Market Intelligence

Public vs. Private

If you read the financial news, you might assume that most banks in the United States are publicly traded, as they’re the only ones that attract widespread media attention.

But just the opposite is true: Most banks in this country are privately held. They tend to be smaller banks owned by local investors who live in the communities the banks serve.

There were 360 banks in the United States at the end of 2020 that traded on the New York Stock Exchange or NASDAQ, not including banks that trade over the counter, according to YCharts.com. That compares to the approximately 4,070 banks, or 86% of depository institutions insured by the Federal Deposit Insurance Corp., that remain privately held – this excludes nontraditional commercial banks, such as those that generate more than 75% of their net revenue from noninterest income or allocate less than a quarter of their asset portfolio to loans.

Going public offers a bank’s owners liquidity, making it easier to buy and sell shares. It also facilitates growth, as publicly traded shares can be used as currency to acquire other institutions.

When the former BB&T Corp. and SunTrust Banks merged in 2020 to form Truist Financial Corp., for instance. It was an all-stock deal, with shareholders of SunTrust receiving 1.295 shares of BB&T for each share of SunTrust.

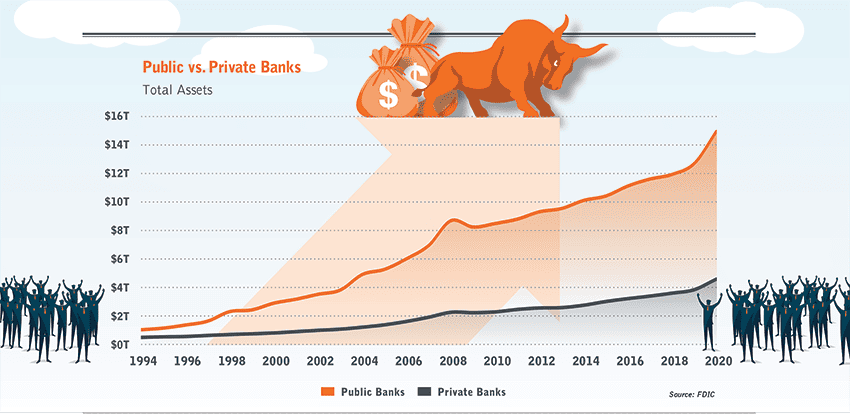

This explains why most of the growth in the banking industry since the early 1990s, when federal restrictions against branch and interstate banking were abolished, has accrued to the minority of banks that trade on the major stock exchanges.

Since 1993, which is the earliest year that comprehensive data on individual financial institutions is available, publicly traded banks have grown 16-fold, from a combined $930 billion in assets to more than $15 trillion by the end of last year. Privately held banks have grown at roughly half that rate, increasing from $510 billion in aggregate assets, up to approximately $4.7 trillion.

Still, fighting the urge to go public offers the tremendous benefit of shielding a bank from the pressures of external investors, analysts and commentators to chase short-term growth at the expense of long-term solvency.

This is a major reason that so many banks have decided to remain private, despite the allure of the public markets.

“Most private banks that decide to go public firmly believe that being a public company provides more tools that can be leveraged to fuel future growth,” says Scott Studwell, managing director and head of equity capital markets and U.S. depositories at the investment bank Stephens. “There must be an acceptance and understanding that those new investors will now have a voice that must be understood, and a company has to be willing to accept that reality. For those who embrace that, going public can be great way to create value for shareholders. For those that don’t, the public markets are not the place to be.”

Oldest Bank Aging Not So Well

On July 30, the European Central Bank released the results of its latest stress test, revealing the perceived strength of 89 of the continent’s leading banks.

Every bank was expected to experience a significant decline in capital under the most severe assumptions of the test, but none more so than Italy’s Banca Monte dei Paschi di Siena.

Founded in 1472, Monte dei Paschi is reputed to be the world’s oldest bank. If a severe recession were to strike, the stress test reveals, the Siena, Italy-based bank could see virtually all its capital evaporate.

The day before the results were released, UniCredit, Italy’s second biggest bank by assets, disclosed that it was in talks to buy Monte dei Paschi, the country’s fourth largest, but only so long as the Italian government agreed to keep the bad loans.

“The city is infuriated,” an 80-year-old man told “The New York Times.” Losing the bank, the man said, “would be like losing a daughter.”

Monte dei Paschi is the largest employer in Siena. Its sale is expected to lead to 5,000 job cuts, a third of the bank’s total headcount.

It’s a reminder that age isn’t an antidote to error.

About the Sponsor

Stephens is a leading family-owned investment firm comprising the businesses of investment banking, advisory, sales and trading, research, insurance and wealth management.

Join OUr Community

Bank Director’s annual Bank Services Membership Program combines Bank Director’s extensive online library of director training materials, conferences, our quarterly publication, and access to FinXTech Connect.

Become a Member

Our commitment to those leaders who believe a strong board makes a strong bank never wavers.