Turning Income Tax Payable Into Earnings

Brought to you by DudleyVentures

The New Markets Tax Credit (NMTC) Program is a two decade old federal tax credit program administered by the Community Development Financial Institutions Fund designed to monetize credits awarded by Department of the Treasury for community revitalization.

A federal tax credit is a dollar-for-dollar reduction of federal income tax payable; it is a permanent reduction of tax in the year the credit is taken. If a bank can acquire them for less than $1, it ends up converting an income tax liability into an earning. The credit creates more net income by reducing the amount in taxes owed.

The CDFI Fund has awarded 18 rounds of NMTCs, totaling $71 billion in tax credit authority. As of October 2022, $60.4 billion in NMTCs have been invested in low-income communities, creating jobs from investments in manufacturing, retail and technology projects. NMTCs are a 39% tax credit paired with a leverage loan. The Office of the Comptroller of the Currency wrote in 2013 that these credits “can help banks meet their financial goals (competitive returns on their equity investments)….[m]eet CRA requirements….[a]nd are a critical tool in helping the credit needs of low-income communities.”2

Of course, as with any equity investment there are risks; risks associated with tax credits include recapture risk, default risk, reputation risk and a lack of liquidity. But these deals are structured with full forbearance from debt that makes the probability of a redemption event unlikely. There’s also less risk at the project level compared with other tax credit programs available to corporations. And a 2017 study found a very low recapture rate.

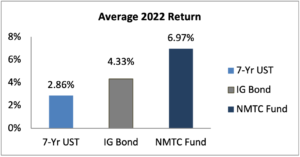

The average return associated with the NMTC Fund, as of November 2022, outperformed seven-year US Treasurys and seven-year investment grade bonds by more than 2.43x and 1.6x, respectively in 2022 on a pre-tax basis.

Returns represent the internal rate of return of each investment categorized as held-to-maturity. The seven-year investment grade bonds for 2022 was determined based on a benchmark interest rate of the same maturity, plus the ICE BofA US Corporate Investment Grade Option-Adjusted Index. NMTC Fund returns are based on recent pricing.

Accounting Options

Typically, banks use two options for GAAP accounting using ASC 740 provisions:

- Flow Through Method: The NMTC amount reduces the income tax expense (below the line). Impairment of the investment balance is categorized as an other expense, impacting pretax income (above the line).

- Deferral Method: The tax credit is recognized as a contra asset (deferred income liability) and amortized into income over the productive life of the investment.

The Financial Accounting Standards Board’s Emerging Issues Task Force is evaluating whether it should expand the proportional amortization method to investments in tax credits beyond LIHTC investments, including investments in NMTCs (below the line treatment), a change many expect to be adopted as early as the first quarter of 2023.

Momeni & Sons Case Study

In 2022, Momeni & Sons, a manufacturer and importer of area rugs, wall-to-wall carpeting and home décor, wanted to establish a 302,600 square foot warehouse and distribution facility in Adairsville, Georgia, to accommodate growing online sales and bring more economic opportunity to the Adairsville community.

Given the magnitude of the project’s size and the rising cost of construction materials, the company needed about $18.7 million to finance the project; its lender also determined that the project could be supported by the NMTC program. With $14 million in NMTC allocation, Wayne, New Jersey-based Valley National Bancorp was able to provide the tax credit leverage loan and the equity in the deal.

Momeni’s new facility created 100 construction jobs and 98 full-time quality jobs at its completion in August 2022, boosting the local economy of Adairsville. The project provided skills training in conjunction with a local workforce development provider, creating high-quality training and instruction to the area; at least 65% of Momeni’s Adairsville labor force will be minority residents.

New Markets Tax Credits provide a lesser-known opportunity for banks to convert tax liability to earnings, while potentially providing Community Reinvestment Act benefits, deposits and loans. There are syndication options available, which eliminate the need for smaller banks to create an independent infrastructure around the NMTCs.

This overview is for informational purposes only and is intended for recipients having sufficient knowledge and experience to make an independent evaluation of the risks and merits of any financing. The New Markets Tax Credit program is extremely complex. Consult your legal counsel, tax counsel and accountant. This information and opinions included in this overview do not, and are not intended to, constitute legal or tax advice. Dudley Ventures makes no representations or warranties of any kind, express or implied, as to the accuracy or completeness of the information or opinions. u00a9 2022 Dudley Ventures, LLC, a Delaware limited liability company. All rights reserved.