Comp Program, Process Considerations in a Changing Regulatory Environment

Boards should address incentive plan risk mitigation, controls and governance processes ahead of the finalization of Section 956.

Brought to you by Meridian Compensation Partners

When Silicon Valley Bank failed earlier this year, followed in quick succession by Signature Bank and First Republic Bank, regulators faced tough questions about their effectiveness and their actions to prevent such failures. In response to these events, greater regulation and scrutiny of incentive plans seemed likely; in short order, the Securities and Exchange Commission added the finalization of Section 956 of the Dodd-Frank Act to its Regulatory Flexibility Agenda with a targeted date of April 2024.

Section 956 requires six regulatory bodies to work together to develop rules governing incentive compensation for banks with $1 billion in assets or more. Until the rules are finalized, banks should follow the existing regulatory guidance from the 2010 Interagency Guidance on Sound Incentive Compensation Practices. Now is a good time for boards to address incentive plan risk mitigation, controls and governance processes to ensure that one, your bank is in alignment with existing guidance, and two, that the compensation committee is prepared ahead of the finalization of Section 956.

Establishing a Controls-Oriented Process for Managing Risk in Incentive Plans

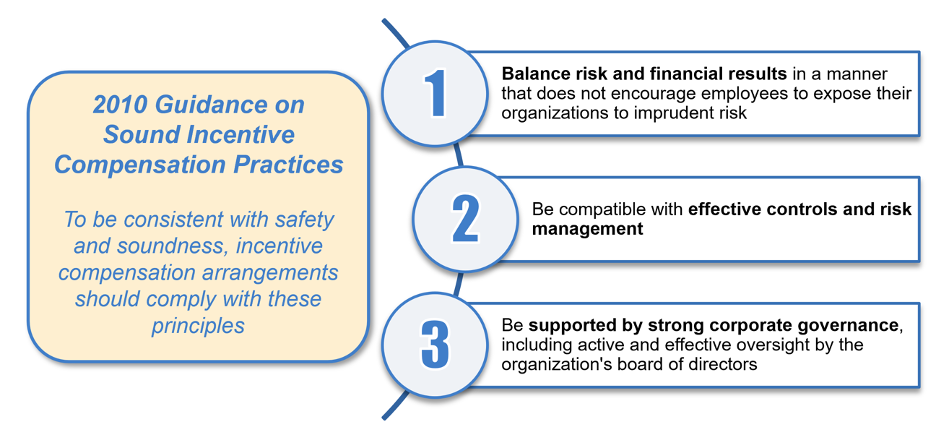

Boards are tasked with overseeing and reviewing executive incentive compensation programs and governance processes that align with the existing regulatory framework. However, they may soon be faced with more onerous incentive compensation requirements, rather than today’s principles-based guidance. The 2010 guidance establishes three principles that banks can review to prepare for greater regulation and enhance existing incentive compensation risk-related practices.

1. Balancing Risk and Financial Results

Under the 2010 Guidance, banks should design incentive compensation programs that consider risk against financial results. In response, banks have designed programs with the flexibility to reduce payouts for risk or compliance concerns, whether through a formulaic reduction or compensation committee discretion. Some incentive plans include mandatory deferrals, payouts in stock and/or reduced upside leverage. These features temper potential short-term gains, which may reduce the motivation for risky executive decision-making.

Many banks also implemented clawback policies in advance of the SEC’s mandatory policy, with triggers for inaccurate financial results, misconduct or significant risk management failures.

Beyond clawback policies, banks should consider the timing of payouts. Deferred payouts provide a mechanism for banks to reduce or forfeit incentives if significant risk concerns are identified. Many banks also use continued vesting upon termination or retirement, which may protect against short-term risky behavior in advance of an executive’s separation.

Before finalization of Section 956, compensation committees should ask:

- Do our incentive programs appropriately manage upside payouts through caps or the amount of payout leverage?

- Do our incentive programs require mandatory deferrals or vesting periods for certain payouts?

- Do our incentive programs include risk mitigators such as balanced performance measures and short- and long-term components?

- Does the compensation committee have discretion to negatively adjust payouts?

2. Documentation, Effective Controls and Risk Management

Banks’ human resources, finance, risk and legal teams all have important roles in reviewing incentive plan risk. These teams should ensure there is a centralized process for reviewing and assessing risk before finalizing payouts.

Before finalization of Section 956, boards should review the bank’s incentive plan processes and controls and ask:

- Do our incentive programs have current written plan documents?

- Is there appropriate documentation of discretionary adjustments, including decisions made in executive session?

- Is there sufficient documentation for qualitative payouts, such as defined goals and performance against those goals? Is there detailed information regarding individual performance reviews and outcomes?

- Does management have a process for tracking and reporting identified risk concerns?

- Are the results verified prior to the payout recommendation?

- Do multiple parties (including the compensation committee and management risk leadership among others) review payout outcomes before approval?

3. Strong Corporate Governance

The 2010 guidance provides clear regulatory expectations that compensation committees must provide strong oversight of incentive plans to ensure the programs do not encourage excessive risk.

Before finalization of Section 956, committees should consider the following:

- Does the committee consider risk from a holistic perspective (like financial, operational, regulatory/compliance and reputational)?

- Has the committee considered the depth and breadth of the annual compensation risk assessment to ensure robustness?

- Does the committee receive regular reporting from the chief risk officer or other equivalent risk management leadership relative to compensation risk?

- Are there communications and interactions between the compensation, audit and/or risk committees?

- Does the committee calendar plan for review of compensation-related, risk-mitigating best practices on a biennial or triennial basis (such as stock ownership guidelines, change-in-control and severance treatments)?

While regulators are likely to continue focusing the most stringent rules on the largest U.S. banks, incentive compensation practices will trickle down to smaller regional and community banks. Incentive program design, controls and processes will undoubtedly change with the finalization of Section 956. Banks should ensure they are effectively adhering to existing regulatory guidance and be ready to respond once 956 rules are finalized.