Bank M&A in 2019: Is It a New World?

Much like the countless dystopian novels and movies released over the years, the environment today in banking begs the question of whether we’ve entered a so-called new world in the industry’s M&A domain.

Deal volume in 2018 was roughly equal to 2017 levels, though many regions in the country saw a decline. And while it’s still early in 2019, the first two months of the year have been marked by a pair of large, transformative deals: Chemical Financial Corp.’s merger with TCF Financial Corp., and BB&T Corp.’s merger with SunTrust Banks. These deals have raised hopes that more large deals will soon follow, creating a new tier of banking entities that live just below the money-center banks.

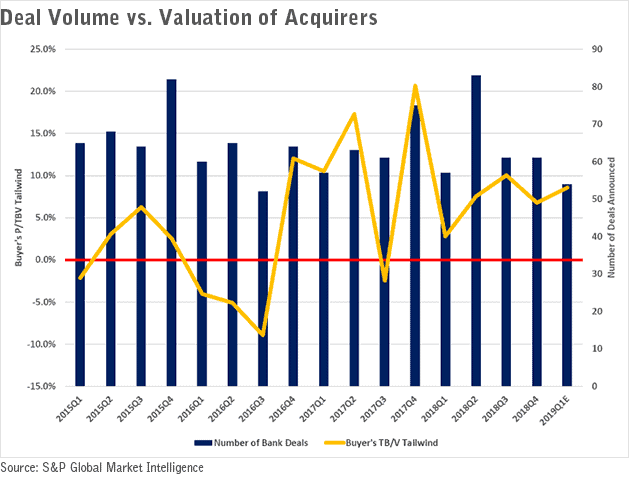

Aside from these two large deals, however, M&A volume throughout the rest of the industry is down over the first two months of the year. As you can see in the chart below, this continues a slide in deal volume that began at the tail end of 2018.

Bank Director’s 2019 Bank M&A Survey highlights a number of the factors that might impact deal volume in 2019 and beyond.

Fifty-seven percent of survey respondents indicated that organic growth is their current priority, for instance, though respondents were open to M&A opportunities. This suggests that banks are more willing to focus on market opportunities for growth, likely because bank management can more easily influence market growth than M&A. The strength of the economy, enhanced earnings as a result of tax reform, easing regulatory oversight and industry optimism in general also are likely contributing to the focus on market growth.

The traditional chasm between banks that would like to be acquirers and banks that are willing to be sellers seems to be another factor influencing banks’ preference for organic market growth. In all the surveys Crowe has performed of bank directors, there always are more buyers than sellers.

The relationship between consolidation and new bank formation also weighs on the pace of acquisitions. If the pool of potential and active acquirers remains relatively stable, the determiner is the available pool of sellers. Each year since 2008, the number of acquisitions has exceeded the number of new bank formations. The result is an overall decrease in the number of deals. It stands to reason, in turn, that this will lead to fewer deals each year as consolidation continues.

Current prices for bank stocks also have an impact on deal volume. You can see this in the following chart, which illustrates the “tailwind” impact on deal volume for publicly traded banks. Tailwind is the percentage by which a buyer’s stock valuation exceeds the deal metrics. When the percentage is high, trading price/tangible book value (TBV) exceeds the deal price/TBV and deal volume is positively affected. The positive impact sometimes is felt in the same quarter, but there can be a three-month lag.

In the beginning of 2019, bank stock prices recovered some of the declines they experienced in the latter half of last year, but they still are at a negative level overall. If bank stock prices continue to lag behind the broader market, as they have over the past year (see the chart below), deal volume likely will be affected for the remainder of the year.

It’s still too early to predict how 2019 will evolve for bank M&A. Undoubtedly there will be surprises, but it’s probably fair to assume a slightly lower level of deals for 2019 compared to 2018.