Succeeding With Mobile Bill Pay

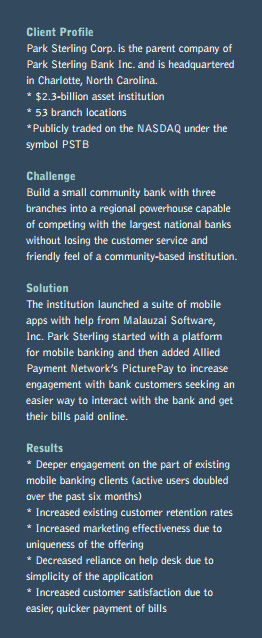

When James C. Cherry, a banking executive with over 31 years of experience, left his position as chief executive officer for Wachovia Bank’s Mid- Atlantic Banking sector to take over a small community bank in Charlotte, North Carolina, with just a few branches, his goal was to create a competitive niche he could dominate.

When James C. Cherry, a banking executive with over 31 years of experience, left his position as chief executive officer for Wachovia Bank’s Mid- Atlantic Banking sector to take over a small community bank in Charlotte, North Carolina, with just a few branches, his goal was to create a competitive niche he could dominate.

“Our company is working to position itself between the small banks and the very large banks as a regional bank,” said Cherry, who is now chief executive officer at Park Sterling Bank Inc., Charlotte, North Carolina. “People don’t feel like they get the personal service they want from the large banks, yet that’s where everybody banks because they offer a broad array of products and services that the smaller banks can’t. Our objective is to exist between the two.”

The strategy is working. Over the past four years, Park Sterling has grown from three humble branches into a 53-branch institution with $2.3 billion in assets. According to Cherry, mobile banking is expected to play a significant role in his bank’s growth plans.

“I think everyone acknowledges that mobile banking is the fastest growing segment of banking services today,” he said. “I think most people believe that eventually your phone will literally be your bank.”

That could be a problem for smaller institutions that have extended online offerings to their customers but that have not yet made the leap to their own smartphone apps, according to Robb Gaynor, chief product officer of Malauzai Software, Inc., Austin, Texas, the firm Park Sterling turned to for its mobile banking platform.

“Community banks may be shrinking in numbers, but there are also community bankers who are growing their institutions,” Gaynor said.

Malauzai works with about 320 community banks and credit unions across the country, providing them with the tools they need to connect to their customers through smartphone applications. According to the company, 55 percent of all banks with less than $15 billion in assets currently have an app. The rest are already behind.

Malauzai works with about 320 community banks and credit unions across the country, providing them with the tools they need to connect to their customers through smartphone applications. According to the company, 55 percent of all banks with less than $15 billion in assets currently have an app. The rest are already behind.

“Being able to distinguish yourself with mobile banking services becomes really important, but it becomes especially important for a company like ours that may have a relatively small footprint in some markets relative to the larger banks,” Cherry said. “Mobile banking can allow us to play larger than our footprint.” One of the solutions Malauzai provided is called PicturePay, a program that lets retail customers take photos of their bills with their smartphones to make a payment. Cherry says that bank customers like the app better than traditional online bill pay functionality offered through the bank’s website. It’s easier to use and doesn’t require the customer to re-enter information about the payment.

PicturePay doesn’t even require the customer to use a computer to pay their bills, Cherry said. “It’s really an extraordinarily user-friendly, attractive product. It positions us very well to deliver on our tagline, which is, providing ‘Answers you can bank on.’’’

According to Malauzai, about 15 percent of the average bank’s customers will use PicturePay to process their monthly bills. That compares to about 4 percent of bank customers who typically use traditional online bill pay functionality.

“The uniqueness of these products, the fact that they’re not offered generally in our marketplace, sets us apart from our competitors in exactly the way we are trying to distinguish ourselves,” Cherry said. “This speaks to the viability of community banks. Today, bankers can get products and capabilities that previously required more scale than the smaller community banks could muster, but that can now allow them to compete very effectively with the larger banks.”

Ralph Marcuccilli is president and CEO of Allied Payment Network, the company that provides the back-end processing for the PicturePay feature. “I think what Malauzai has proven is that community banks can really lead,” he said. “They don’t have to sit back and wait for the big banks to deliver the technology that >customers are adopting. They can really be out in front of them.”

For Cherry and his institution, it’s about providing the tools bank customers want without sacrificing the feel of a community- based bank.

“We don’t market ourselves as a community bank, nor do we market ourselves as a large bank,” Cherry said. “We market ourselves as a bank that is large enough to provide customers with the solutions they need and small enough to deliver those in a personal way. We think (PicturePay) will result in increased interest in our company, which always translates into increased business.”