Common Themes in Banks’ Critical Audit Matters

Beginning in 2019, auditors of large accelerated filers that file with the U.S. Securities and Exchange Commission were required to communicate critical audit matters, or CAMs, in their audit opinions. An analysis of Form 10-K filings for U.S. depository institutions for reporting periods covering June 30, 2019, through Dec. 31, 2019, reveals common themes of interest to bankers. The 10-Ks of large accelerated filers with a Dec. 31, 2019 year-end represent the first time these required communications appeared in a significant amount of bank filings.

Banks that are classified as large accelerated filer might wonder how their CAMs compare to those of other banks; SEC filers that do not have the designation might wonder what to expect in their own audit opinions for fiscal years ending on or after Dec. 15, 2020.

Background

In 2017, the Public Company Accounting Oversight Board (PCAOB) adopted Auditing Standard 3101, which requires auditors to communicate CAMs in their audit opinions for audits of large accelerated filers with fiscal years ending on or after June 30, 2019.

The PCAOB defines a critical audit matter as “any matter arising from the audit … that was communicated or required to be communicated to the audit committee and that: (1) relates to accounts or disclosures that are material to the financial statements and (2) involved especially challenging, subjective, or complex auditor judgment.” CAMs are intended to provide insight beyond the boilerplate audit opinion and share important information with investors.

Each CAM included in the audit opinion should include:

- What: Identification of the CAM.

- Why: Principal considerations that led the auditor to determine the matter was a CAM.

- How: A description of how the CAM was addressed in the audit, including a description of one or more of the following: (1) the auditor’s response or approach most relevant to the matter; (2) a brief overview of the audit procedures performed; (3) an indication of the outcome of the audit procedures; (4) key observations with respect to the matter.

- Where: The relevant financial statement accounts or disclosures that relate to the CAM.

Number of CAMs

Crowe specialists analyzed the audit opinions of U.S. depository institutions that are large accelerated filers and filed directly with the SEC (“issuers”) with year-ends between June 30 and Dec. 31, 2019, using data from Audit Analytics.

In 2019, 150 depository institutions reported CAMs; and all depository institutions that both file with the SEC and are large accelerated filers reported at least one CAM. The average number of CAMs per issuer was just shy of 1.5. Approximately two-thirds of issuers reported just one CAM, while just under 10% of issuers reported more than two CAMs. Four CAMs was the maximum observed in any one depository institution, with only one institution reporting that number (Exhibit 1).

CAMs per issuer

CAM themes

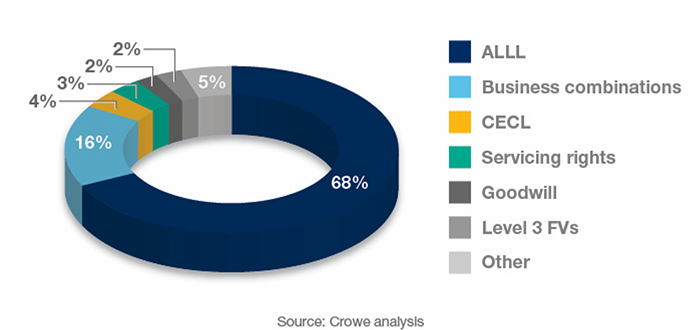

Auditors of the 150 bank issuers reported a total of 221 CAMs. Unsurprisingly, the most common CAM was related to the allowance for loan and lease losses. This CAM appeared in every bank issuer’s opinion and constituted 68% of the total CAMs reported by bank auditors. In addition to the 150 CAMs specific to the allowance, eight CAMs were specific to the disclosure around the pending adoption of the Accounting Standards Update (ASU) 2016-13 (Accounting Standards Codification 326), commonly referred to as current expected credit losses accounting standard.

The second most common CAM topic – business combinations – appeared 35 times across 32 issuers’ opinions. Nearly three-fourths (27) of the business combination CAMs were specific to certain acquired assets and liabilities, most commonly loans and identifiable intangible assets. Six CAMs were more general in nature and covered entire acquisition transactions. Two CAMs were specific to Day 2 acquisition accounting.

Twenty-eight CAMs were outside of the common topics of the allowance, CECL and business combinations. These CAMs spanned topics including goodwill impairment, servicing rights valuations, deferred tax asset valuation allowances, contingencies, level three fair values and revenue recognition, among others (Exhibit 2).

Banking CAM topics

The number and nature of CAMs will vary over time, but the most frequently observed topics appearing in 2019 CAMs will likely always be prevalent in bank audit opinions. As more institutions adopt CECL, the incidence of CECL as a CAM almost certainly will increase.

The prevalence of CAMs related to business combinations likely will be directly related to the level of bank acquisitions that occur in a given period. Other CAM topics such as goodwill impairment, deferred tax asset valuation allowances, and fair value considerations might increase or decrease based on market conditions.