Christopher D. Wolfe is a managing director in Fitch Ratings’ financial institutions group. His responsibilities include overseeing the coverage of ratings and analysis on U.S. banking institutions. He is also a member of Fitch’s corporate finance criteria committee. Prior to joining Fitch in 1999, Christopher was a financial analyst with the Federal Reserve Bank of New York. He was responsible for collateral valuation and review, and acceptance of accountholders and counterparties with the bank’s credit and risk management department. Christopher earned a B.S. in business administration from Alfred University in New York.

As the Regulatory Pendulum Swings, Relief and Risks Emerge

As the pendulum swings towards loosening regulation, bank management and boards should keep in mind that the regulatory pendulum can swing back the other way.

Brought to you by Fitch Ratings

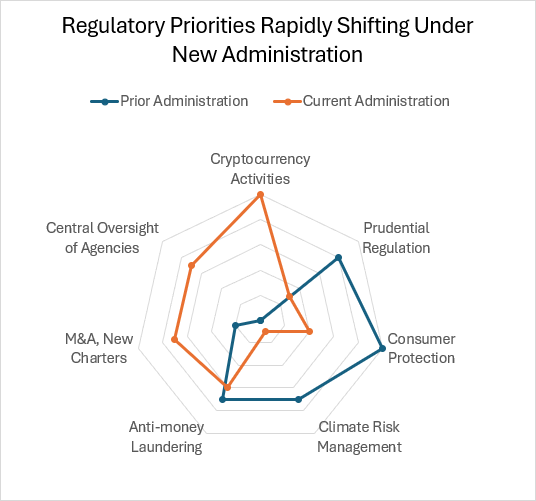

The deregulatory momentum in Washington, D.C., is reshaping the U.S. banking rulebook, with mixed medium-term implications for bank credit profiles. It can be said that some of the initial deregulatory efforts merely restore the status quo pre-2021. But as the pendulum swings towards loosening regulation, bank management and boards should keep in mind that the pendulum can swing back the other way.

Fitch Ratings sees the greatest swings in the following areas:

Prudential Regulation

Prudential regulation is the centerpiece. The previously proposed Basel III endgame and long-term debt rules are likely to be watered down or abandoned. Policymakers have signaled changes to the supplementary leverage ratio (SLR) and globally systemically important banks (G-SIBs) surcharge to improve treasury market functioning. There is also serious consideration to lowering the community bank leverage ratio from the range of 8 to10 percent to the range of 6 to 8 percent and raise applicability to community banks up to $15 billion in assets.

Crypto Activities

Crypto policy has turned permissive. With the passage of the GENIUS Act, legislative guardrails are now in place for stablecoins, with regulatory agencies working out the rules of engagement for banks as agencies remove hurdles that had been in place. Banks will need to think both offensively and defensively to the extent stablecoins become a mainstream financial product. For example, stablecoins can be an opportunity to improve service offerings, but at the same time could pose strategic and/or cyber risks if not properly managed.

Centralized Oversight of Agencies

While regulatory agencies are unlikely to be consolidated, the current administration has prized centralized oversight of the bank regulatory bodies. An executive order now routes rulemakings through Office of Management and Budget for review, leveraging the Treasury-led Financial Stability Oversight Council (FSOC) to align agency actions. While regulatory streamlining can cut compliance costs and improve consistency and coordination, Fitch notes that the loss of regulatory independence could invite more politicization which could further exacerbate regulatory swings when there is a change in administration.

Consumer Protection

Consumer protection has seen some of the sharpest swings so far. The Consumer Financial Protection Bureau (CFPB) has withdrawn existing rules, suspended work on proposed rules and delayed not-yet-effective rules. Revisions to the Community Reinvestment Act have been rescinded. Lighter regulation emanating from the CFPB provides more scope for banks in consumer lending, but at the same time could increase state scrutiny of consumer lending.

Climate Risk Management

Climate risk management is retreating. Agencies withdrew from an international climate-risk forum, the Securities and Exchange Committee stopped defending its climate disclosure rule, and the Office of the Comptroller of the Currency (OCC) withdrew its climate risk principles for banks over $100 billion. While regulatory intensity on climate has been dialed way back, climate events have increased in frequency and cost. Banks should understand the importance of insurance and fiscal support in mitigating losses.

M&A, New Charters

On M&A and new charters, regulators signal greater openness and speed. The Federal Deposit Insurance Corp. and OCC reset their policy and rules back to what had previously existed. Moreover, senior officials have called for timelier approvals, as bank deal clearances have often taken over a year, imposing costs and uncertainty on buyers and sellers alike. This more open attitude for bank M&A will likely accelerate consolidation within the industry.

Anti-Money Laundering

Anti-money laundering (AML) policy is mixed. Authorities intensified actions against drug cartels and sharply lowered cash reporting thresholds for money service businesses along the southern border, increasing compliance burdens. At the same time, enforcement of the Corporate Transparency Act and proposed rulemaking to reduce AML compliance cut in the other direction. Despite this somewhat mixed messaging, banks will need to walk a fine line as regulatory expectations could rapidly shift.

Ultimately, while the regulatory pendulum has swung towards loosening, banks should be cognizant that it will likely swing back the other way at some point.