How Innovative Banks Capitalize on Cryptocurrency

This summer, three new developments in the relationship between banks and cryptocurrency players signaled a shift in attitudes toward digital assets.

In May, JPMorgan Chase & Co. began providing banking services to leading crypto exchanges Coinbase and Gemini Trust Co., – a notable change given that Chairman and CEO Jamie Dimon called the seminal cryptocurrency Bitcoin “a fraud” just three years ago. In July, the acting comptroller for the Office of the Comptroller of the Currency, Brian Brooks – who served as the chief legal officer for Coinbase prior to his appointment – released an interpretation letter confirming that financial institutions can bank cryptocurrency clients and could even serve as digital asset custodians. And this month, the popular crypto exchange Kraken secured a special purpose banking charter in Wyoming, marking the first time a crypto company gained banking powers, including direct access to payment rails.

Cryptocurrency is gaining wider acceptance as a legitimate commercial enterprise. But, like other money services businesses, these companies still find it difficult to obtain basic banking services. This is despite the fact that crypto is becoming more mainstream among consumers and in the financial markets. The industry is booming with a market capitalization equivalent to over $330 billion, according to CoinMarketCap, but it’s currently served by just a handful of banks.

The best-known institutions playing in the cryptocurrency space are New York-based Signature Bank and Silvergate Capital Corp., the parent company of La Jolla, California-based Silvergate Bank.

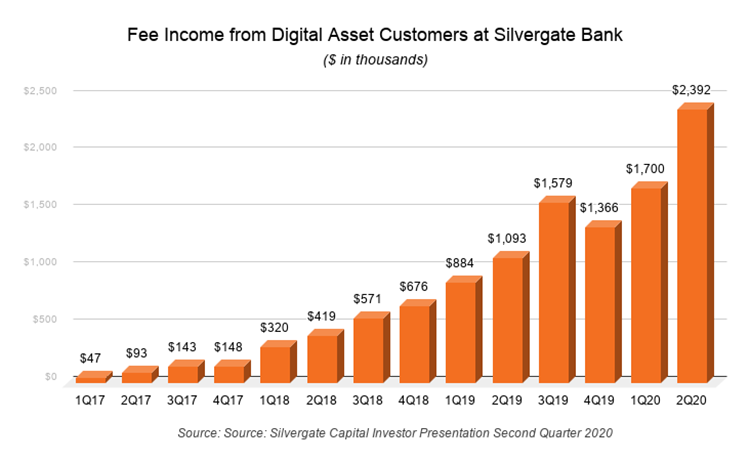

Signature’s CEO Joseph DePaolo confirmed in the company’s second-quarter earnings call that $1 billion of the bank’s deposits in quarter came from digital asset customers. And at just $1.9 billion in total assets, Silvergate Bank earned over $2.3 million in fees in the second quarter from its crypto-related clients. These gains weren’t from the activity taking place on the banks’ respective payment platforms. They came from typical commercial banking services – providing solutions for deposits, cash management and foreign exchange.

One community bank hoping to realize similar benefits from banking crypto businesses is Provident Bancorp. The $1.4 billion asset institution based in Amesbury, Massachusetts, which recently rebranded as BankProv, aims to treat crypto companies as it would any other legal commercial customer. Crypto customers may have heightened technology expectations compared to other clients, and present heightened compliance burdens for their banks. But the way CEO David Mansfield sees it, these are all things BankProv needs to address anyway.

“It really pushes traditional, mainstream corporate banking to the next level,” he explains, “so it fits with some of our other strategic goals being a commercially focused bank.”

Before BankProv launched its digital asset offering, it did a lot of groundwork.

The bank revamped its entire Bank Secrecy Act program, bringing in experts to help rewrite procedures and new technology partners like CipherTrace to provide blockchain analytics and transaction monitoring. It retooled its ACH offerings, establishing a direct connection with the Federal Reserve and expanding its timeframe for processing transactions to better serve clients on the West coast. And BankProv’s team met with crypto-related businesses for insights about what they wanted in a bank partner, which led the bank to upgrade its API capabilities. BankProv is working with San-Francisco-based fintech Treasury Prime to make it possible for crypto clients to initiate transactions directly, instead of going through an online banking portal.

At the same time, BankProv made plans for handling the new deposits generated by the business line; crypto-related companies often experience more volatility in market fluctuations than typical commercial clients.

“It’s definitely top of the regulator’s mind that they don’t want to see you using these funds to do long-term lending,” Mansfield says.

For BankProv, part of managing these deposits is deploying them toward the bank’s mortgage warehouse lending business; those loans are short-term, maturing within seven to 15 days. “[Y]ou need to find a good match on the asset side,” Mansfield explains, “because just having [deposits] sit in Fed funds at 10 basis points doesn’t do you much [good] right now.”

While BankProv officially announced that it would begin servicing digital asset customers in July 2019, the onset of Covid-19 made it difficult to get the program into full swing until recently. With travel being severely limited, BankProv made it a priority to hire new business development talent earlier this month that came with a pre-existing Rolodex of crypto contacts. The digital asset business hasn’t appeared in the company’s 2020 earnings releases so far.

Banking crypto-related clients will only make sense for some of the most forward-thinking banks; but for those that are successful in the space, the upside is significant. Mansfield believes BankProv has the attributes needed to thrive as a part of the crypto community.

“You have to be open minded and a little innovative. [I]t’s certainly not going to be right for the vast majority of banks,” he says, “and I think that’s why there’s really only two that are dominating the space right now. But I feel there’s at least room for a third.”