Do Top Executives at Public Banks Get Paid More Than Those at Private Banks?

Median cash compensation for top executive positions at public banks is consistently about 25% to 30% more than their counterparts at private banks.

Brought to you by Blanchard Consulting Group

Over the years, the question has been frequently asked as to whether public bank executives — banks that file a proxy statement with the Securities and Exchange Commission that contains compensation data — get paid more than private bank executives. In the past, we have not seen a significant difference, but given today’s competitive market for talent, we decided it was time to conduct an updated analysis to see if the answer has changed.

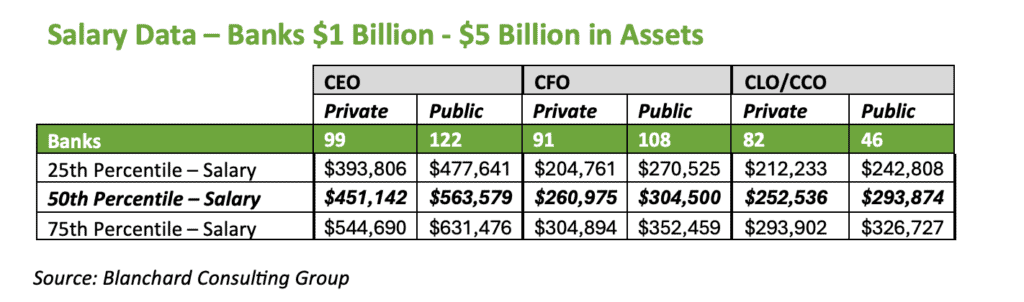

Using our proprietary client database, which includes private client data from our surveys and consulting along with public bank data gathered for compensation reviews, we looked at the compensation levels paid and aged through 2023 for three top executive positions: CEO, chief financial officer (CFO) and chief lending or chief credit officer (CLO/CCO). We focused our statistical analysis on banks with assets between $1 billion and $5 billion. The sample included 221 banks, of which 122 were public banks and 99 were private banks. We also reviewed data institutions with assets from $500 million to $10 billion and found that the results were consistent.

What did we find out about salary and total cash compensation levels?

For the CEO position, the average median salary at a public bank is approximately 25% higher than that at a private bank. For CFOs, the median salary at public banks was 17% higher. For the CLO/CCO positions, we also found a similar jump in the public bank’s salary level: 16% higher.

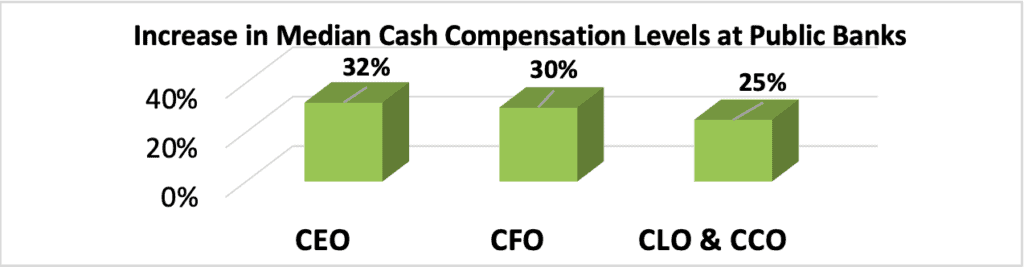

Not surprisingly, when cash incentives are added to the compensation mix, there remains a similar differential. The increase percentages go up slightly since annual cash incentive compensation is often based on a multiple of base salary. We found that the median total cash compensation, defined as salary plus cash incentive or bonus, for the CEO at a public bank was 32% higher, for the CFO was 30% higher and for the CLO/CCO positions 25% higher than the same positions at a private bank.

Not surprisingly, when cash incentives are added to the compensation mix, there remains a similar differential. The increase percentages go up slightly since annual cash incentive compensation is often based on a multiple of base salary. We found that the median total cash compensation, defined as salary plus cash incentive or bonus, for the CEO at a public bank was 32% higher, for the CFO was 30% higher and for the CLO/CCO positions 25% higher than the same positions at a private bank.

How do we apply this data?

Compensation for top executives should be viewed in terms of the total compensation package. Total compensation typically includes salary, cash incentive/bonus, equity-based vehicles, retirement programs and perquisites. When making decisions about salary and total compensation, it is important to understand what similar public and private banks are paying for similar positions. Banks are often competing for the same executive talent, and the differentiator may depend on the availability of various compensation programs at an individual bank.

Effective compensation programs are structured to allow bank executives to earn at a level commensurate with the performance they are driving. The structure of that compensation should be aligned with the bank’s compensation philosophy and strategic plan. The purpose of looking at compensation comparisons is to help set a competitive total compensation structure that will reward employees for achieving performance goals, while also retaining them for the long-term health of the bank. Employees who feel they are being compensated in a fair and transparent fashion tend to be more engaged and dedicated to the bank and its success.

Simply because the market data says public bank executives are paid more than private bank executives, should we make similar adjustments based on our corporate structure? The answer depends on your unique situation. Be sure to dig a little deeper into the competitive situation, compensation philosophy and the individuals who are in those executive positions.