Earnings Are High but Bank Stock Prices Are Low

Banks are doing very well, if you look at credit quality and profitability. But tell that to investors.

Last week, the Federal Open Market Committee raised the target federal funds rate by 75 basis points, the third hike of that magnitude in a row, to combat inflation.

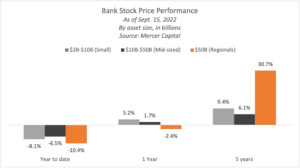

The market has punished equities lately in response, but even more so, bank stocks, probably in anticipation of a recession that may have arrived. The S&P 500 fell 21.61% in 2022 as of Friday, Sept. 23, but the S&P U.S. large cap bank index was down 25.19% in that same time frame, according to Mercer Capital using S&P Global Market Intelligence data. By asset size, large banks have seen the biggest declines so far this year.

Going back further in time, the cumulative return for U.S. bank stocks in general, as measured by the S&P U.S. BMI Banks index, was down 5.30% as of Sept. 22 from the start of 2020, compared to a gain of 21.55% for the S&P 500.

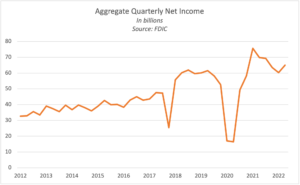

Investors’ dim view of bank stocks belies the underlying strengths of many of these banks. Bank net income of $64.4 billion in the second quarter was higher than it had been in the same quarter of 2018 and 2019, according to the Federal Deposit Insurance Corp. Since 2019, in fact, bank profitability has been going gangbusters. Rising interest rates improved net interest margins, a key profitability statistic for many banks. Plus, loan growth has been good.

And credit quality remains high, as measured by the noncurrent loan and quarterly net charge-off rates at banks, important bank metrics tracked by the FDIC. Despite weaknesses in mortgage and wealth management, this combination of variables has made many banks more profitable than they were in 2018 or 2019.

“Earnings are excellent right now, and they’re going to be even better in the third and fourth quarter as these margins expand,” says Jeff Davis, managing director of Mercer Capital’s financial institutions group.

Investors don’t seem to care. “It’s been a real frustration and a real incongruity between stock prices and what’s going on with fundamentals,” says R. Scott Siefers, managing director and senior research analyst at Piper Sandler & Co. “You’ve had a year of really great revenue growth, and really great profitability, and at least for the time being, that should continue. So that’s the good news. The bad news is, of course, that investors aren’t really as concerned with what’s going on today.”

Worries about a possible recession are sending investors away from bank stocks, even as analysts join Davis in his prediction of a pretty good third and fourth quarter for earnings this year. The reason is that investors view banks as sensitive to the broader economy, Siefers says, and think asset quality will deteriorate and the costs of deposits will rise eventually.

The place to see this play out is in two ratios: price to earnings and price to tangible book value. Interestingly, price to tangible book value ratios have remained strong – probably a function of deteriorating bond values in bank securities’ portfolios, which is bringing down tangible book values in line with falling stock prices. As a result, the average price to tangible book value as of Sept. 23 was 1.86x for large regional bank stocks and 1.7x for banks in the $10 billion to $50 billion asset range, according to Mercer Capital.

Meanwhile, price to earnings ratios are falling. The average price to earnings ratio for the last four quarters was 10.3x for large regional banks, and 11.4x for mid-sized bank stocks. (By way of comparison, the 10-year average for large cap bank stocks was 13.4x and 14.6x for mid cap bank stocks, respectively.)

For bank management teams and the boards that oversee them, the industry is entering a difficult time when decisions about capital management will be crucial. Banks still are seeing loan growth, and for the most part, higher earnings are generating a fair amount of capital, says Rick Childs, a partner at the tax and consulting firm Crowe LLP. But what to do with that capital?

This might be the perfect time to buy back stock, when prices are low, but that depletes capital that might be needed in a recession and such action might be viewed poorly by markets, Childs says. Davis agrees. A lot of companies can’t or won’t buy back their own stock when it’s gotten cheap, he says. “If we don’t have a nasty recession next year, a lot of these stocks are probably pretty good or very good purchases,” he says. “If we have a nasty recession, you’ll wish you had the capital.”

It’s tricky to raise dividends for the same reason. Most banks shy away from cutting dividends, because that would hurt investors, and try to manage to keep the dividend rate consistent, Childs says.

And in terms of lending, banks most certainly will want to continue lending to borrowers with good credit, but may exercise caution when it comes to riskier categories, Davis says. Capital management going forward won’t be easy. “If next year’s nasty, there’s nothing they can do because they’re stuck with what’s on the balance sheet,” he says. The next year or two may prove which bank management teams made the right decisions.