How Banks Can Make a Lasting Impact With the Financially Underserved

For the financially underserved in the United States – primarily socioeconomically disadvantaged people of color, as well as minority-owned small and medium-sized businesses that lack sufficient access to the banking ecosystem – the widening wealth gap and financial hardships resulting from the pandemic is their lived reality.

Herein lies an opportunity for banks. There are millions of U.S. households that are unbanked or underbanked, according to the Federal Deposit Insurance Corp., and nearly 1 million minority-owned small businesses, according to the U.S. Census Bureau. Without access to the banking system, these groups often turn to higher-cost alternatives for their banking needs, and may be unable to build wealth for financial goals such as retirement or a home purchase. This lack of access also means they may be unable to borrow to attend college or start a business.

These groups need the support and security that the banking system offers. Now, with more banks reassessing the fee structures of their deposit accounts and financial products, financially underserved individuals and businesses are likely to represent new customers and additional sources of growth in the face of increasing competition from nonbank financial technology companies.

What’s more, bringing financially underserved individuals into a banking system that fosters an environment of trust and promotes their financial well-being can directly benefit U.S. economic growth. Narrowing the wealth gap for Black Americans could add roughly $1 trillion to the U.S. economy by the end of this decade, according to a recent study by McKinsey & Co.

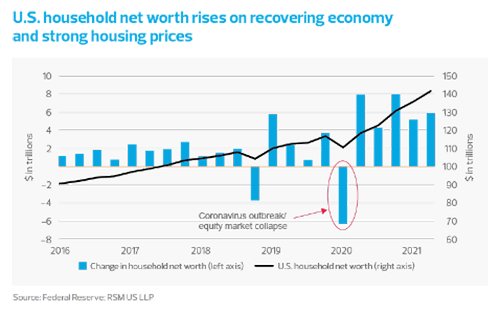

Household wealth in the United States continues to grow, but a large number of people still lack financial assets such as stock market investments or nonfinancial assets such as real estate.

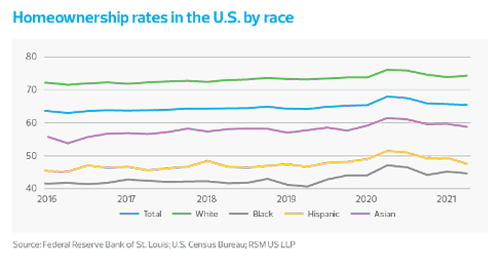

Census data underscores the disparity in homeownership rates among various racial groups in the United States. Homeownership rates for all races, except white Americans, has declined as the pandemic continues, the data show. Further, the gap between white and Black homeowners is yet again nearing its widest point since the U.S. Census Bureau began tracking the data.

The economic disparities don’t end with financially underserved U.S. households. The pandemic has deeply affected small businesses owned by people of color, according to data published by the Federal Reserve. Here are some of the findings from the Fed’s 2021 Small Business Credit Survey:

- Ninety-two percent of Black-owned firms reported experiencing financial challenges in 2020 (up from 85% in 2019), followed by Asian-owned firms (89%, up from 70%) and Hispanic-owned firms (85%, up from 78%). White-owned firms were the least likely to report financial challenges (79%, up from 65% in 2019).

- Black business owners were the most likely to tap into their personal funds in response to their firms’ financial challenges (74%) compared to Hispanic-owned firms (65%), Asian-owned firms (65%), and white-owned firms (61%).

The Fed also points out the concerns faced by small businesses owned by people of color in how they obtain financing needed to operate their businesses. From the report:

- Across owner groups, Black-owned firms that applied for traditional forms of financing were least likely to receive all of the financing they sought (13%). Hispanic and Asian-owned firms (20% and 31%, respectively) were also less likely than white-owned firms (40%) to receive all of the financing for which they applied.

- Firms owned by people of color were twice as likely as white-owned firms to report that they did not use a financial services provider. Twelve percent of Black- and Hispanic-owned firms did not use financial service providers, followed by 11% of Asian-owned firms and 6% of white-owned firms.

The financing challenges that underserved individuals and minority-owned businesses faced before the pandemic, coupled with the shock of the pandemic itself, has created a perfect storm. This current economic environment highlights the need to help these groups – and that banks can play a significant part in this effort. Here are some ways banks can deploy support:

- Invest in community development financial institutions (CDFIs) or become CDFI-certified.

- Create programs to support community development activities.

- Increase educational outreach to the under- or unbanked.

- Support minority communities through charitable giving.

Banks don’t necessarily need to be creative with ways to support the financially underserved, but they do need to be intentional. During the current economic recovery, the public has viewed banks much more favorably than they did coming out of the Great Recession. But in the near term, working to close the increasing wealth gap and support the financially underserved will likely be key areas where banks can make the biggest difference, cultivating increasingly favorable views from customers and the broader public. In doing so, banks can unlock a means to new growth while simultaneously supporting continued economic expansion.

This article was originally published by RSM US LLP in its winter 2022 industry outlook for financial services.