Say-On-Pay Trends at Banks: Proxy Firms Increase “No” Recommendations

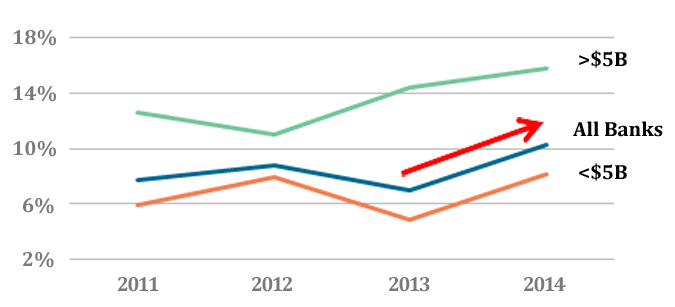

What should public bank boards know about proxy firm recommendations? McLagan evaluated Institutional Shareholder Services’ (ISS) recommendation patterns for management say-on-pay (MSOP) votes at bank shareholder meetings this year. ISS’ “no” vote recommendations were up from 2013 to 2014, summarized in the chart below:

Larger banks receive greater scrutiny from ISS and are more likely to get a negative recommendation. Banks with assets greater than $5 billion received “no” recommendations almost twice as frequently as banks below $5 billion.

Despite the increase in negative recommendations, overall shareholder approval remained high. Nearly 75 percent of banks received greater than 90 percent support for MSOP, and half were above 95 percent approval.

Caution! Receiving a negative recommendation can have a dramatic impact on the level of shareholder approval. McLagan performed an analysis of actual shareholder votes after ISS had made a recommendation on pay practices, either “for” or “against.” The table below shows a distribution of vote results.

| MSOP Vote Results | ||

| Percentile | ISS Recommendation | |

| For | Against | |

| 25th Percentile | 92% | 59% |

| 50th Percentile | 96% | 75% |

| 75th Percentile | 98% | 85% |

At the median, those banks receiving a “for” vote recommendation from ISS also received a 96 percent approval vote from shareholders. In contrast, a bank receiving a “no” vote recommendation only received a 75 percent approval vote—a drop of 21 percentage points at the median! The drop was even more significant at the 25th percentile, where a “no” vote recommendation resulted in an approval rating of only 59 percent, down 33 percentage points from banks that received a “for” vote recommendation.

Here are the landmines to watch out for that can trigger a “no” vote recommendation.

| Top 3 Reasons for ISS “No” Recommendation |

| Pay for Performance Disconnect |

| Mega-grants of Equity (e.g. sign-on or retention bonus) |

| Problematic Pay Practices (e.g. excise tax gross up or re-pricing options) |

An example of a pay for performance disconnect is when the CEO is paid above the 75th percentile of ISS’ comparative group, but the bank’s performance as measured by total shareholder return (TSR) is below the 50th percentile. Another example would be an increase in CEO compensation as TSR decreases.

Some banks escaped receiving a “no” recommendation in 2014 even though their pay practices would presumably have merited one. The reason? One example is TSR for a bank may have improved and been relatively strong compared to the comparative group; as a result, some pay practices might be given a pass. But, if TSR slips, these banks may well receive a different recommendation.

In summary, don’t take your MSOP vote results for granted. Be proactive in making appropriate adjustments to executive compensation and watch out for the top 3 reasons for “no” vote recommendations, especially if your bank’s TSR is decreasing. It’s much easier to fix the problems before receiving a failing MSOP vote result.