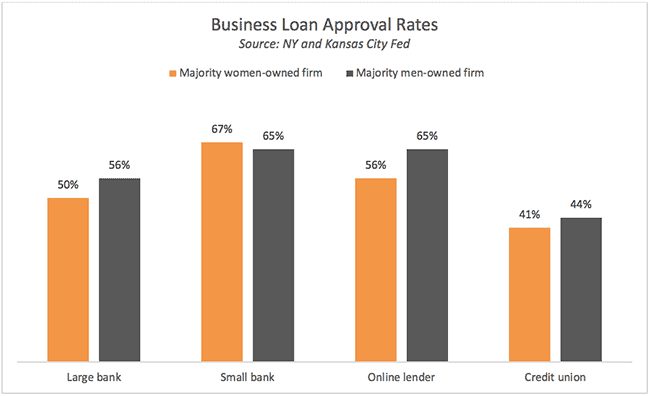

Women—and small business owners in general—are more likely to be approved for a business loan by a small bank than any other option, according to the Fed. But despite higher approval rates at small banks, women are more likely to seek funding from a large bank or online lender.

Stories like Zadeh’s may explain what’s driving women to online lenders and larger banks. “Everything is driven by the data, and there is no possibility of any kind of gender bias,” says Rob Rosenblatt, the head of lending for the online lending platform Kabbage.

Applying online, in theory, reduces bias, so a female applicant could be more optimistic that her loan would be approved.

For women seeking to grow their businesses, access to capital can make a big difference—and expand lending opportunities for the banks that enhance their efforts to this group.