5 Things to Know About the New AML Whistleblower Law

Among a bank board of directors’ many obligations is the responsibility to assure the bank complies with Bank Secrecy Act and other anti-money laundering laws and regulations.

This includes providing oversight for senior management and the BSA compliance officer, staying abreast of internal AML developments and reporting within the bank, and considering external market factors and regulatory developments. But even in a regulatory environment where penalties for BSA/AML violations have increased in amount, frequency and reputational importance, some boards are slowly reacting to recent Congressional legislation designed to further incentivize bank employees to blow the whistle on perceived or actual AML lapses. Here are five things bank boards need to know one year after the implementation of the Anti-Money Laundering Act of 2020 (AMLA).

1. Congress uncapped whistleblower awards

Congress enacted the AMLA in January 2021, which significantly revised the existing whistleblower provisions of the BSA and sought to bolster AML enforcement. Prior to the AMLA, the BSA’s whistleblower provisions were sparse and rarely invoked. The prior law allowed whistleblower rewards for information relating to a violation of the BSA, but capped the award amount at $150,000, which contributed to the law being underutilized. The new law removed that cap; now, whistleblowers who voluntarily provide original information to their employer or the departments of Treasury or Justice could collect up to 30% of amounts collected in actions where over $1 million in sanctions are ordered. As the industry knows, 30% of recent fines is substantial. If a whistleblower qualified in connection with the three 2021 actions from the Financial Crimes Enforcement Network, or FinCEN, their awards could have amounted up to $2.4 million, $30 million and $117 million, respectively.

2. Looking to prior precedent.

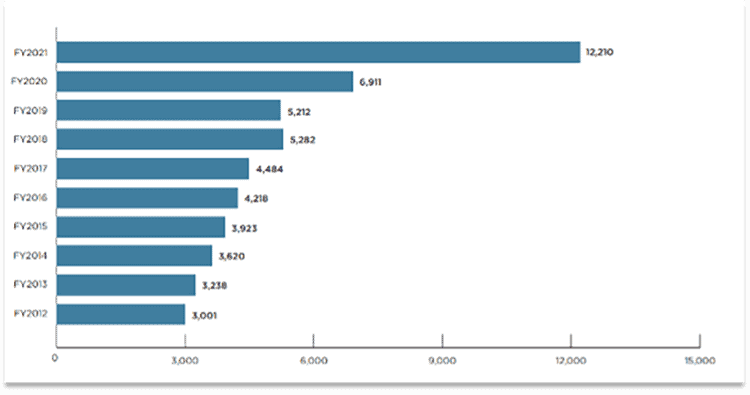

The new AML whistleblower program is largely modeled on the Securities and Exchange Commission’s successful program established under the Dodd-Frank Act, which may provide a window into the future of AML enforcement. The SEC’s program has been a resounding success over the past 10 years, resulting in more than 52,400 tips as well as $1.2 billion awarded to 238 individuals. According to the SEC’s recent Annual Report to Congress, fiscal year 2021 was a record-breaking year for the program in terms of tips received and amounts awarded to whistleblowers: $564 million was awarded to 108 individuals.

3. Employees can blow the whistle to their managers

Unlike the SEC’s program, a “whistleblower” under the new AML program includes employees who provide information to an employer – including as a part of their job duties – in addition to those who report to Treasury or DOJ. This means employees can blow the whistle if they observe compliance failures, and everyday interactions between management and financial intelligence unit investigators could be deemed whistleblower tips that trigger anti-retaliation protections and a possible award.

4. Tips are already being filed

Even though FinCEN has not issued rules implementing this new whistleblower law, tipsters do not need to wait to file a complaint with their employer or the government. Banks should react accordingly. In fact, it was recently reported that a tip has already been made to FinCEN detailing a wide-ranging money laundering scheme, and one lawyer has reported several inquiries received from internal compliance personnel interested in blowing the whistle. There is also recent precedent that the government does not need to wait until regulations are written to provide awards: In November 2021, the National Highway Traffic Safety Administration announced a $24 million award – its first ever – even though the agency is still writing its rules. In other words, the doors are open to AML whistleblowers now.

Number of SEC Whistleblower Tips

5. Boards should not wait to act

Boards should consider the implications and the expanded legal risk of the AMLA whistleblower law on their existing whistleblower programs. Among other steps that can be taken now, boards should provide oversight to senior management in:

- Developing enterprise-wide training tailored to specific positions within the bank, including for directors, that covers how to identify a tip for purposes of the new AML law, how to respond to an internal whistleblower and best practices to protect the bank from retaliation lawsuits.

- Reviewing and updating policies and procedures for internal whistleblowers.

- Assessing internal reporting structures, including hotlines and other channels.

- And triaging recent internal tips and conducting reviews of the response, where appropriate.