How to Combat Bank D&O Headwinds

Brought to you by AHT Insurance

Banks and their boards are at a crossroads of a hardening director and officers (D&O) insurance market, which is creating some challenging conversations as they approach their D&O renewal.

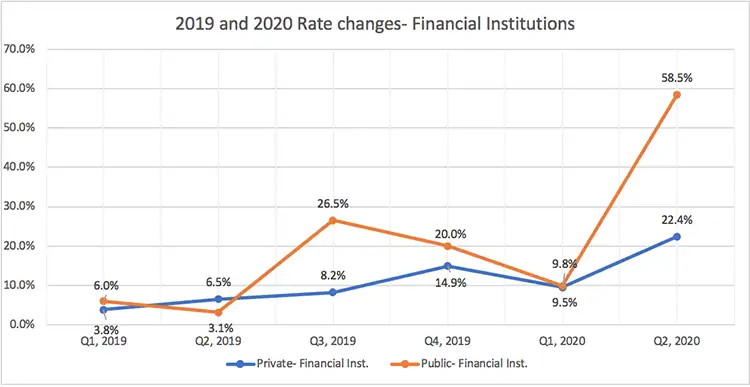

Prior to Covid-19, banks were seeing rate increase ranging from 3% to 26%, strictly based on an overall hardening of the D&O market. But the pandemic has had several specific impacts to the bank D&O renewal process.

Bank D&O underwriters realized very quickly that they would need substantially more information regarding an institution’s response to Covid-19 before they can comfortably offer terms. These questions cover how the bank reacted to their employee base, their response to their customers, their loan and investment exposure to certain high-risk industries and even the impact to the network with so many employees working remotely. Here is a list of the most common coronavirus-related questions a bank can expect.

The analysis of these additional questions means what used to take weeks to produce a quote can now take months. Everything now is a bit more delayed; banks need to budget more time allowances throughout the renewal process.

The pandemic has made multi-year options a thing of the past. Uncertainty associated with the virus and how quickly it caused fact patterns to change has challenged underwriters in ascertaining what the will look like over the next 12 months. Two-year or three-year options are virtually non-existent except for smaller privately held banks from the incumbent carrier.

D&O underwriters are almost paralyzed with fear of offering competing quotes on a bank they do not already have a relationship with. They worry about taking on a new bank and some unanticipated, unexpected pandemic-related claim happens during that first year for which they would be responsible.

The pandemic has made the insurance marketplace messier than it has ever been. Capacity is down, rates are up and underwriters are scrutinizing all new and existing business. Here’s what AHT has been doing for banking clients as they approach their renewal:

1. Set expectations early. Hold your renewal strategy presentation three to four months in advance and make sure you understand what the recent rate increases have been for your broker’s other banking clients to aid in the budgeting process. It can be a difficult message, but it is much better to understand what the rate environment is for similar banks based on the current data months in advance of the renewal.

2. Differentiate your institutions among your peers. We have been doing this for years in meetings with D&O underwriters, but it is more critical than ever. Because D&O lacks actuarial studies that can somewhat predict the probability of a claim, underwriters use the proxy of what I call ‘perceived quality of management.’ The best way for them to experience this is via hearing executives speak on the bank’s operations, compared to written responses.

We include a host of underwriters dedicated to the bank D&O space, including the incumbent underwriter. We begin with a general overview by the executive team of the bank and then open it up for questions from the underwriters, many of which are requested and shared in advance of the meeting.

These meetings expedite the process, especially the questions portion. We typically go from meeting to quote to bind with fewer delays or subjectivities. That’s because Underwriters get a better understanding of the risk, outside of information strictly available on the application and public filings. Some information included in those documents may not paint as full a picture as one that has the additional color added.

Including incumbents in the meeting allows them to experience the interest from competitors. This does not mean we recommended moving from incumbents; It simply means that they gain an understanding that they may need to ‘sharpen their pencils.’ It also increases the chance of gaining some interest from alternative carriers where there may not have been without the meeting.

3. Where there may be fewer alternative options, also look at options with higher retentions.

4. Look for a summary of renewal options as early as possible, understanding that D&O underwriters usually do not quote more than a month in advance. Two weeks prior is a good time to review options.

5. Lastly, more than ever, I am being asked to summarize the process and the results at the subsequent board meeting.

We are seeing challenging renewals the like that we have not seen for years, but your bank can mitigate the challenges by being as proactive and as transparent as possible.