A Costly Problem Facing Banks

Bill pay is a central tool in digital banking suites – but most customers aren’t actively using it.

It’s counterintuitive: Banks play a central role in our financial lives, yet most consumers opt to pay billers directly, according to “How Americans Pay Their Bills: Sizing Bill Pay Channels and Methods,” a survey conducted by Aite Group. The online survey of more than 3,000 U.S. consumers was commissioned by the bill-pay platform BillGO.

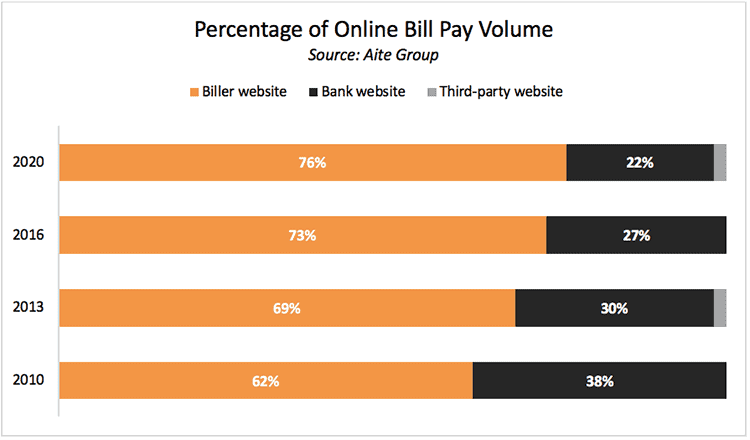

Almost 60% of bills are paid online, according to the survey, which finds that the percentage of online bill payments paid directly via a biller’s website – already accounting for the vast majority – increased by 14 points since 2010. In that same time period, banks’ share declined by 16 points as third-party entrants entered the space.

The result is chaos for consumers seeking to pay their bills on time and a missed opportunity for their banks.

“[For] many financial institutions, bill pay has been a fairly strategic component of the consumer relationship,” says David Albertazzi, Aite’s research director in the retail banking and payments practice. Along with automated loan payments and direct deposits, bill pay is viewed as a core element of the primary financial relationship.

There’s also the real cost associated with this problem: One bank recently shared with Bank Director that it built a bot just to deregister inactive bill-pay users sitting on its core system.

Bank Director’s 2020 Technology Survey finds that improving the customer experience is a top technology objective. Albertazzi says that bill pay should be part of that strategic consideration – and the experience needs to improve. Dramatically.

“The actual model and the experience have not changed for many years,” he says. “Today, it’s pretty prone to friction.” Payees must be added manually by the customer, and there’s a risk of mis-keying that information. Customers can’t choose how to pay, beyond their primary checking account. They aren’t notified by the bank when the bill is due. The payments lack information and context, and they don’t occur in real time.

These barriers limit the experience, driving more than three-quarters of the Americans who pay bills online to just go directly to their biller’s website.

Financial institutions need to shift from a transactional to a customer-centric mindset, says Albertazzi. “Once financial institutions do that, then there’s a great opportunity to recapture market share,” he says.

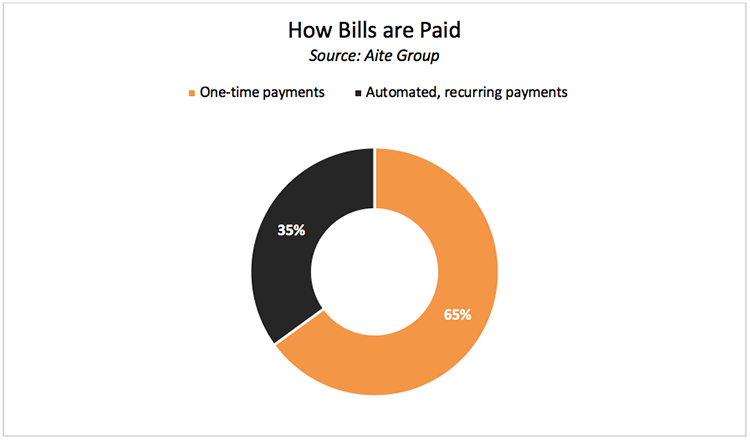

Banks should also consider how they can change customer behavior. Just a third of bills are scheduled to be paid on a recurring basis, according to survey respondents, which points to another gap where banks lose a bill-pay user, according to Albertazzi. Encouraging customers to enroll in automatic payments means they’re more likely to keep using their bank’s bill-pay capabilities.

Most customers trust their bank, but poor experiences have driven consumers to a decentralized model that benefits no one. With the massive adoption of digital channels that accompanied Covid-19, banks have a chance to change consumer behaviors.

“Providing that convenience to the consumer, the transparency in the process and addressing efficiencies to the entire consumer bill-pay experience will help drive change in consumer bill payment behavior over time,” says Albertazzi.