From how-to articles, director training videos, key interviews with industry leaders and more, Bank Services provides bank executives and directors with the tools to help grow their financial institutions. To sign up for exclusive access to this online bank board resource, please contact Bank Services at 615-777-8461 or [email protected].

The CRE Conundrum

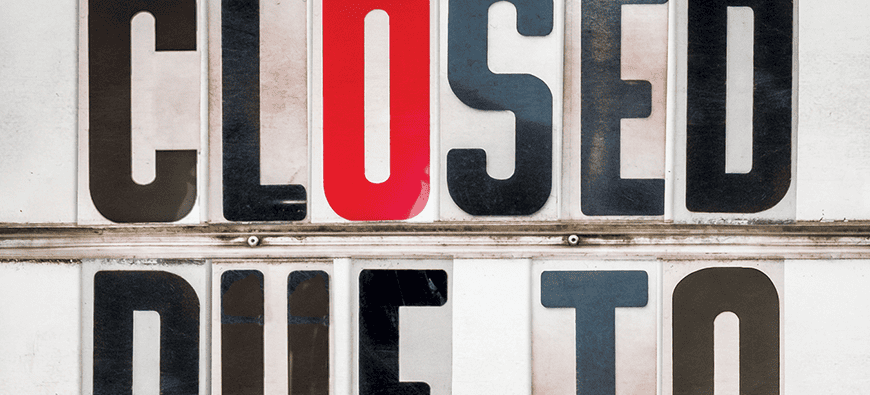

As commercial real estate goes, so go banks. CRE owners and operators are in cash flow purgatory, trying to collect rent from struggling commercial tenants while facing their own loan payments. Less rent means less cash to service their debts, which will eventually mean lower profits and higher losses for banks. The most consequential question facing bankers eight months into the coronavirus pandemic is what will happen to the CRE market. “The majority of economic activity takes place in a physical structure somewhere,” says Ryan Severino, chief economist at global real estate firm JLL. “Things are bought, things are manufactured,…

You have accessed a resource that is only available to our Bank Services members and Subscribers.

Read The Article

Please enter your username and password below. If you have established a password please click ‘forgot your password’

Join OUr Community

Bank Director’s annual Bank Services Membership Program combines Bank Director’s extensive online library of director training materials, conferences, our quarterly publication, and access to FinXTech Connect.

Become a Member

Our commitment to those leaders who believe a strong board makes a strong bank never wavers.