PayPal Is Not a Bank. Or Is It?

Last Tuesday, payment company PayPal Holdings’ market capitalization of $277 billion was higher than the entire KBW regional bank index of $213.5 billion. This has been true for months now.

Tom Michaud, CEO of Keefe, Bruyette & Woods, noted PayPal’s valuation in a February presentation for Bank Director. “They can really afford to invest in ways a typical community bank can’t,” he said at the time.

PayPal’s market value is richer than several large banks, including PNC Financial Services Group, Citigroup and Truist Financial Corp.

But how can that be? When you compare the earnings reports of PayPal to the banks, you can see the companies’ focuses are entirely different. PayPal promotes its growth: growth in payment volume, growth in accounts and growth in revenue. Truist and PNC are more inclined to highlight their profitability, which is typical of well established, legacy financial companies.

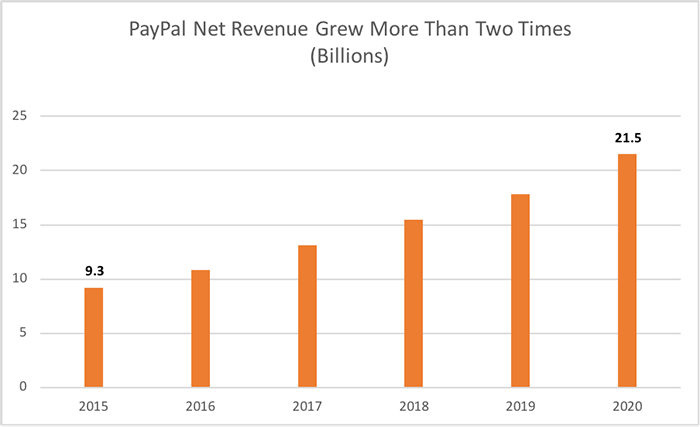

Source: Paypal

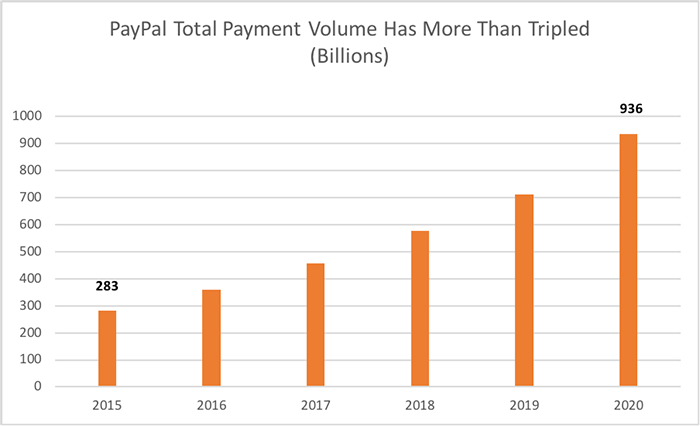

Source: PayPal. Total payment volume is the value of payments, net of payment reversals, successfully completed on PayPal’s platform or enabled by PayPal on a partner platform, not including gateway exclusive transactions.

PNC reported net income of $7.5 billion, an increase of 40% from the year before, on total revenue of $13.7 billion in 2020. PayPal reported earnings of $4.2 billion in 2020, nearly double what the company had earned the year prior.

PayPal was trading at about 67 times earnings last Wednesday, while Truist was trading at about 19 and PNC at 28, according to the research firm Morningstar.

Of course, it’s silly to compare PayPal to banks. PayPal isn’t a bank, nor does it want to be, says Wedbush Securities managing director and equity analyst Moshe Katri. “It’s better than a bank,” he says. “What you’re getting from PayPal is a host of products and services that are more economical.”

Katri says PayPal, which owns the person-to-person payments platform Venmo, offers transaction fees that are lower than competitors. For example, PayPal advertises fees to merchants for online transactions for a flat 2.9% plus 30 cents. Card associations such as Visa and Mastercard offer a variety of pricing options for credit and debit cards.

Katri says PayPal’s valuation is related to its platform and its earnings power. PayPal has roughly 350 million consumers and about 29 million merchants using its platform, with potential to grow. Not only could PayPal expand its customer base, but it could also grow its transactions and fees per customer.

“It allows you to do multiple things: shop online, transfer funds, transfer funds globally, bill pay,” Katri says. “They offer other products and services that look and feel like you’re dealing with a bank.”

PayPal also offers small business loans, often for as little $5,000. It uses transaction data to underwrite loans to merchants that may appear unattractive to many banks.

But PayPal is more often compared to competitors Mastercard and Visa than to banks. Both Mastercard and Visa saw a decline in payment volume during the pandemic after losing some in-person merchant business, according to the publication Barron’s. In contrast, PayPal did especially well during 2020, when the pandemic forced more purchases to move online.

PayPal’s size and strength have helped it invest, including recent initiatives like an option to pay via cryptocurrency, a touchless QR-code payment option and a “buy now, pay later” interest-free loan for consumers.

PayPal CEO Dan Schulman said on a fourth-quarter earnings call that the company plans to enhance bill pay options this year and launch budgeting and savings tools. “We all know the current financial system is antiquated,” he said.

But the juggernaut that is PayPal may not ride so high a few years from now. Shortly after a February investor presentation where the company projected a compound annual growth rate of 20% in revenue, reaching $50 billion by 2025, the stock price skyrocketed to $305 per share.

It has come down considerably since then, along with many high-flying technology companies. PayPal’s stock sunk 20% to $242.8 per share at market close last Wednesday, according to Morningstar. Katri has a buy rating on the stock, assuming a price of $330 per share.

Morningstar analyst Brett Horn thinks PayPal’s long term prospects are less certain, even though few payments companies are as well positioned as PayPal right now. Competitors are active in mergers and acquisitions, getting stronger to go up against PayPal’s business model. Apple Pay remains a formidable threat.

On the merchant processing side, Stripe and Square are among the players growing considerably, too. What’s clear is that giant payments platforms may continue to erode interchange fees and other income streams for banks.

“The digital first world is no longer our future,” Schulman said in February. “It is our current reality and it will forever change how we interact in almost all elements of our lives.”