Laura Alix is the Director of Research at Bank Director, where she collaborates on strategic research for bank directors and senior executives, including Bank Director’s annual surveys. She also writes for BankDirector.com and edits online video content. Laura is particularly interested in workforce management and retention strategies, environmental, social and governance issues, and fraud. She has previously covered national and regional banks for American Banker and community banks and credit unions for Banker & Tradesman. Based in Boston, she has a bachelor’s degree from the University of Connecticut and a master’s degree from CUNY Brooklyn College.

Banks Revisit Incentives As Deposit Competition Stays Hot

As banks battle it out for deposits, they’re changing pay structures to reward commercial bankers who can bring on stable, low-cost funding.

Unlike many business banks, Watermark Bank in Oklahoma City doesn’t have commercial lenders on staff.

That’s by design. The $319 million bank, founded in 2019, instead relies on a team of relationship managers to build out its portfolio of clients, competing for that business against investment banks, wealth managers and other financial institutions. CEO Matt Pollock says commercial bankers are expected to focus on clients’ holistic financial needs, including treasury management and operating accounts, rather than strictly loans.

Building a deeper client relationship is reflected in the incentive structure for Watermark’s commercial bankers. “Since day one, we have had an incentive program that includes loans, deposits, treasury and income goals. And the deposit side has always been at least equal to, if not weighted more, than the loan side,” Pollock says. “We do that to drive behavior, because it has always been our belief that we have to have the best deposit portfolio possible to grow the bank.”

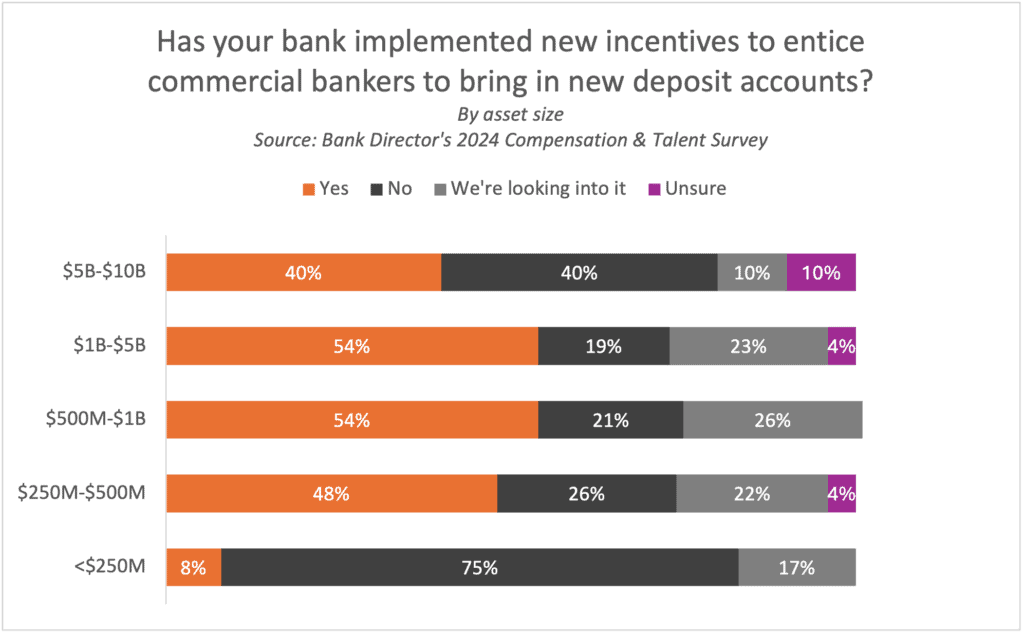

There’s some evidence that Watermark’s approach has grown increasingly common as banks battle it out for deposit relationships. As lending appetites — and demand — have cooled and deposit competition has intensified, banks are rethinking how to reward commercial bankers. Bank Director’s 2024 Compensation & Talent Survey reveals that more banks have adjusted incentive programs to encourage deposit growth. Almost half of participating directors and executives say their bank implemented incentives for commercial bankers to bring in new deposit relationships, compared with 42% who said as much a year earlier. These incentives are more common at banks above $250 million in assets.

About three years ago, Vantage Bank Texas in San Antonio adjusted its incentive plan for commercial bankers to move away from a focus on originating loans, says Chief Human Resources Officer Eric Thompson. The $4.2 billion subsidiary of VBT Financial Corp. previously used a scorecard that emphasized lending relationships but has since revised that to account for each banker’s overall profitability, including deposit relationships and fee-based services along with lending.

“We also built in things such as treasury management referrals, because we know that those are sticky items,” Thompson says. Relationship managers are encouraged to think about getting the client’s deposit relationships and treasury management business before talking about loans or lines of credit.

Stephen Peary, a partner in the financial services practice at the recruiting firm Smith & Wilkinson, says he has witnessed “a huge shift” in incentive structures as well as the role of the commercial banker more generally.

Organizations looking to recruit commercial banking talent are seeking out well-rounded bankers who are comfortable talking about the client’s holistic financial needs. They’re also increasingly seeking bankers who possess subject matter expertise in some vertical like healthcare or entertainment.

“Banks have made a huge push to not just incentivize commercial bankers to bring on board deposits, but actually build out teams solely focused on leading with a deposit-first strategy to bring in new commercial clients,” he says.

Even with a “deposit-first” strategy, it’s important that bankers look at a client’s entire financial needs and not strictly focus on luring them with the highest deposit rate on the market.

“It is the most competitive environment that I have ever been in from a deposit standpoint,” Pollock says. “If you just lead with the rate, you’re going to get the highest cost deposit. You really have to have conversations with clients about their liquidity needs. There’s typically some amount that needs to be at a higher savings rate or can be locked up for a year that can earn more, versus day-to-day operating capital.”

Banks that made this shift in their talent strategy six months or a year ago are now starting to see those efforts bear fruit, Peary says. The longer an institution waits to adapt, the less likely it may be to attract the bankers it wants to grow its business.

Fifty-seven percent of the executives and directors taking part in the 2024 Compensation & Talent Survey expect their bank to add commercial or business lending staff. The banks that are most successful at this will be able to clearly articulate a long-term vision for the banker’s role within the broader organization, Peary says, rather than pursuing a temporary “deposit-first” strategy that only lasts until the rate environment changes.

“They have a clearly defined business plan and business strategy, and they understand how these individuals fit into the overall structure hierarchy of their commercial banking function,” Peary says. “Those organizations are more successful. I actually think that’s probably a bigger driver than compensation.”