Well Conceived and Executed Bank Acquisitions Drive Shareholder Value

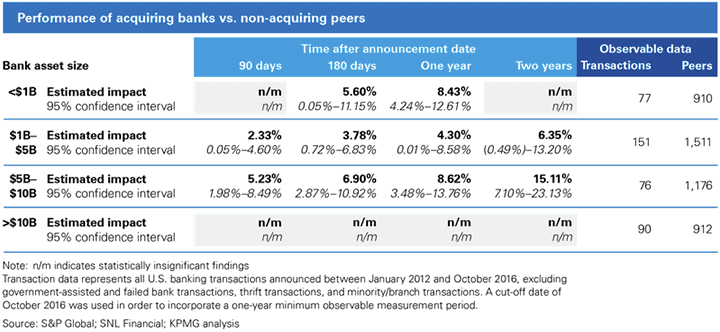

Recent takeovers among U.S.-based banks generally have resulted in above-market returns for acquiring banks, compared to their non-acquiring peers, according to KPMG research. This finding held true for all banks analyzed except those with greater than $10 billion in assets, for which findings were not statistically significant.

Recent takeovers among U.S.-based banks generally have resulted in above-market returns for acquiring banks, compared to their non-acquiring peers, according to KPMG research. This finding held true for all banks analyzed except those with greater than $10 billion in assets, for which findings were not statistically significant.

Our analysis focused on 394 U.S.-domiciled bank transactions announced between January 2012 and October 2016. Our study focused on whole-bank acquisitions and excluded thrifts, acquisitions of failed banks and government-assisted transactions. The analysis yielded the following conclusions:

- The market rewards banks for conducting successful acquisitions, as evidenced by higher market valuations post-announcement.

- Acquiring banks’ outperformance, where observable, increased linearly throughout our measurement period, from 90 days post-announcement to two years post-announcement.

- The positive effect was experienced throughout the date range examined.

- Banks with less than $10 billion in assets experienced a positive market reaction.

- Among banks with more than $10 billion in assets, acquirers did not demonstrate statistically significant differences in market returns when compared to banks that did not conduct an acquisition.

Factors Driving Value

Bank size. Acquiring banks with total assets of between $5 billion and $10 billion at the time of announcement performed the strongest in comparison with their peers during the period observed. Acquiring banks in this asset range outperformed their non-acquiring peers by 15 percentage points at two years after the transaction announcement date, representing the best improvement when compared to peers of any asset grouping and at any of the timeframes measured post-announcement.

Acquisitions by banks in the $5 billion to $10 billion asset range tend to result in customer expansion within the acquirer’s market or a contiguous market, without significant increases in operational costs.

We believe this finding is a significant factor driving the value of these acquisitions. Furthermore, banks that acquire and remain in the $10 billion or less asset category do not bear the expense burden associated with Dodd-Frank Act stress testing (DFAST) compliance.

Conversely, banks with nearly $10 billion in assets may decide to exceed the regulatory threshold “with a bang” in anticipation that the increased scale of a larger acquisition may serve to partially offset the higher DFAST compliance costs.

The smaller acquiring banks in our study—less than $1 billion in assets and $1 billion to $5 billion in assets—also outperformed their peers in all periods post-transaction (where statistically meaningful). Banks in these asset ranges benefited from some of the same advantages mentioned above, although they may not have received the benefits of scale and product diversification of larger banks.

As mentioned earlier, acquirers with greater than $10 billion in assets did not yield statistically meaningful results in terms of performance against peers. We believe acquisitions by larger banks were less accretive due to the relatively smaller target size, resulting in a less significant impact.

Additionally, we find that larger bank transactions can be complicated by a number of other factors. Larger banks typically have a more diverse product set, client base and geography than their smaller peers, requiring greater sophistication during due diligence. There is no substitute for thorough planning, detailed due diligence and an early and organized integration approach to mitigate the risks of a transaction. Furthermore, alignment of overall business strategy with a bank’s M&A strategy is a critical first step to executing a successful acquisition (or divestiture, for that matter).

Time since acquisition. All three acquirer groups that yielded statistically significant results demonstrated a trend of increasing returns as time elapsed from transaction announcement date. The increase in acquirers’ values compared to their peers, from the deal announcement date until two years after announcement, suggests that increases in profitability from income uplift, cost reduction and market expansion become even more accretive with time.

Positive performance pre-deal may preclude future success. Our research revealed a positive correlation between the acquirer’s history of profitability and excess performance against peers post-acquisition. We noted this trend in banks with assets of less than $1 billion, and between $1 billion and $5 billion, at the time of announcement.

This correlation suggests that banks that were more profitable before a deal were increasingly likely to achieve incremental shareholder value through an acquisition.

Bank executives should feel comfortable pursuing deals knowing that the current marketplace rewards M&A in this sector. However, our experience indicates that in order to be successful, acquirers should approach transactions with a thoughtful alignment of M&A strategy with business strategy, an organized and vigilant approach to due diligence and integration, and trusted advisers to complement internal teams and ensure seamless transaction execution.